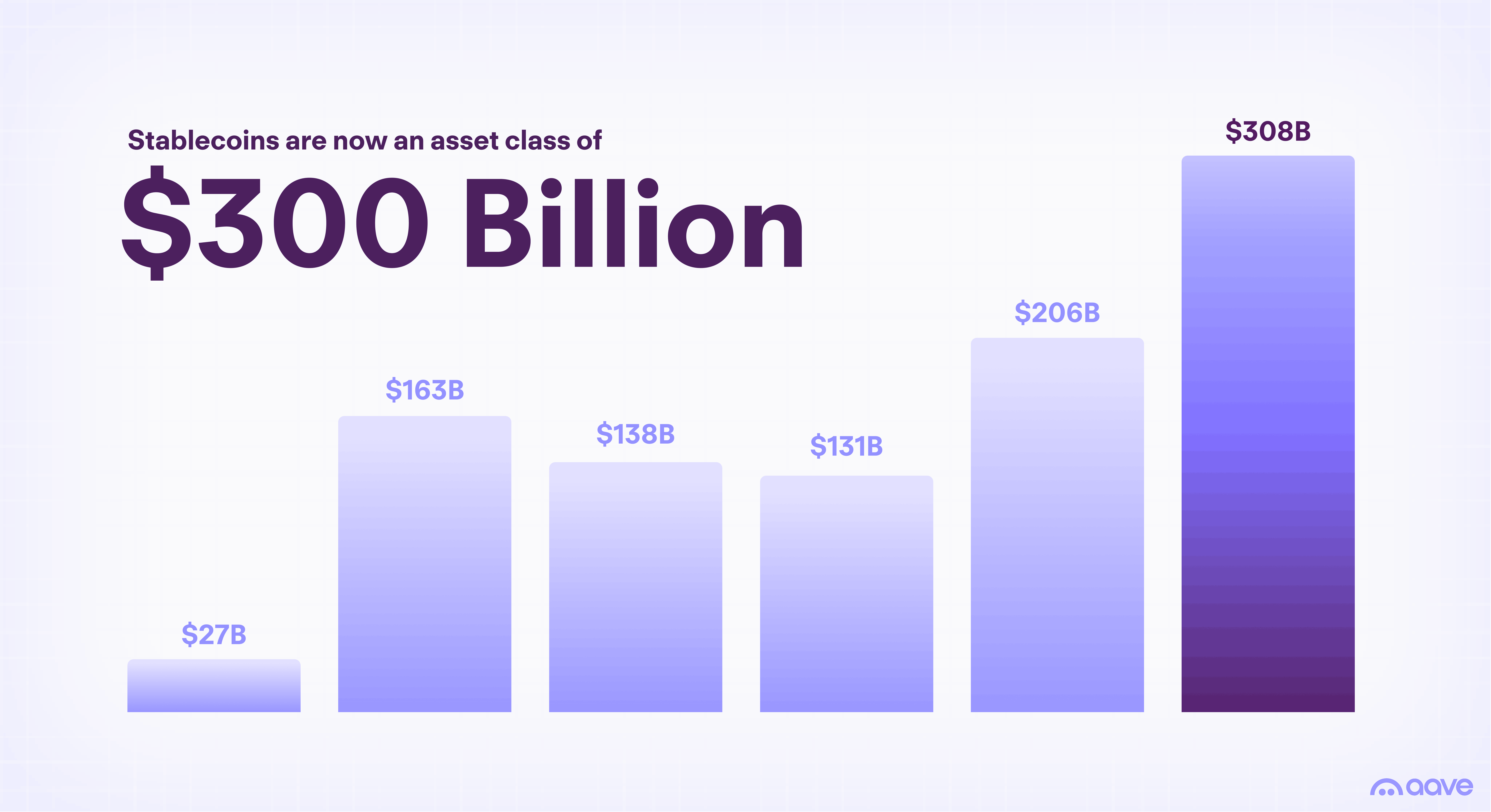

With global stablecoin market capitalization surpassing $300 billion in 2025, protocols like Aave serve as critical engines for their growth and proliferation.

The number of stablecoins is expanding rapidly, with major corporations and established financial brands announcing plans to launch their own products. DeFi Llama tracks more than 300 stablecoins, yet only 14 of them currently hold a market cap exceeding $1 billion. Aave has served as a launchpad for the majority of these bluechip stablecoins by unlocking utility, facilitating borrowing, and expanding distribution to drive significant supply growth.

As the stablecoin landscape becomes increasingly competitive, Aave provides stablecoin issuers with the strongest pathway for scaling their assets. Aave provides issuers with distribution while delivering users resilient, predictable yields across diverse strategies. Aave is the home of stablecoins with a commanding share of stablecoin liquidity deposited in DeFi lending markets (80%+ share of USDT & USDC deposits/borrows on Ethereum). Other distinct stablecoins all benefit from Aave's deep, unified liquidity, which works to draw in more supply and activity to create a reinforcing flywheel that no other protocol can match.

Stablecoins on Aave

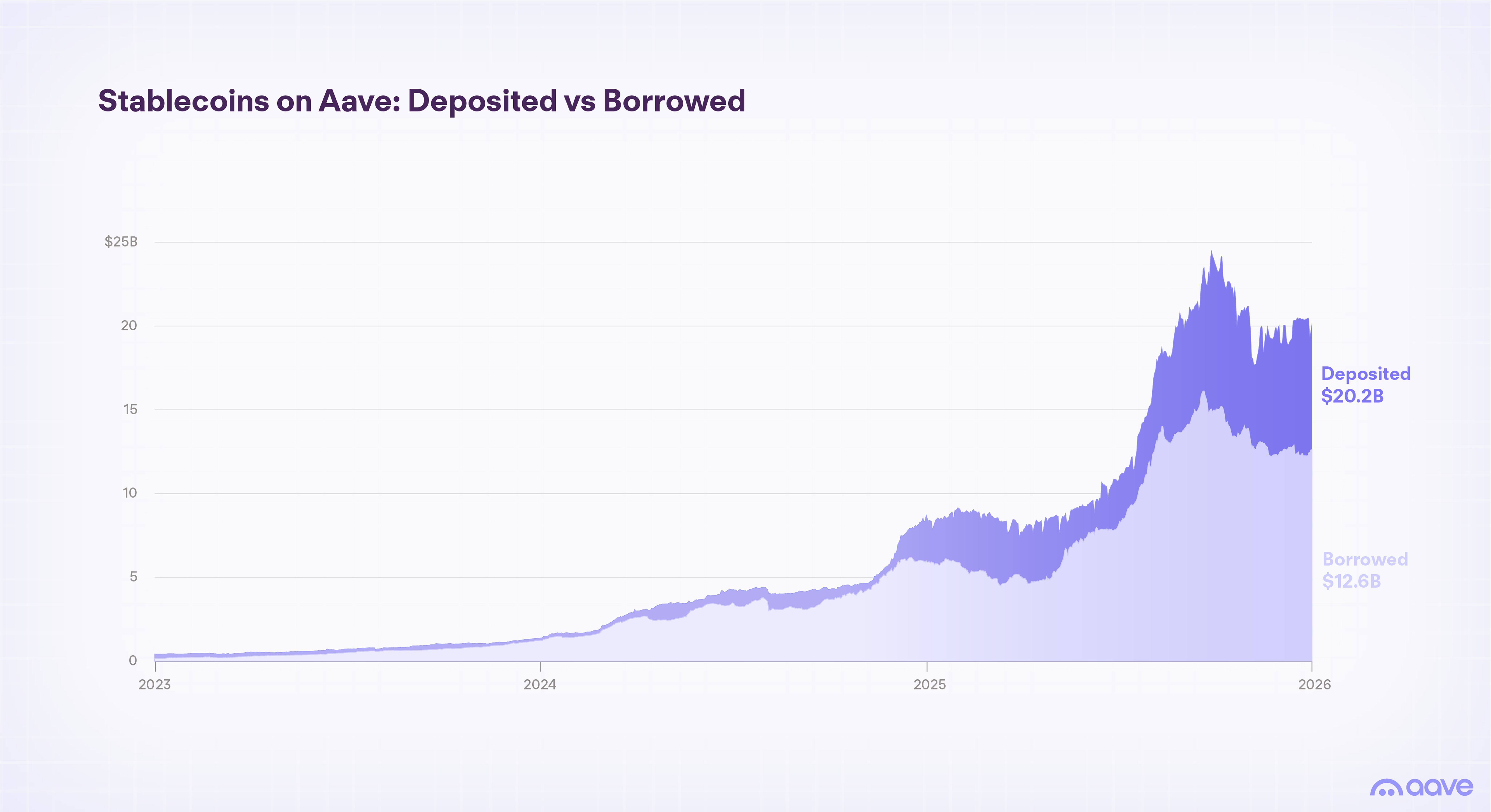

On Aave, stablecoins have been extensively used for borrowing against crypto collateral and have seen increasing adoption as tools for saving, hedging, and pursuing yield opportunities.

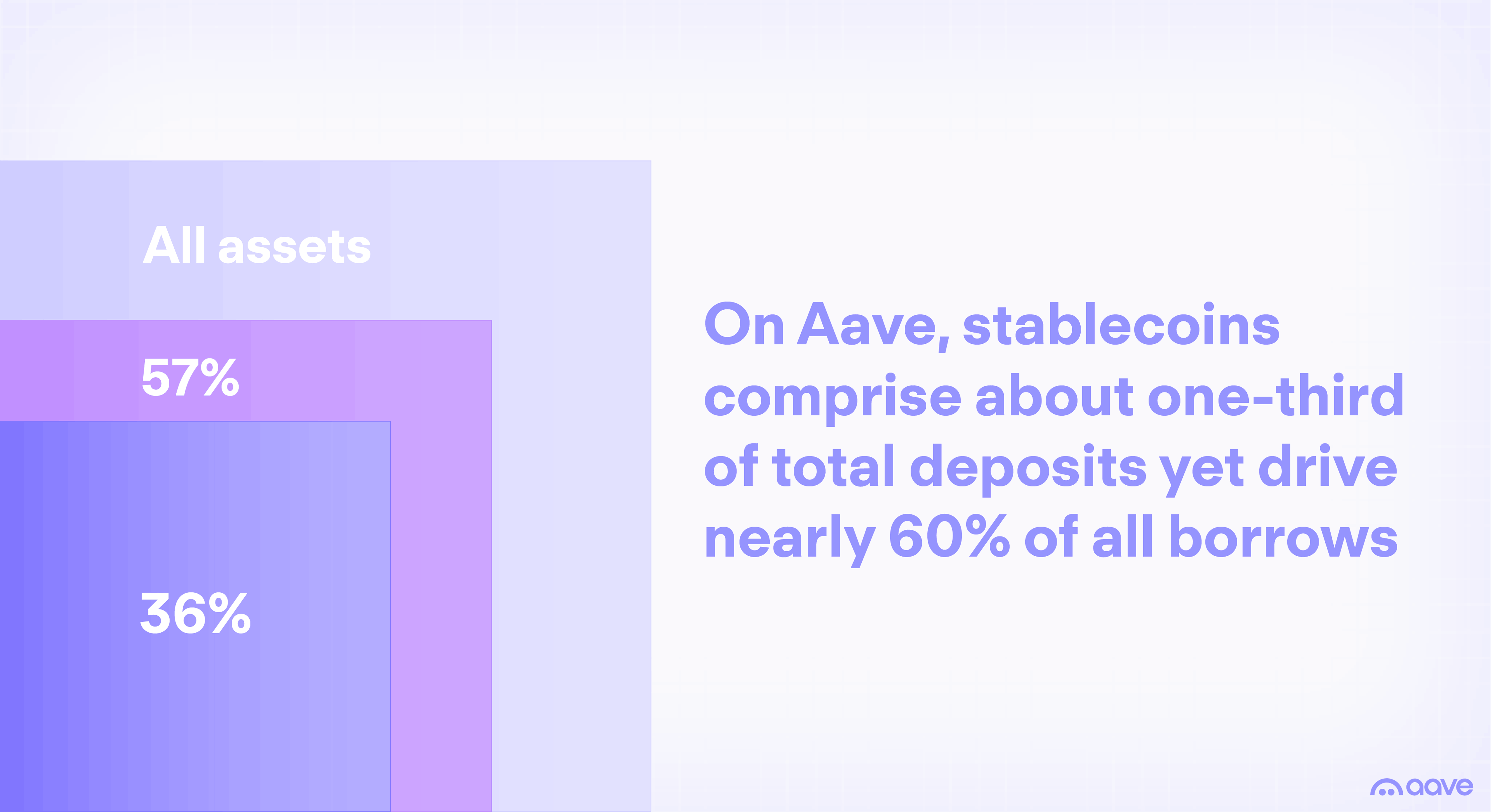

With $13 billion of stablecoins borrowed against $20 billion of deposits, stablecoins comprise more than 50% of all borrowing on Aave despite being just ~33% of total deposits.

Throughout 2025, the share of stablecoins in total assets and deposits has steadily trended higher, driven by declining crypto prices (flight to safety) and the proliferation of Earn programs (deposit-only positions with no borrowing activity) to provide users with yield on stablecoin deposits powered by Aave. These programs span integration partners including exchanges (e.g., Binance, crypto.com), self-custodial wallet providers (e.g., MetaMask, Bitget, Ledger Live), embedded wallet providers (e.g., Privy, Para, Dynamic, Turnkey), and others.

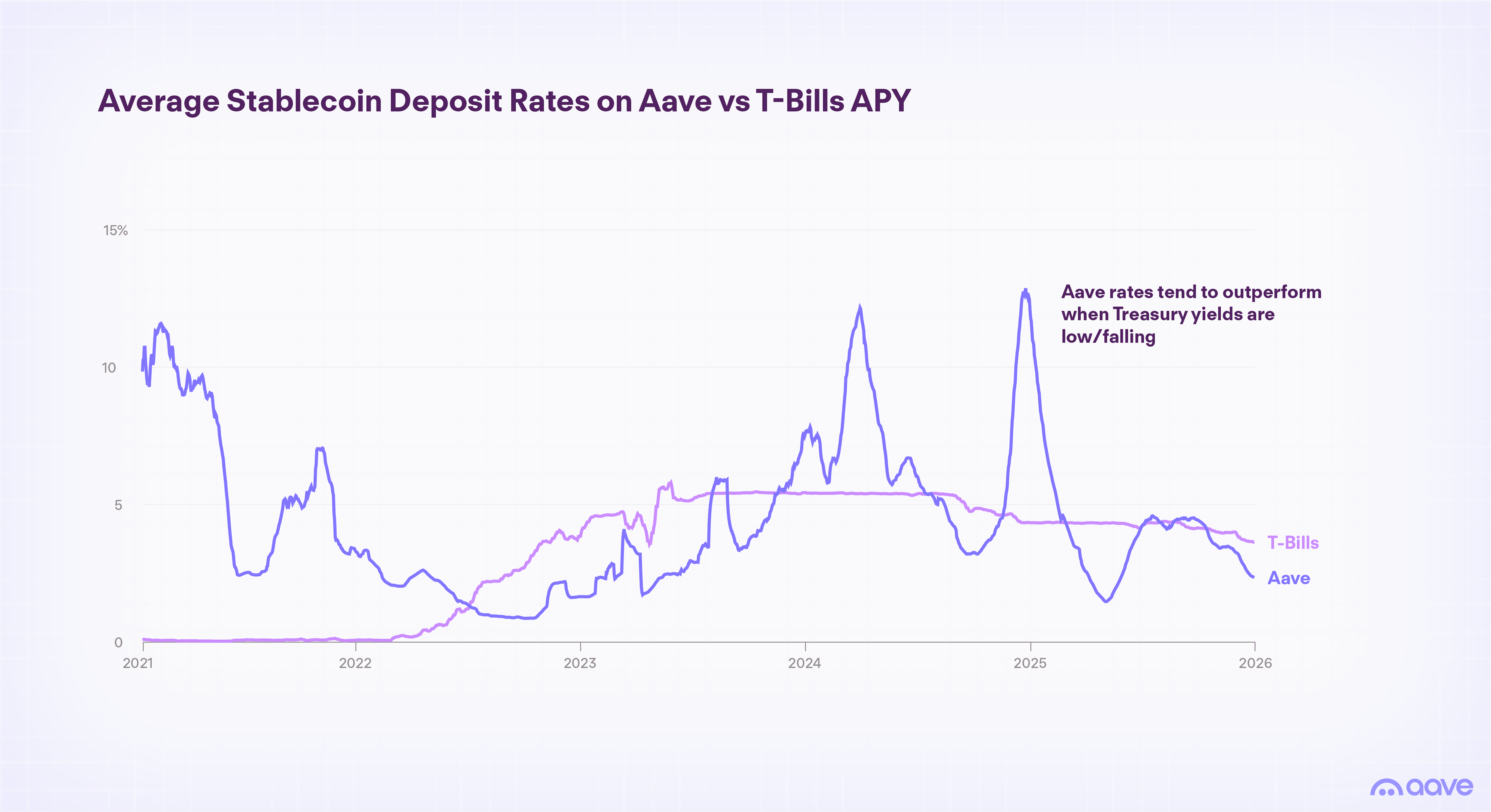

The current easing environment is supportive of this trend. Fed rate cuts make DeFi yields more attractive relative to traditional finance, and Aave's high utilization rates (>60%) keep deposit yields robust and largely insulated from Fed policy shifts.

By asset, USDT and USDC have remained the dominant stablecoins used across Aave and the broader crypto ecosystem. Since Aave accounts for most of DeFi lending activity, Aave's supply and borrow rates for these stablecoins largely reflect overall DeFi credit conditions and serve as benchmark rates for other stablecoin and financial products.

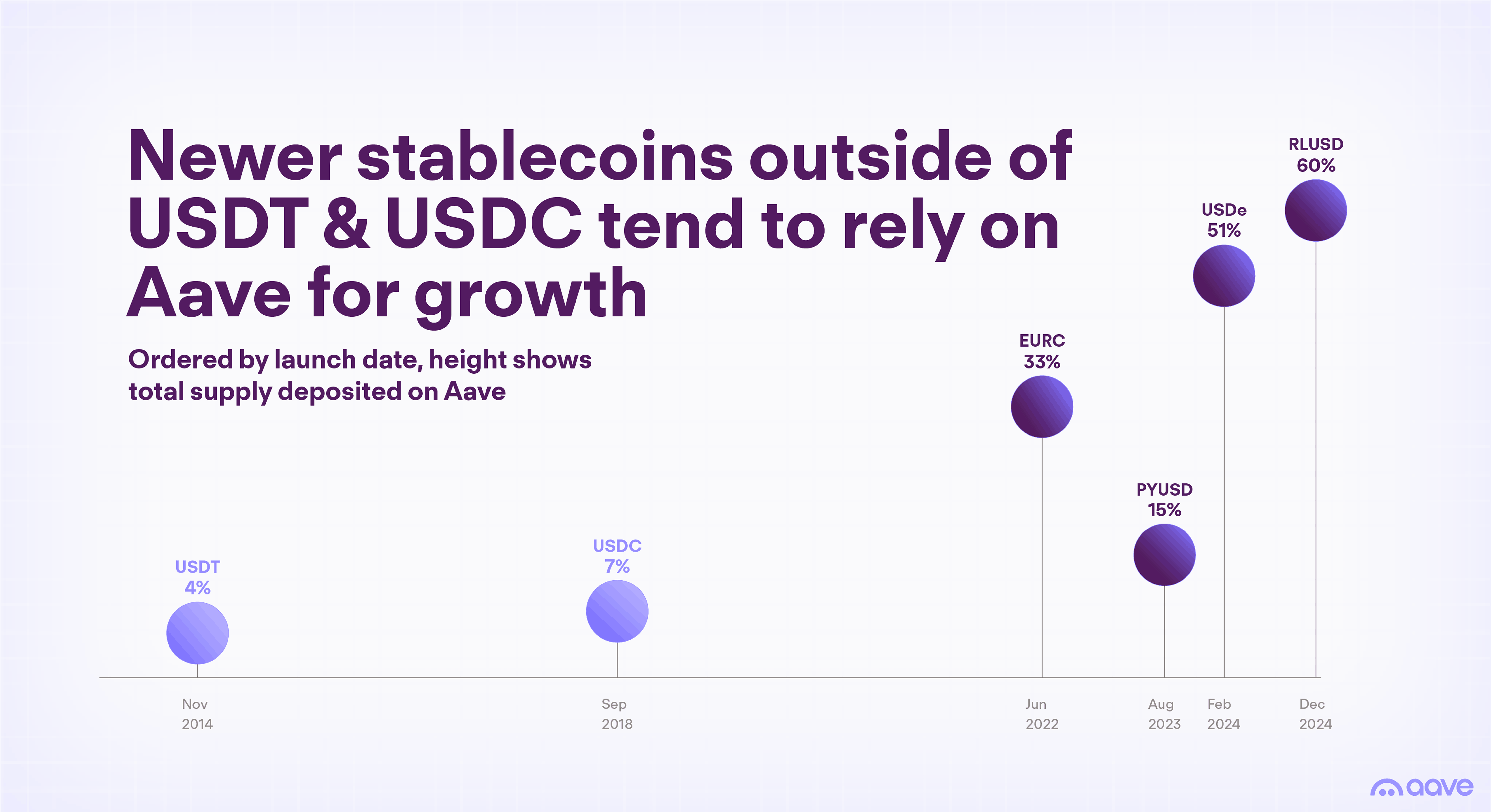

However, an emerging cohort of stablecoins is challenging the longstanding Tether-Circle duopoly, including Ripple's RLUSD and PayPal's PYUSD. Both have posted impressive supply growth into the billions in recent months, highlighting Aave's yield engine as a catalyst for stablecoin scaling.

Institutional Borrowing on Aave Propels Ripple's RLUSD to Over $1 Billion

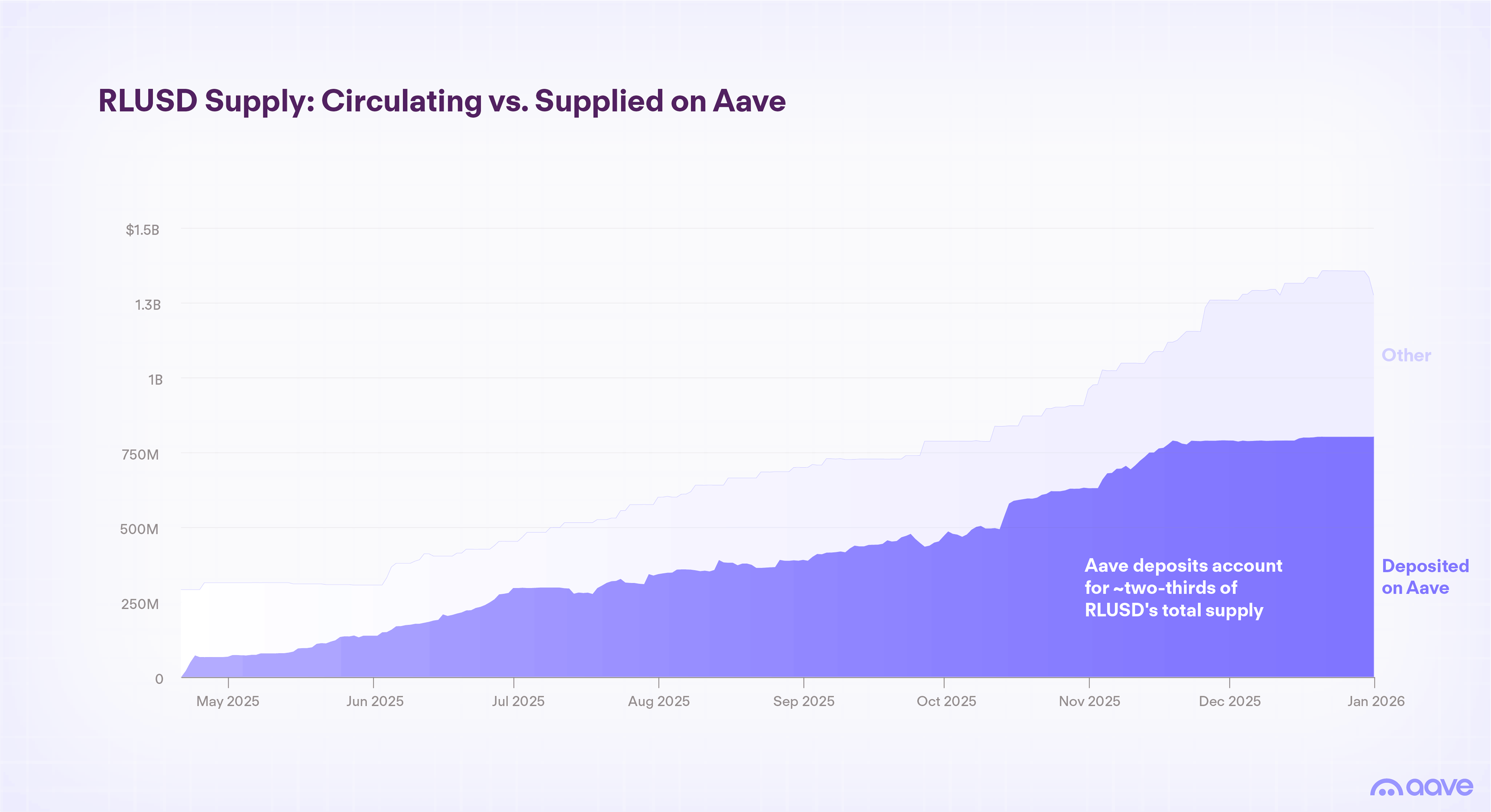

In December 2024, Ripple launched RLUSD, a NYDFS-approved stablecoin initially made available on Ethereum and the XRP Ledger. RLUSD was first integrated into the Aave V3 Ethereum Core Market in April 2025 when its circulating supply was around 250m. By 2025 year-end, RLUSD supply exceeded 1.3 billion – marking a 5x increase in just nine months and making it one of the fastest stablecoins to reach the milestone achievement.

Most of RLUSD's expansion has occurred on Aave with 800m deposited on Aave (representing nearly two-thirds of RLUSD's total supply).

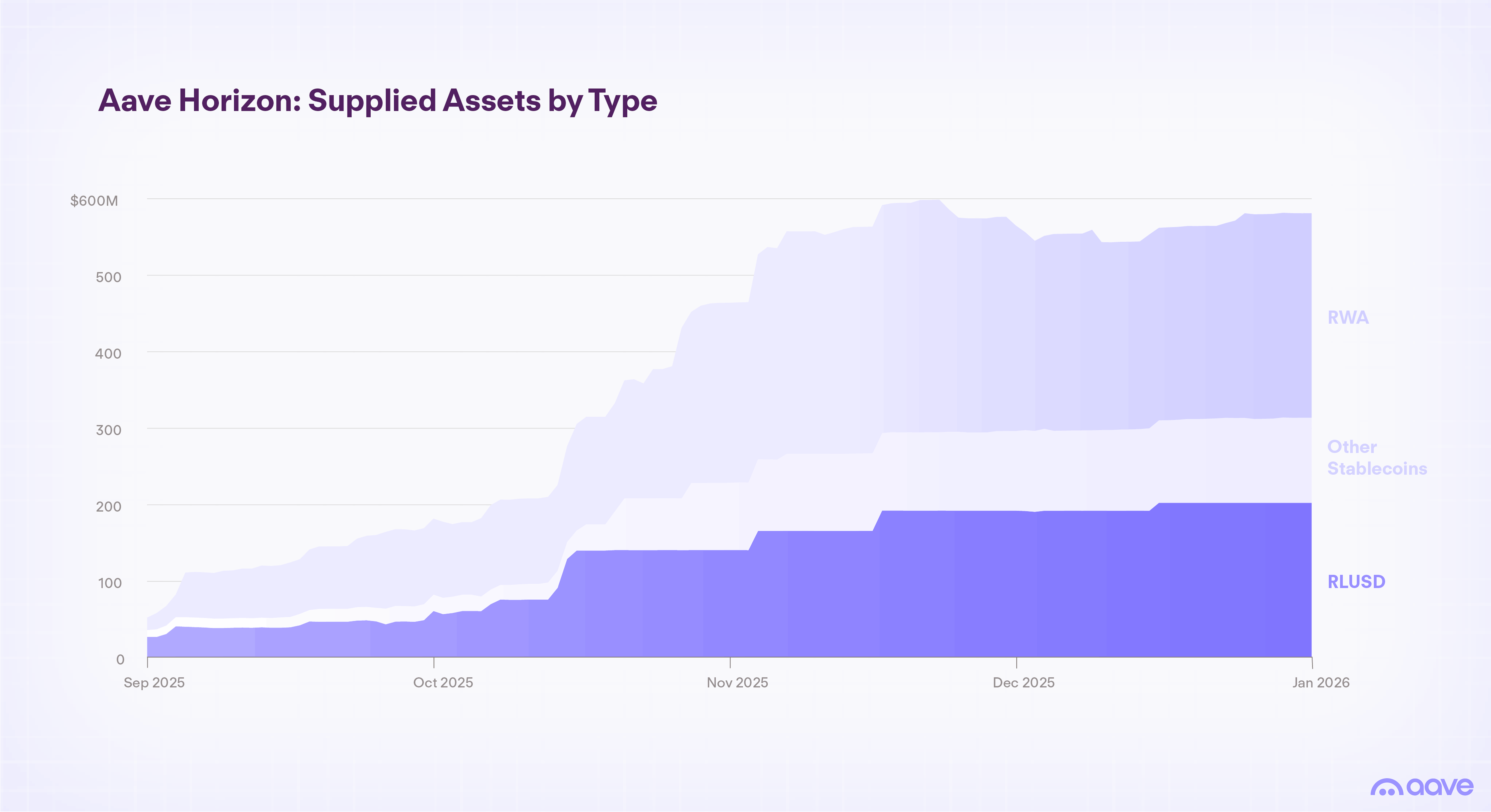

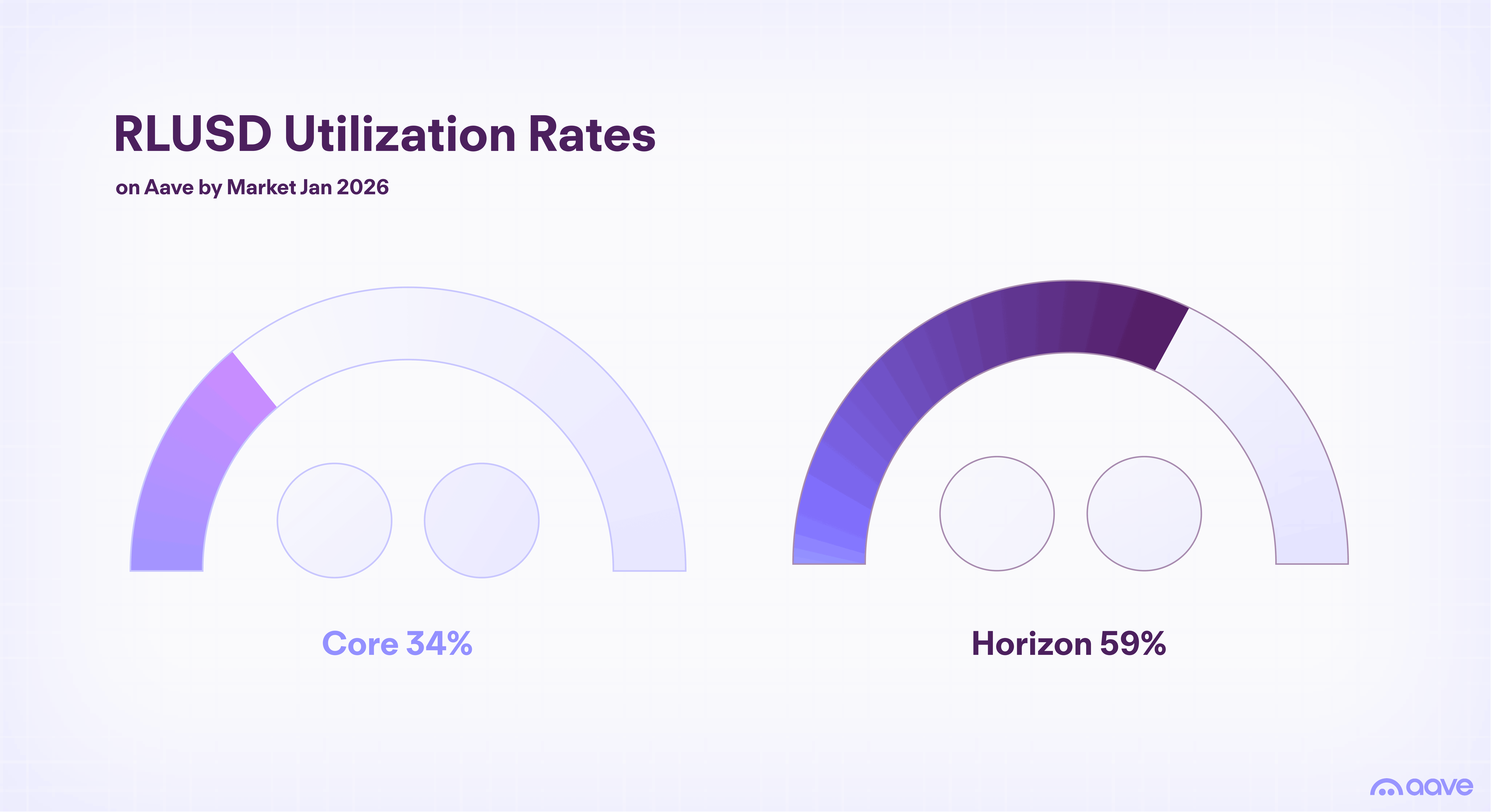

The launch of the Aave Horizon RWA Market in August 2025, which enabled qualified institutions to borrow stablecoins against tokenized securities as collateral, was a major driver of RLUSD's growth on Aave. Aave Horizon featured RLUSD as one of the few borrowable stablecoins alongside USDC and GHO, sparking immediate institutional demand for leveraged yield plays.

Today, RLUSD stands as Aave Horizon's largest single asset, with utilization rates steadily holding above 60%, far higher than rates on the V3 Core Ethereum market and driven entirely by institutional borrowers.

PayPal USD Sees Fresh Resurgence via Aave

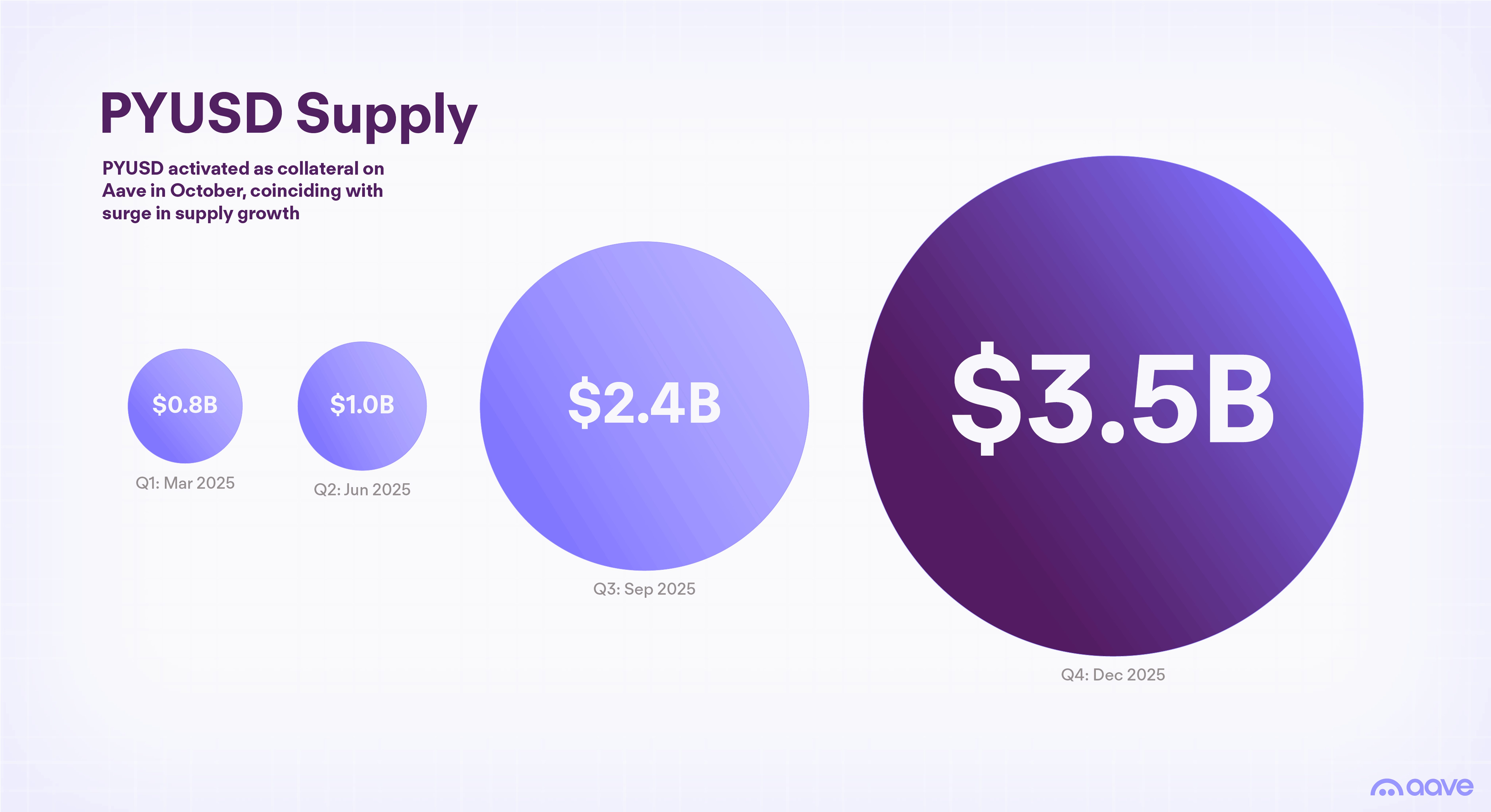

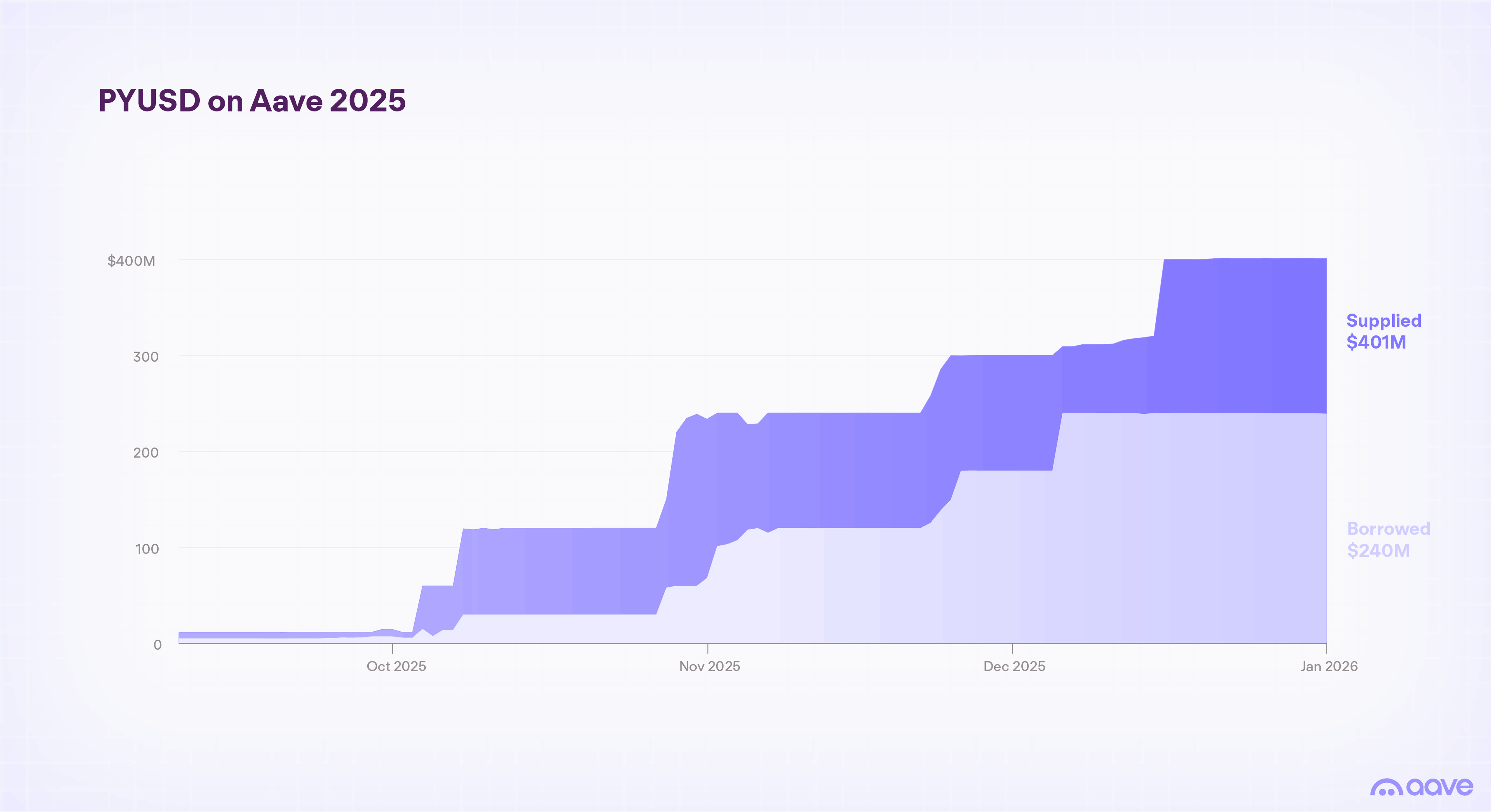

In August 2023, PayPal launched PYUSD, its own stablecoin issued by Paxos. Though it has been in existence for several years, PYUSD's growth largely materialized after its enablement as collateral on Aave V3 Core Ethereum in October 2025, combined with targeted supply incentives on Aave.

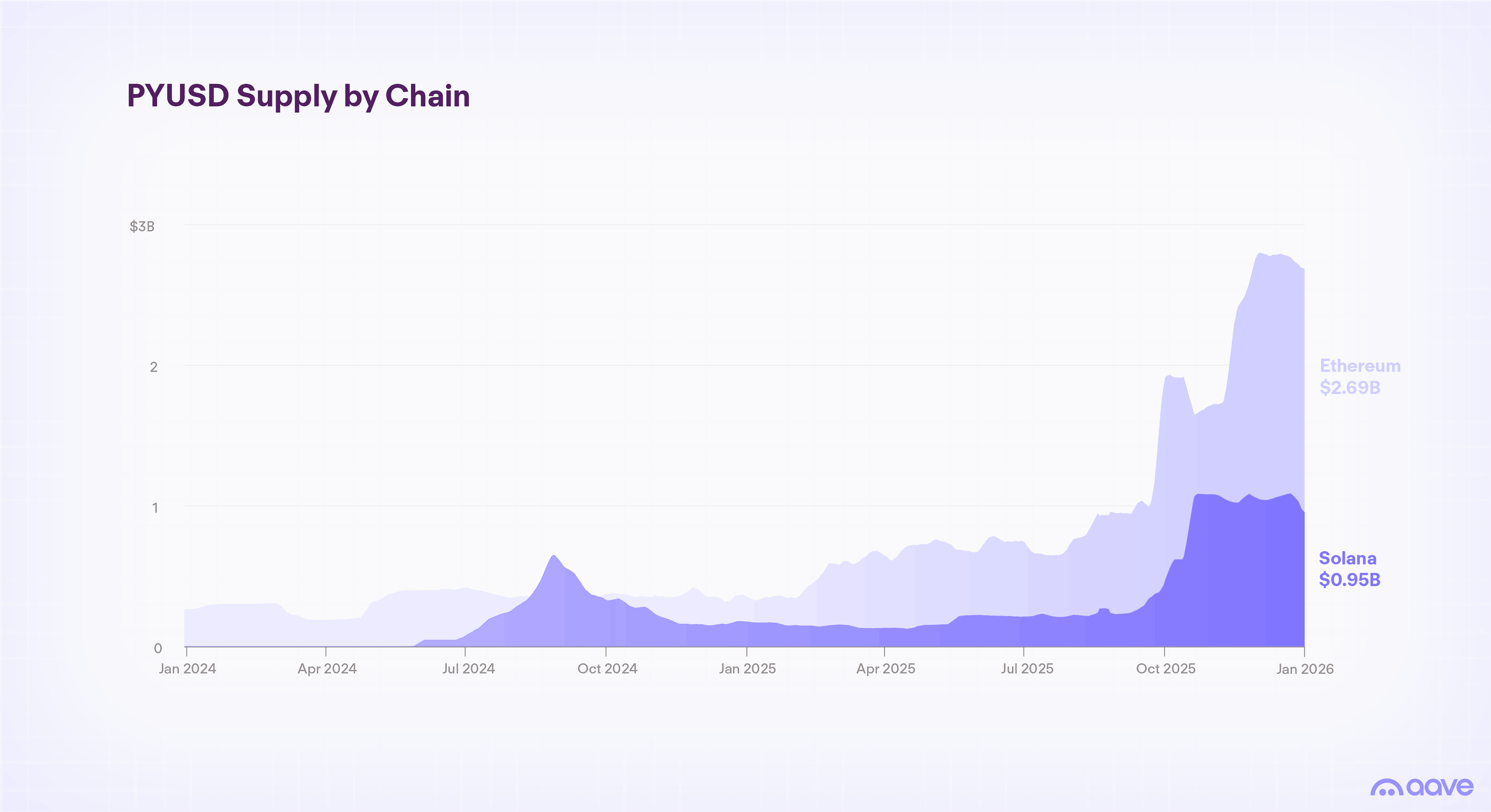

Since the start of October, PYUSD supply has surged by ~50% to a total of $3.6 billion. A substantial amount of its growth stems from Aave, where PYUSD deposits have grown to $400m, accounting for nearly half of PYUSD's supply growth on Ethereum since it had been enabled as collateral. PYUSD deposits have repeatedly hit supply caps, requiring frequent increases that fill almost instantly each time.

PYUSD supply incentives on Aave have coincided with a fresh surge in adoption. Liquidity has now shifted decisively from Solana (PayPal's initial target market for PYUSD) to Ethereum, which hosts nearly 3x more PYUSD supply than all other chains combined, a clear signal of Aave's unmatched distribution power.

Additionally, a Paxos technical error briefly minted an erroneous ~300 trillion PYUSD in October 2025. Aave risk stewards swiftly froze PYUSD markets as a precaution, helping to limit fallout until Paxos rectified the error and preserving trust in PYUSD's peg and stability.

The Aave Advantage – Why Stablecoins Scale Fastest on Aave

Aave's ecosystem connects asset issuers with a dedicated borrower base to support diverse use cases, along with top-tier service providers and DeFi partners to ensure robust tooling for effective scaling.

-

Yield-bearing deposits: Aave enables any stablecoin to turn into a yield-bearing asset as aToken deposits with yield/interest backed by real borrowing demand. Yields on stablecoin deposits are often more competitive than the rates on Treasuries, and are resilient in any macro rate environment.

-

Flexible market configurations: Aave enables flexible market configurations (e.g., Core markets, isolated pools, E-Mode) to support diverse use cases including leveraged yield opportunities (i.e., looping) that have propelled assets like Ethena's USDe to over $10bn in supply.

-

Aave Horizon RWA Market: The Aave Horizon RWA Market unlocks greater utility for tokenized RWAs by enabling them to serve as real-time collateral for stablecoin loans. Aave Horizon provides greater distribution for stablecoins to reach institutional borrowers, which can offer rapid scaling potential as evidenced by RLUSD's trajectory.

-

Proactive risk management: Aave's risk stewards provide proactive risk management to enhance peg stability for stablecoins to scale safely and sustainably. They monitor for broader market risks, dynamically adjust supply caps and parameters, and offer risk isolation and contagion prevention (e.g., the PYUSD minting incident) to safeguard peg stability and sustainable growth.

-

Unmatched liquidity depth: Above all, Aave is the premier venue for stablecoin liquidity across all of DeFi with $20 billion in total stablecoin deposits. This represents 70-90% of all stablecoin liquidity deposited across lending protocols. Aave's edge in depth of stablecoin liquidity supports sustainable yields and offers unmatched scaling capacity for stablecoins.

Data shows that many emerging stablecoins rely heavily on Aave as their primary source of growth. Newer stablecoins (based on their launch date) tend to have a larger percentage of their circulating supply deposited on Aave.

Aave's Proven Outcomes for Supporting Issuers & Scaling Stablecoins

Tether (USDT)

Aave has been a major contributor to USDT's onchain growth and usage. Nearly 6% of total USDT supply (~$6B of $102.7B) has been deposited through Aave, and as of Dec 2025 the protocol supports ~80% of USDT lent onchain and ~60% of USDT held in DeFi. Aave helps with cross-chain distribution – its brand and reputation make it the premier DeFi protocol of choice for new blockchains, such as the recently launched Plasma chain where Aave helped attract $7bn in deposits within days of launch (which includes Tether's USDT0 and XAUT).

Circle (USDC)

Aave is Circle's primary onchain lending market for USDC. USDC deposits on Aave totals nearly $6bn, representing ~60-75% of all USDC on lending protocols. As of December 2025, ~60% of all USDC liquidity used in DeFi resides on Aave. Aave has supported USDC's growth by powering yields for many of the stablecoin Earn programs, and supported Circle by also creating markets for its other issued assets including EURC (Circle's Euro-stablecoin) and USYC (tokenized MMF).

Ethena (USDe)

Aave has been the key accelerator in the growth of Ethena's USDe, which was able to scale to $10 billion in less than 500 days of its launch. By providing a market for leveraged looping and working with DeFi partners like Pendle to create new ways of harnessing yields, Aave deposits of USDe-related assets have accounted for up to 50% of total USDe supply at its peak. Ethena also leverages Aave as a treasury management tool, earning yields on its regulated stablecoin USDtb.

Ripple (RLUSD)

Ripple was able to scale RLUSD to $1.3bn in under a year of its launch. Most of this growth took place on Aave (controls two-thirds of RLUSD float) which connected RLUSD with a strong network of borrowers. RLUSD has become the largest asset on the Aave Horizon RWA market, where robust institutional demand has kept borrowing utilization rates on RLUSD consistently above 50%.

PayPal (PYUSD)

PYUSD has seen strong growth and activity on Aave since deploying its rewards. PYUSD deposits have reached their current supply cap, which have necessitated frequent increases and have filled nearly immediately each time they are raised. Aave's contributions to PYUSD's recent growth is notable as PYUSD incentives have historically targeted Solana and other lending protocols, suggesting incentives deployed on Aave tend to drive more sustainable outcomes.

Maple (syrupUSDT and syrupUSDC)

Aave helps bridge Maple's institutional capital with DeFi liquidity. Aave's integration of Maple's regulated yield-bearing assets (e.g., syrupUSDC and syrupUSDT) were recently integrated on Aave's Core Ethereum market along with Aave's Plasma Instance, where syrupUSDT became one of the fastest-growing assets, attracting over $500m in inflows shortly after launch.

Scale with Aave

Whether a stablecoin for payments, native yield, or both, Aave is the only lending protocol that can reliably scale new assets to billions of dollars in liquidity. With a multi-year track record across a variety of chains, stablecoins that bet on Aave scale best.