The Fintech Approach

The fintech revolution began with a simple premise: make finance convenient, affordable, and personal. Early challengers often targeted niches like payments, lending, or investing, using data-driven and digital-first models to compete with the incumbents. Many fintech solutions were initially offered as standalone mobile apps, prized for their ease of use and convenience, but the real shift in fintech came with embedded finance. Fintechs have become increasingly adopted as infrastructure to embed financial services into everyday platforms.

Crypto and DeFi are on the same trajectory, evolving from specialized applications to foundational infrastructure for open, programmable money. Yet, the frictions of blockchain infrastructure (e.g., wallet complexities, seed phrases, gas fees) have stifled mainstream adoption. Forward-thinking fintechs are bridging this gap by combining abstraction techniques with intuitive interfaces to provide new DeFi-powered customer experiences in savings, payments, and credit.

Trends Shaping Modern Finance

Like fintechs, DeFi closely aligns with inevitable trends shaping finance:

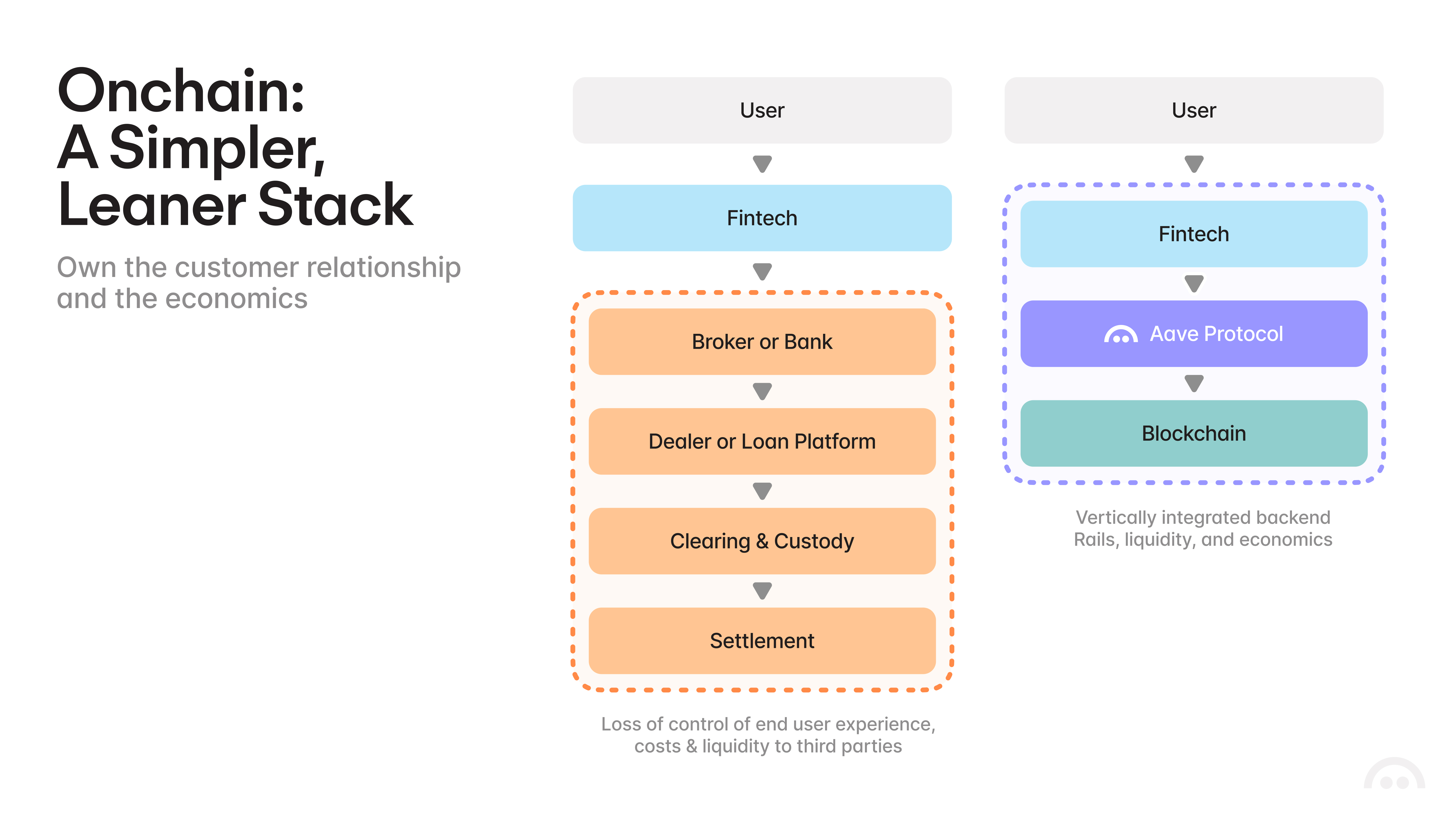

- With digital-first models and automated processes, fintechs operated on a leaner tech stack than traditional banks with physical branches. DeFi works in a similar way, using programmable smart contracts to automate processes including in lending, borrowing, and yield generation.

- Settlement delays are outdated. Fintechs offer features like near-instant payments and early paycheck access to attract customers frustrated with the constraints of traditional banking. DeFi also operates with near-instant settlement speeds to power payments use cases including remittances, foreign exchange, and payouts.

- Fintechs have made finance more inclusive and convenient by broadening accessibility, expanding market hours and meeting customers where they are. Crypto is powered by global financial rails, providing a convenient way for anyone to access financial services with 24/7/365 availability.

Fintechs started as user-facing apps but have gradually shifted focus towards building backend systems that support vertical integration for embedded finance applications at scale. Companies typically look to integrate vertically to foster stronger customer relationships and to improve user experiences. By controlling more of their operating stack, companies can lower costs, reduce reliance on third parties, and keep more of the value that they create.

With DeFi, benefits of vertical integration can go even further. Programmable composability lets companies run leaner while providing more control over the product, the operating margins, and the customer relationship. Since fintechs already own the distribution channel, integrating Aave allows them to capture more of money flows onchain.

Aave’s Evolution into Core Infrastructure

Aave has evolved from a lending protocol into a robust infrastructure layer for fintechs, banks, wallets, and DeFi developers. Aave’s deep liquidity markets and flexible integration tools enable fintechs to offer a variety of DeFi-powered products:

- Crypto-backed loans serve customers who hold digital assets but need liquidity. Instead of selling their crypto holdings, customers can borrow against them without exiting their investment positions. For fintechs offering crypto trading, this creates a natural product extension that can unlock liquidity users without having to sell their assets, increase customer engagement on their platforms, and expand revenue opportunities. Read more about the advantages of Aave’s crypto-backed loans here.

- Embedded yield accounts transform idle customer balances into productive assets. Any fintech with customer deposits can integrate Aave markets to offer DeFi-powered savings accounts. User deposits on Aave can earn interest from borrowing activity within the protocol, and Aave's adoption of the ERC-4626 tokenized vault standard simplifies the integration so fintechs can offer low-maintenance yield products for their customers.

Bridging the Gap: Abstracting DeFi into User-Facing Apps

Fintech and DeFi are converging toward a unified model. Fintechs, renowned for their superior customer experiences, are increasingly turning to DeFi to overcome the constraints of legacy financial rails. At the same time, crypto apps built on DeFi’s infrastructure aim to overcome long-standing user frictions to provide consumer-grade fintech experiences. Self-custody, clunky wallet addresses, unpredictable gas fees, and private key management has largely kept DeFi in the domain of crypto-natives and tech-savvy individuals. Fortunately, the infrastructure gap has been narrowing with improvements in scalability, increased connectivity to fiat rails, and better tooling to abstract blockchain complexities.

The combination of DeFi’s utility and fintech’s intuitive interfaces allows for transformative customer experiences in financial service, where users won’t have to know blockchain mechanics to feel its impact. They will simply experience faster, smarter, and more intuitive finance.

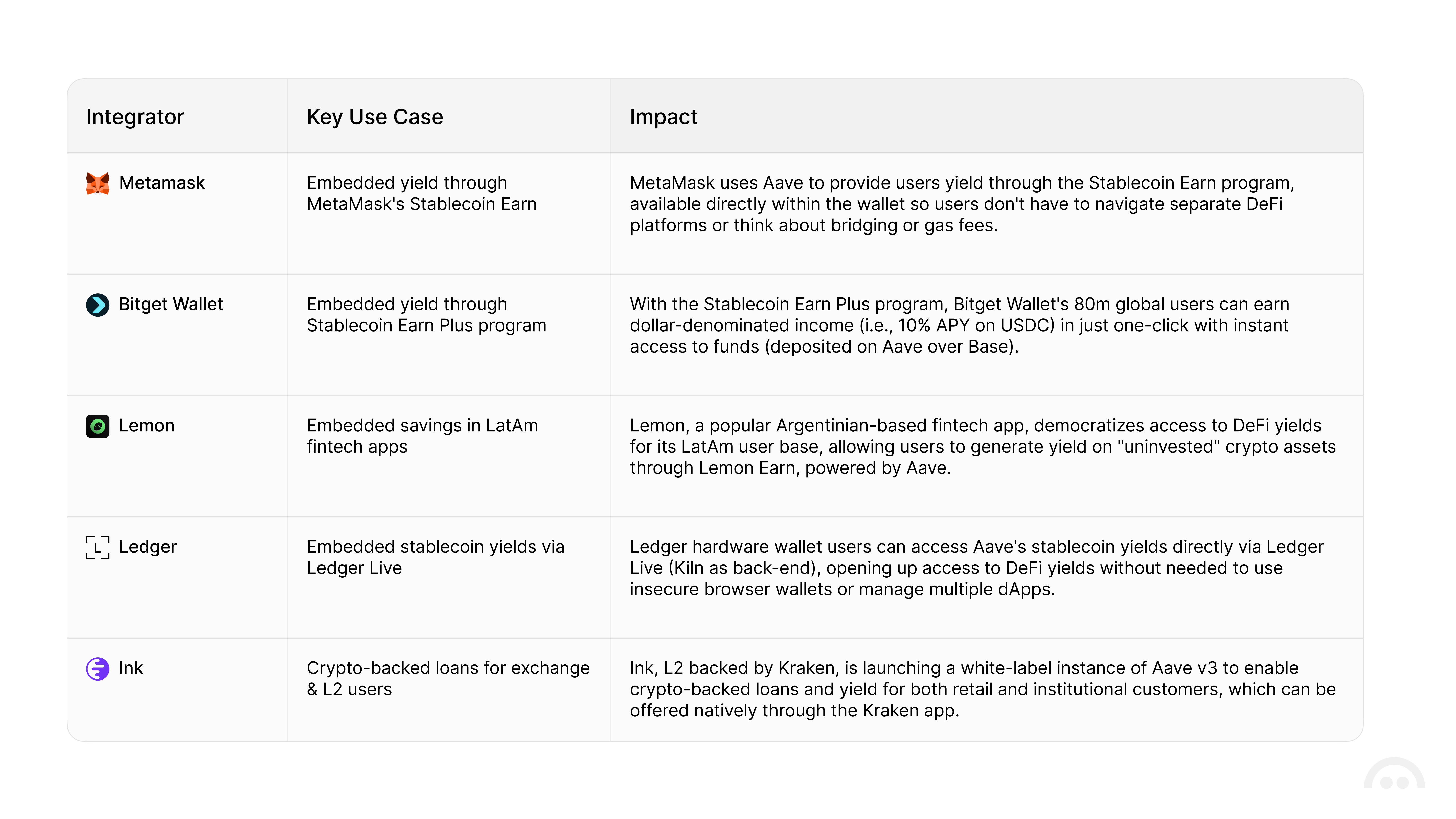

Aave has made significant progress along this front, serving as the backend liquidity layer for an expanding array of innovative user experiences. With its pioneering backend integration in 2022 with LatAm-based fintech Lemon, Aave has built the industry's most comprehensive track record in servicing this model, consistently delivering secure and reliable support to its partners.

More recently, Aave has also been integrated directly into exchanges and crypto wallets. Wallets like MetaMask and exchanges like Bitget embed quick-access yield accounts into their apps through their Earn program, powered exclusively by Aave. Ledger allows self-custody users to access Aave’s stablecoin yields directly through Ledger Live with no browser required. Additionally, Ink (L2 blockchain backed by Kraken), announced a partnership with Aave and will exclusively leverage Aave’s proven technology to enhance and expand its onchain product offerings.

Embedded Wallets: Lowering the Barriers

Embedded wallets have been a breakthrough in DeFi adoption, dramatically simplifying the onboarding process for users by integrating crypto functionality into fintech apps. Programmable and web-native, they combine account management, authentication, and secure key handling so that users can interact with onchain services. Key benefits include:

- Web2-like authentication / sign-in so users can authenticate using familiar methods such as social logins using Google or Apple accounts.

- Instead of relying on seed phrases, embedded wallets provide users with social recovery, which avoids single points of failure and provides users with more peace of mind over their crypto assets.

- Simpler fee payments with smart accounts. Integrators can manage approval logic and choose which tokens pay for gas fees (including stablecoins) or can even opt to sponsor fees to streamline UX.

Aave has partnered with embedded wallet providers like Privy (broad, low-friction onboarding via SDKs), Para (cross-chain versatility for neobanks and payments), Dynamic (flexible wallet infrastructure for stablecoin payments), and Turnkey (secure key management for enterprise/trading apps) to make integration effortless.

These embedded wallets serve a wide range of integrators, including TradFi and crypto natives, but all pair well with Aave’s lending/yield primitives. They add distribution on top of Aave’s liquidity, so that more can turn their balances into productive, yield-generating assets.

Forging the Future of Embedded Finance with Aave

The convergence of fintech and DeFi marks the next stage in financial innovation. One where money moves faster, works harder, and becomes accessible to anyone. Aave's evolution into core infrastructure powering lending, yield, and credit markets through embedded integrations positions it as the liquidity engine behind this shift. By abstracting away crypto’s complexities, Aave enables fintechs to deliver DeFi-powered experiences without compromise. Aave and its partners are advancing the fintech mission of making finance more efficient and accessible to all.

Learn more about how to build on the Aave stack today.