In October, the Fed lowered Fed Funds Rate by another 25 bps to bring the target range to 3.75% to 4.00%, with further easing expected. This blog post explores how Fed policy shifts affect DeFi markets and why Aave is uniquely positioned in the current cycle.

Background: How Fed Policy Impacts DeFi

The FOMC's federal funds rate influences credit conditions and economic activity by anchoring credit products like mortgages and loans.

Aave's rates, which are driven organically by borrowing activity and supply/demand dynamics, are not mechanically tied to Fed policy. Still, macro shifts and Fed rates influence risk appetite and capital flows, which then drives borrowing behavior and affects DeFi activity:

- Rate cuts → stimulates economy → risk-on rotation → higher DeFi utilization → rising DeFi rates + revenue.

- Rate hikes → savings more attractive → capital flight to safer yields → lower DeFi utilization → softer protocol fees.

Rate cuts tend to attract risk-seeking capital to crypto and into DeFi to search for yield opportunities; rate hikes do the reverse, pulling risk-averse capital away from DeFi into safer financial assets like US Treasuries.

Historical Fed Policy vs. Impact to DeFi

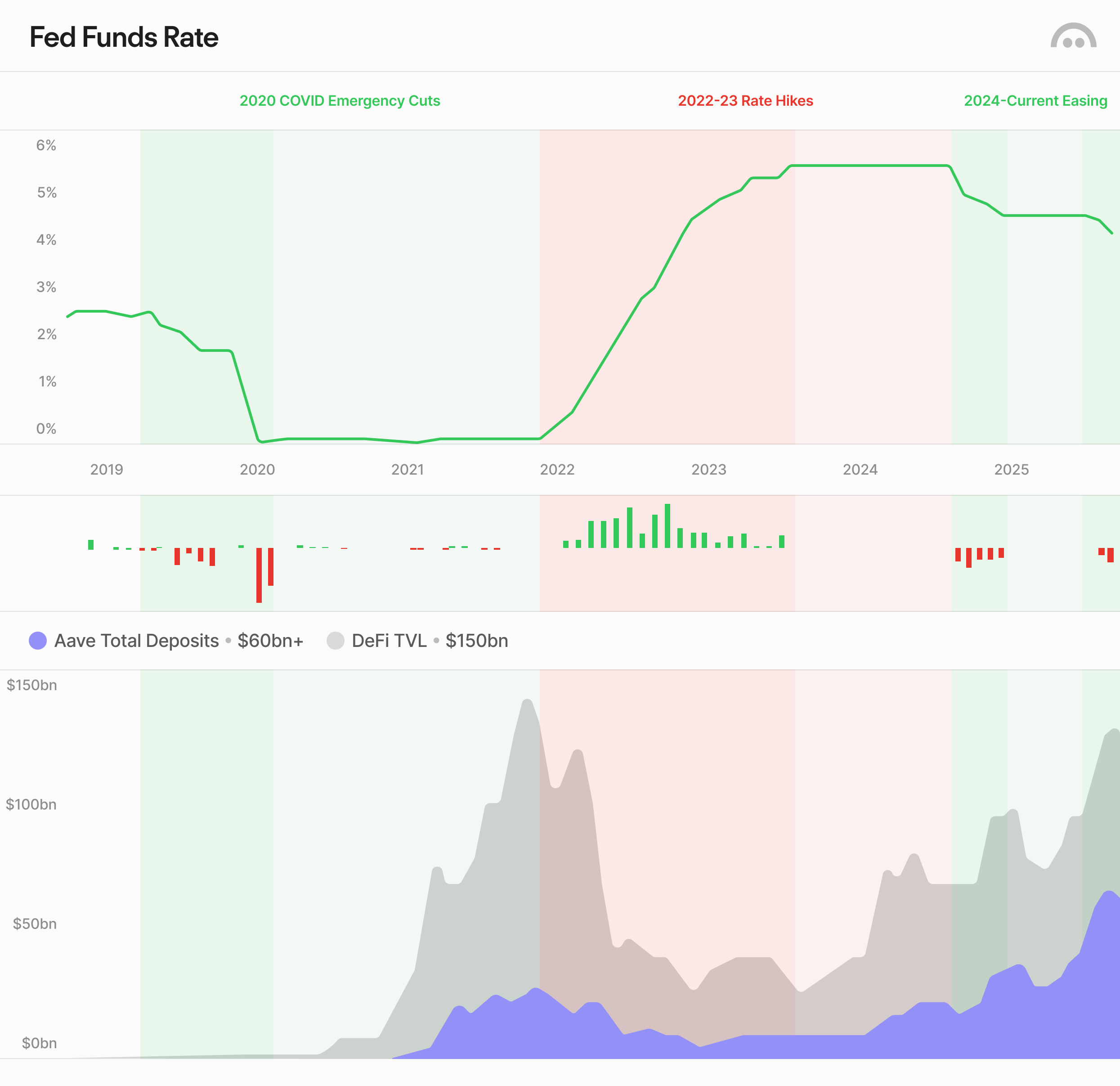

Since Aave V1 launched in January 2020, the protocol has weathered a full monetary cycle: beginning with COVID-era emergency rate cuts, 2022-23 aggressive hikes to combat inflation, and now the first easing cycle since March 2020.

2020 Emergency Cuts Give Rise to DeFi Summer

During 2020's near-zero interest rate environment, demand for yield became a key catalyst for "DeFi Summer", a pivotal period driven by yield farming and liquidity mining programs that attracted new participants and substantial liquidity to DeFi protocols. DeFi yields far outpaced TradFi's near-zero rates, creating a stark differential that attracted large capital inflows into the sector and propelled DeFi TVL from under $1 billion at the start of 2020 to $15 billion by year-end.

For Aave, DeFi Summer marked its initial breakout. As ETH surged to new highs, investors turned to Aave to earn yield and access liquidity by borrowing against their ETH using crypto-backed loans, an alternative to direct selling. Aave became the second protocol to surpass $1 billion in TVL (shortly after MakerDAO).

2022-23 Hikes Exacerbate Harsh Crypto Winter, Spark DeFi Yield Renaissance

The Fed began hiking rates in March 2022 to combat rising inflation driven by stimulus measures, pandemic-related supply chain disruptions, and shocks from global conflicts. This marked the start of one of the most aggressive monetary tightening periods in history with the Fed Funds target range increasing 525 bps to 5.25-5.50% by mid-2023.

The rate hikes curbed yield farming and speculation, triggering a capital migration from riskier crypto assets toward safer, non-volatile assets like stablecoins or cash-like products. This drove a steep decline in crypto prices, compounded by high-profile collapses among centralized crypto providers that eroded trust and confidence in the industry. DeFi TVL declined nearly 80% over 2022. Still, amid the difficult conditions of "crypto winter", several important advancements for DeFi emerged:

-

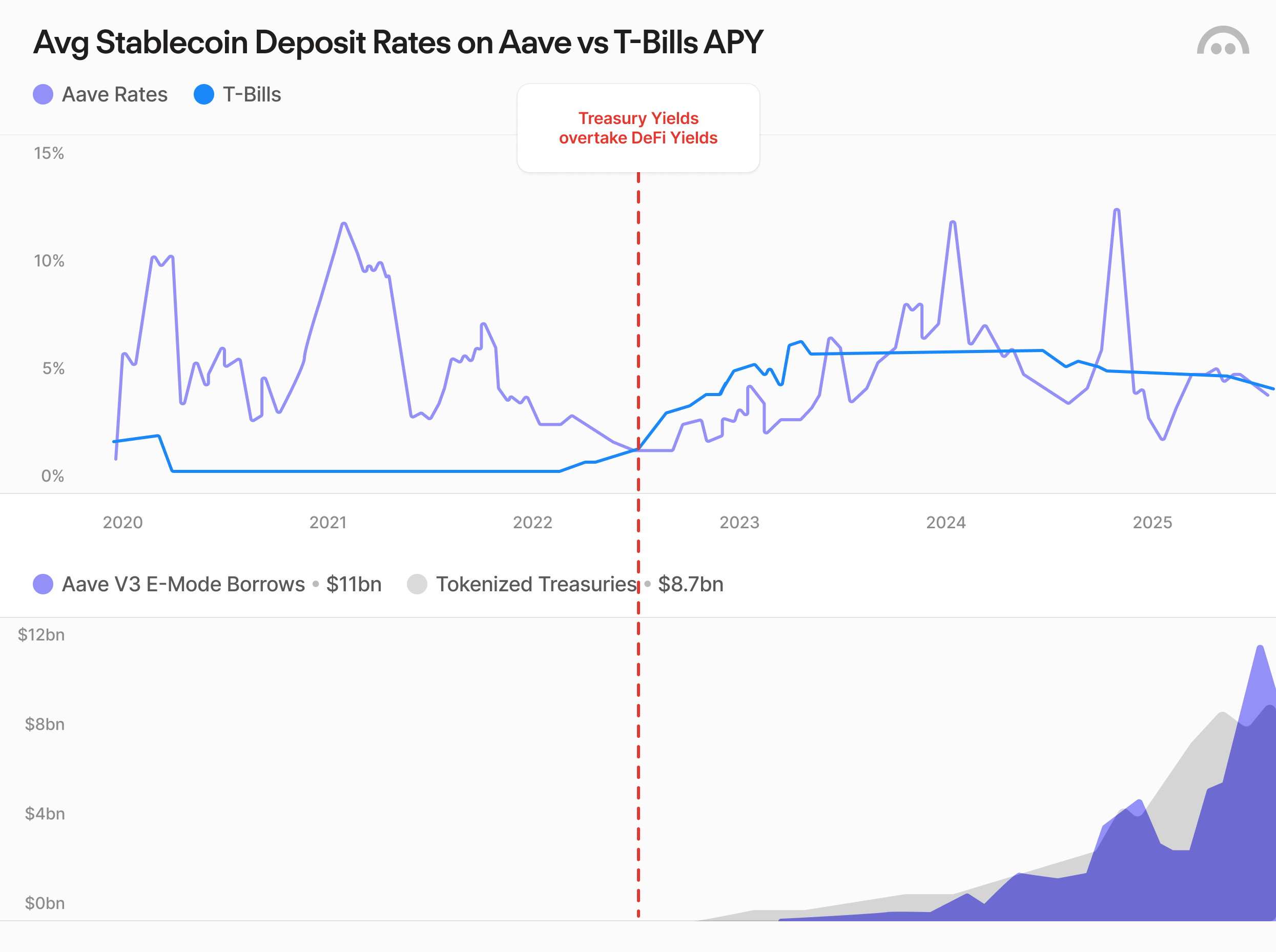

TradFi rates brought onchain, sparking tokenization surge: As TradFi yields eclipsed DeFi's declining yields, builders sought to bridge the yield gap by tokenizing real financial assets to bring 5%+ Treasury yields to DeFi. These efforts brought on trusted financial brands like BlackRock and Franklin Templeton for tokenized money market funds, which drew institutional interest.

-

DeFi pursues safer designs and real-yield products: Yield sourced by inflationary tokenomics proved unsustainable, prompting a search for better product designs backed by safer, more reliable yields. This gave way to the creation of new yield assets like liquid staking tokens and re-staked tokens (LSTs and LRTs), along with yield-bearing stablecoins (absent feature of USDC & USDT). Higher rates increasing the opportunity cost of holding non-yielding assets have pushed crypto treasuries and allocators to optimize idle ETH and stablecoin holdings.

Aave, which already enabled any asset to earn real yields sourced from borrowing interest through its core lending markets, introduced important tooling for these assets: leveraged looping markets for LSTs/LRTs and yield stables (see Ethena case study), the GHO stablecoin along with an option to earn low-risk interest by staking for sGHO, and Aave Horizon to unlock utility for tokenized funds by enabling RWA borrowing.

Aave in the Current Easing Cycle: Structurally Superior

While the previous cutting cycle gave rise to DeFi Summer, these were extraordinary circumstances that are not present with the current easing environment. We are unlikely to see zero rates or the same level of stimulus, digital acceleration, and speculative frenzy that brought many to DeFi for the first time. Similarly, we likely won't see as wide of a rate differential between DeFi yields and treasury yields as our industry has evolved and turned to more sustainable yield sources.

Even without these same tailwinds, Aave enters this environment in a structurally superior position. Continued monetary easing should support greater borrowing activity as rates are cheaper. The new developments and improvements made during "crypto winter" have helped to establish Aave as the preferred venue to scale up yield assets. Aave has also found increased institutional adoption as corporates and funds now treat Aave as on-chain treasury infrastructure, including on Aave Horizon which has grown to become the largest RWA marketplace.

As treasury yields compress, capital will rotate towards rate-neutral or crypto-native yields including LSTs/LRTs, stablecoins like GHO or delta-neutral stablecoins. These products derive yield independently from Fed rates from network activity, borrowing demand, and carry trades.

Further, the Aave DAO can maintain flexibility in its treasury strategy to position for a lower rate environment. To counteract these macroeconomic shifts and maintain competitiveness, Aave's risk managers can adjust key protocol parameters through governance like interest rate curve slopes, LTVs, and supply/borrow caps. For example, Chaos Labs submitted a governance proposal to lower the interest rate curves for major stablecoins to "better reflect current market yields, which have reduced borrower tolerance for higher rates" and to "stabilize borrowing demand and support sustainable protocol revenue in a relatively lower-yield environment."

The success of Aave no longer hinges on emergency Fed cuts. With structural improvements made during crypto winter and the heightened rate environment, Aave has evolved into resilient, capital-efficient rails for yield across risk-on and risk-off regimes. Aave continues to serve as DeFi's benchmark rate, while laying the foundation for tomorrow's onchain financial system.