Latin America (LatAm) represents one of the world’s fastest growing crypto markets, driven by economic instability, financial exclusion, and restrictive capital controls. Government spending and public debt have devalued local currencies and eroded trust in institutions. People have tended to save in cash which can be cumbersome and unsecure. Naturally, the idea of having digitally native currency outside the control of banks and governments has resonated with the predominantly young population.

Many have turned to bitcoin and USD-denominated stablecoins as essential tools for protecting savings, facilitating efficient cross-border remittances, and enabling financial inclusion for the unbanked. Yet, even as the region has embraced stablecoins as the de facto digital dollar, there are still barriers that prevent people from making effective use of financial services available to them.

Latin America is already leapfrogging legacy banking technology as payments are largely processed over non-bank payment rails like Brazil’s PIX, Mexico’s SPEI or with stablecoins through fintech apps. Aave is well positioned to lead this next phase by bringing real yield, credit, and capital efficiency to the hundreds of millions of Latin Americans who already hold stablecoins but are leaving money on the table.

LatAm Crypto Adoption Trends

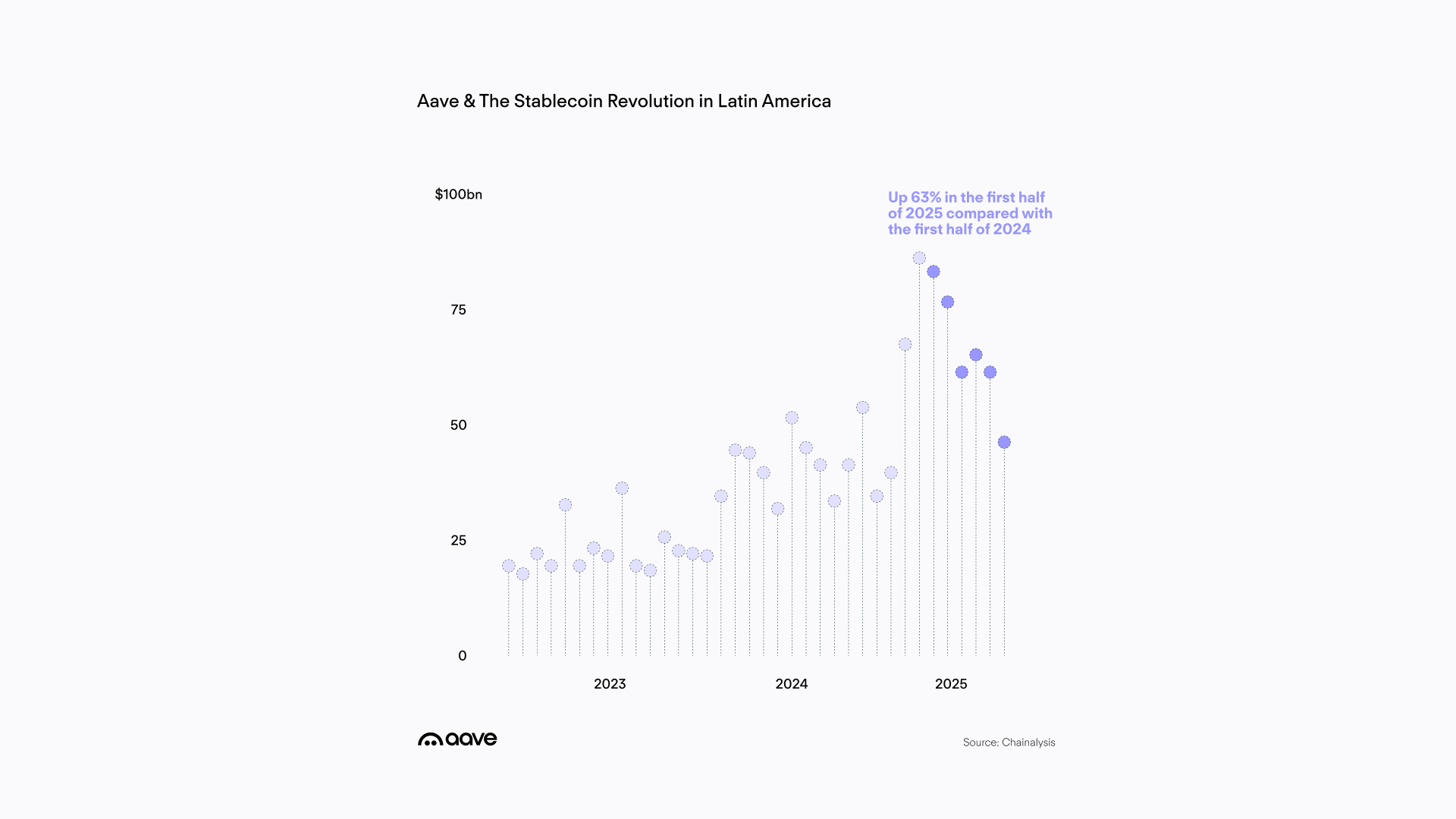

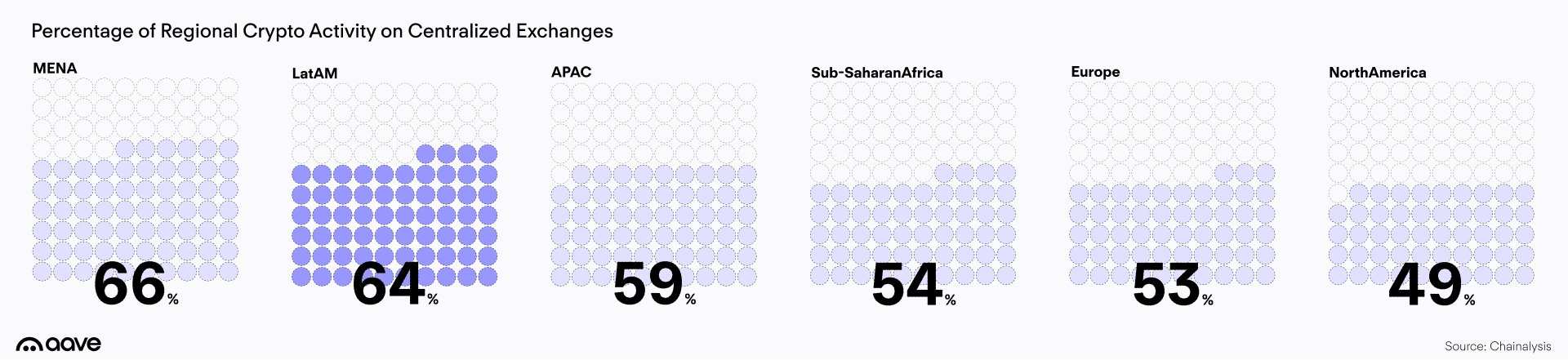

According to Chainalysis' 2025 Geography of Cryptocurrency Report, crypto transfer volumes in LatAm accelerated from +53% to +63% YoY growth in 2025. The region reportedly stands out for its relatively high use of stablecoins and heavy reliance on centralized exchanges compared to global averages. Fintech apps have emerged as the main financial platforms by integrating crypto and offering fiat on-ramps, remittance services, and integrations with local payment systems.

Despite clear demand for stablecoins, DeFi adoption has lagged compared to overall crypto usage and activity. Chainalysis’ Crypto Adoption Index shows that for most countries in Latin America, DeFi has been on drag on the overall index ranking as LatAm users rely more on centralized service providers compared to users elsewhere around the globe.

This gap is one of the biggest opportunities in crypto today. Relative to users in other regions, many LatAm stablecoin holders are missing out on potential yield opportunities on otherwise idle capital. Fintechs and financial service providers can look to enhance offerings by integrating DeFi protocols to provide credit and yield for users.

How Aave Empowers Savings for LatAm Users

Aave empowers businesses and individuals to do more with their stablecoin holdings by transforming them into productive, yield-generating assets. Fintech apps can integrate Aave to enable embedded DeFi solutions, providing customers with credit and yield offerings into user-friendly interfaces powered by Aave on the backend. Stablecoin deposits on Aave earn yields backed by real borrowing demand, providing users with dollar-denominated returns. This effectively provides a second layer of wealth benefits – stablecoins serve as a currency hedge while Aave-yield expands holdings through interest (i.e., save on the denominator and expand the numerator).

Aave also enables:

- Crypto-backed loans so anyone can unlock liquidity against crypto holdings without selling.

- Asset conversions with ability to swap between crypto and stablecoins like USDT & USDC.

- Multi-network support, as Aave is available on many low-cost networks used to power remittances and other stablecoin activity for LatAm users including BNB, Polygon and Celo.

By integrating Aave and its embedded DeFi solutions, app users never have to know that they are interacting with crypto to experience the benefits of DeFi.

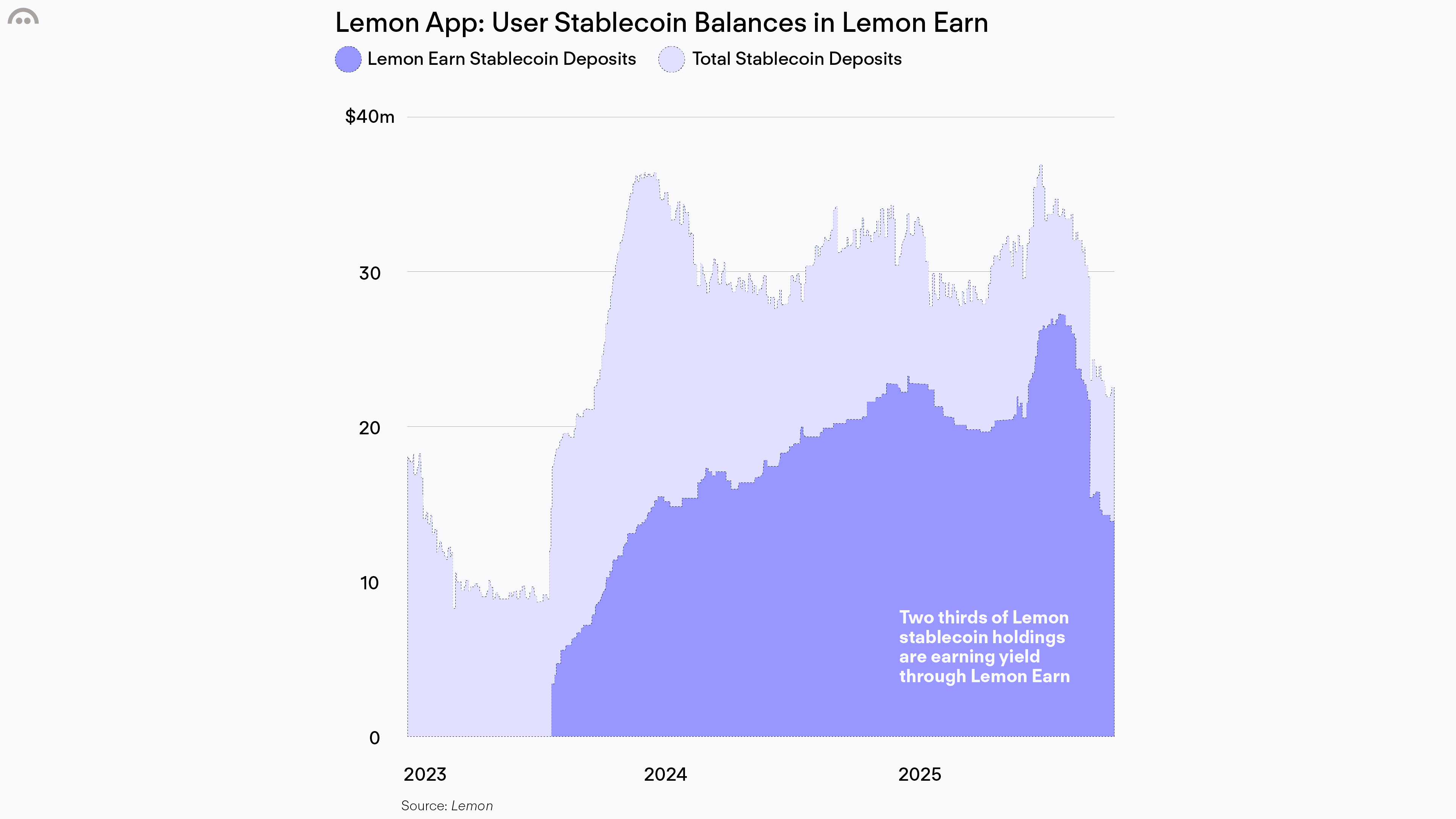

Aave Powers Yield for Lemon's Earn Program

As an early instance of embedded DeFi, Argentinian-based fintech app Lemon integrated Aave in 2022 to power its Earn program. Lemon users can activate yield on “Uninvested Currencies” by opting-in to the program, which abstracts the crypto and DeFi complexities away from users. Aave currently powers yields for more than 130,000 Lemon users who have opted into the Earn program, up 73% YoY, on ~$40m of Lemon deposits including more than $20m of stablecoins.

According to the Lemon team, the average user is 30 years old, with around 80% coming from Argentina and 20% from Perú, where Lemon only entered as of late last year. More recently, Lemon raised $20m in a Series B to accelerate regional expansion into new markets including Colombia, Mexico, Brazil and Chile, with the goal of reaching 10m users within the next 12 months.

Aave: The First Choice for LatAm Fintechs

Belo, a consumer fintech app with operations in Argentina and Brazil, allows users to store, send, and spend using pesos, stablecoins, or crypto. Users can make payments in the currencies of their choice through QR code, PIX, or using the Belo Mastercard (Argentina-only). Belo leverages Aave to provide simplified and automated savings on stablecoins or crypto assets for its app.

"At Belo, we rely on Aave as one of our main DeFi protocols to give our users access to the best yields in the most simple way." Manuel Beaudroit, Belo Co-founder & CEO

Ripio enables its 4 million app users, mainly in Argentina and Brazil, to earn yield on stablecoins holdings by depositing into Aave or other platforms. All of Ripio's products reach 25M in Latin America (B2B2C). In November 2025, Ripio launched wARS, a stablecoin pegged to the Argentine peso, and plans to launch similar stablecoins for other local currencies across the region to facilitate cross-border payments. More recently, Ripio revealed it holds a crypto treasury worth more than $100m.

"At Ripio, we're leveraging Aave to empower individuals to earn yields on crypto assets, fostering efficiency and growth in Latin America's digital economy. Users and businesses can hold stablecoins that automatically earn yield from Aave while remaining instantly available for payments, transfers, or card spending." Sebastian Serrano, Ripio Co-founder & CEO

Buenbit is an Argentinian-based crypto exchange which also serves users across Mexico, Peru and Colombia. The company provides a wide range of services for both individuals and institutions, including tokenized US stocks and Aave-enabled yield on crypto and stablecoins holdings.

"Aave's deep liquidity, stable rates, and reliable withdrawals make it a trusted foundation for Buenbit’s yield product. By integrating with Aave in our backend, Buenbit can offer safe and steady stablecoin yield opportunities to our users." Federico Ogue, Buenbit Co-founder & CEO

Outlook

Stemming from economic pressures, LatAm’s stablecoin adoption is uniquely positioned to leapfrog traditional banking infrastructure into a new DeFi-based paradigm. Elsewhere around the globe, the primary hurdle is simply getting stablecoins into the hands of users. The next leg of stablecoin adoption should come from credit and yield. LatAm fintechs should look to integrate Aave to upsell their users on DeFi-powered solutions so they can attract and grow customer stablecoin deposits.

Aave is committed to empowering individuals and businesses in LatAm so that they can borrow, earn, and save smarter.