Today, the total crypto market is valued at $4 trillion, a fourfold increase in just two years, driven by widespread adoption among retail investors, institutions, and businesses. The launch of bitcoin and ether ETFs have attracted more than $70 billion worth of inflows and corporate holdings of crypto worth over $100 billion, reflecting strong institutional interest. With over 50 million American adults owning crypto, it has become a staple in investment portfolios and a core component of personal wealth.

Lending and credit naturally complement trading and investment activity by unlocking greater access to capital. For financial platforms offering basic crypto trading for users (buy/sell/hold), integrating crypto-backed loans is a logical evolution. These loans enable users to access liquidity from their crypto holdings to manage finances, fund expenses, or pursue broader investments without selling their assets. Fintechs can add on crypto-backed loans to enhance trading platform utility, drive higher trading volumes, and improve user engagement and retention.

Benefits of Onchain Lending vs. Traditional Loans

Crypto-backed loans are a powerful tool for crypto holders to unlock liquidity, access flexible financing, and leverage market opportunities without selling their assets. Leveraging blockchains for speed, transparency and efficiency, crypto-backed loans offer a superior borrowing experience compared to traditional credit & loan products, which are often riddled with inefficiencies, high fees, opaque processes, and restrictions. Key benefits include:

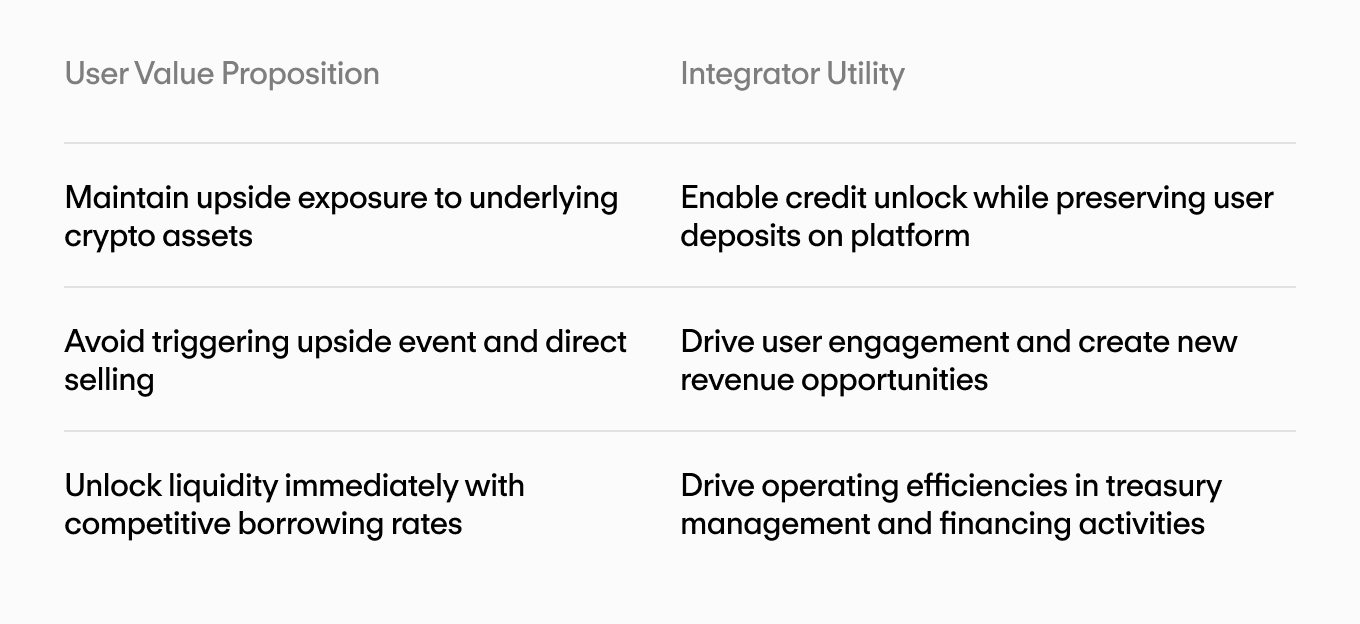

- Unlock liquidity from crypto assets without selling. Users can borrow stablecoins against their assets, which can be used to pay for personal expenses or to acquire more crypto for greater price exposure. Unlike with direct selling, borrowers maintain upside exposure on their holdings and can potentially avoid triggering a taxable event.

- Borrow with flexible terms including no fixed repayment schedules. Unlike traditional bank loans, crypto-backed loans are available 24/7/365 and require no credit checks or account minimums. Loan terms are flexible with no fixed repayment schedules or separate interest payments, ensuring accessibility and convenience for borrowers.

- Borrow at competitive rates compared to traditional credit products. Automating credit functions with smart contracts reduces overhead costs and reliance on intermediaries. Over the last 12 months, on-chain stablecoin borrow costs have averaged 4-6%, lower than centralized crypto-backed loan products (~8-12%) or personal loans (~10-15+%).

For fintech operators, offering crypto-backed loans can meet user demand for utility beyond basic buy/sell/hold on their crypto assets. This helps to strengthen customer relationships for access to credit and liquidity while also creating opportunities for broader utility and growth within the system:

- Enhanced platform utility to attract users and retain deposits. Crypto-backed loans can drive engagement as users frequently access the app to manage loans or leveraged positions, and improve the stickiness of customer deposits.

- Increased trading activity and revenue opportunities. Greater borrowing power boosts trading volumes, transaction frequency, and average trade size. Crypto-backed loans create a new revenue stream and opportunities to cross-sell financial services, driving growth in average revenue per user (ARPU) and customer lifetime value (CLV).

- Margin expansion and improved reliability. Automation reduces reliance on traditional intermediaries and enhances system reliability and resilience by minimizing risk of human error, resulting in a lower cost to serve and operating margin expansion.

With onchain lending, operators can meet growing demand for crypto asset utility while still maintaining customer relationships through their platforms. Moreover, DeFi can introduce additional opportunities for operators to offer other financial products or to drive operating efficiencies around treasury management and financing activities.

Aave’s Market Leading Solution for Integrators

For operators ready to empower their customers to do more with their idle crypto holdings by enabling crypto-backed loans, plugging into Aave is the simplest and quickest option to get started. Advantages of integrating Aave include:

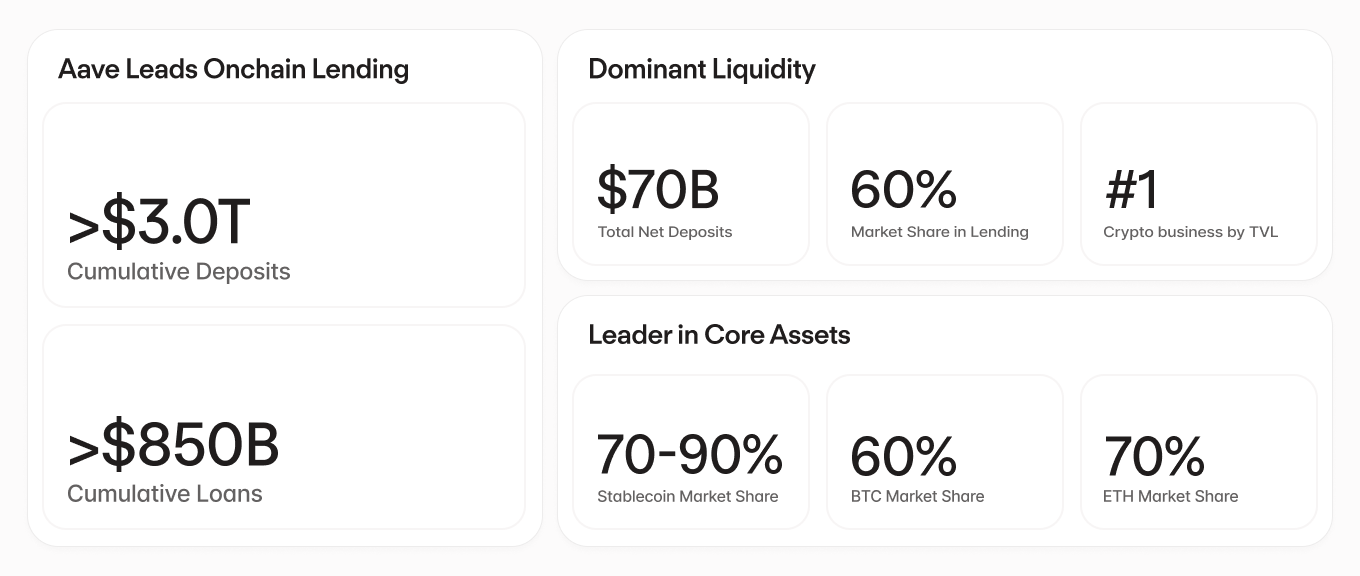

- Aave leads DeFi lending and offers deep liquidity across major markets. Aave is the market leader in DeFi lending with more than $70 billion in net deposits, capturing a commanding share across all lending platforms for major asset markets including stablecoins, ETH & staked ETH assets, and BTC-related assets.

- Competitive and resilient borrow rates. Aave’s deep liquidity and optimized market structure deliver highly competitive rates for borrowers, and have proven to support large inflows and outflows at scale without rate degradation across all major assets. Consequently, Aave is relied upon as the benchmark for DeFi rates.

- Real-time risk and performance monitoring. Aave offers full transparency into counterparties’ holdings, allowing for easy verification and traceability at any given time, unlike centralized lending providers which operate with opaque practices.

- Proven resilience across market cycles. Aave’s overcollateralization model and liquidation mechanisms have consistently protected lenders from default risk. More than $3 billion in liquidations across 250,000+ events have been successfully processed on Aave with minimal protocol-level losses.

By integrating Aave’s API or SDKs, operators can enable users to access crypto-backed loans without ever having to leave their app. Utilizing Aave’s existing infrastructure provides a fast-track for operators to bring their product offerings to market quickly, and Aave’s deep liquidity markets provide competitive and resilient rates for ideal user borrowing experiences.

For regulated operators requiring robust controls to meet compliance requirements, Aave has the tooling to source liquidity from its existing markets as a permissioned credit line for loans or to create siloed markets with access controls, such as Aave Horizon. Or if looking to offer more customized products for users, like individual risk premiums or tiered yield reward systems, operators will soon be able to leverage Aave V4's modular Hub and Spoke architecture for tailored solutions. V4 increases flexibility for any type of implementation, including custom loan markets with bespoke risk parameters, peer-to-peer borrowing, and separate custody setup through regulated entities to match traditional banking standards.

Outlook

Crypto is becoming a larger component of wealth for many individuals, who want access to credit through their trusted financial applications. Fintechs can meet customer demand to do more with their crypto by integrating Aave to offer crypto-backed loans – a more efficient and flexible form of borrowing that cannot be matched by traditional credit providers. Aave remains committed to equipping operators with the tools needed to deliver the benefits of DeFi to a global audience. Contact our team or learn more about how to integrate Aave here.