Liquidations, though undesirable for borrowers, serve as a critical safety mechanism for lenders and the Aave protocol. With billions in liquidations processed over its lifetime, Aave continues to demonstrate robust performance during periods of high volatility and market stress, showcasing the resiliency of the protocol.

Key Aggregate Liquidation Statistics

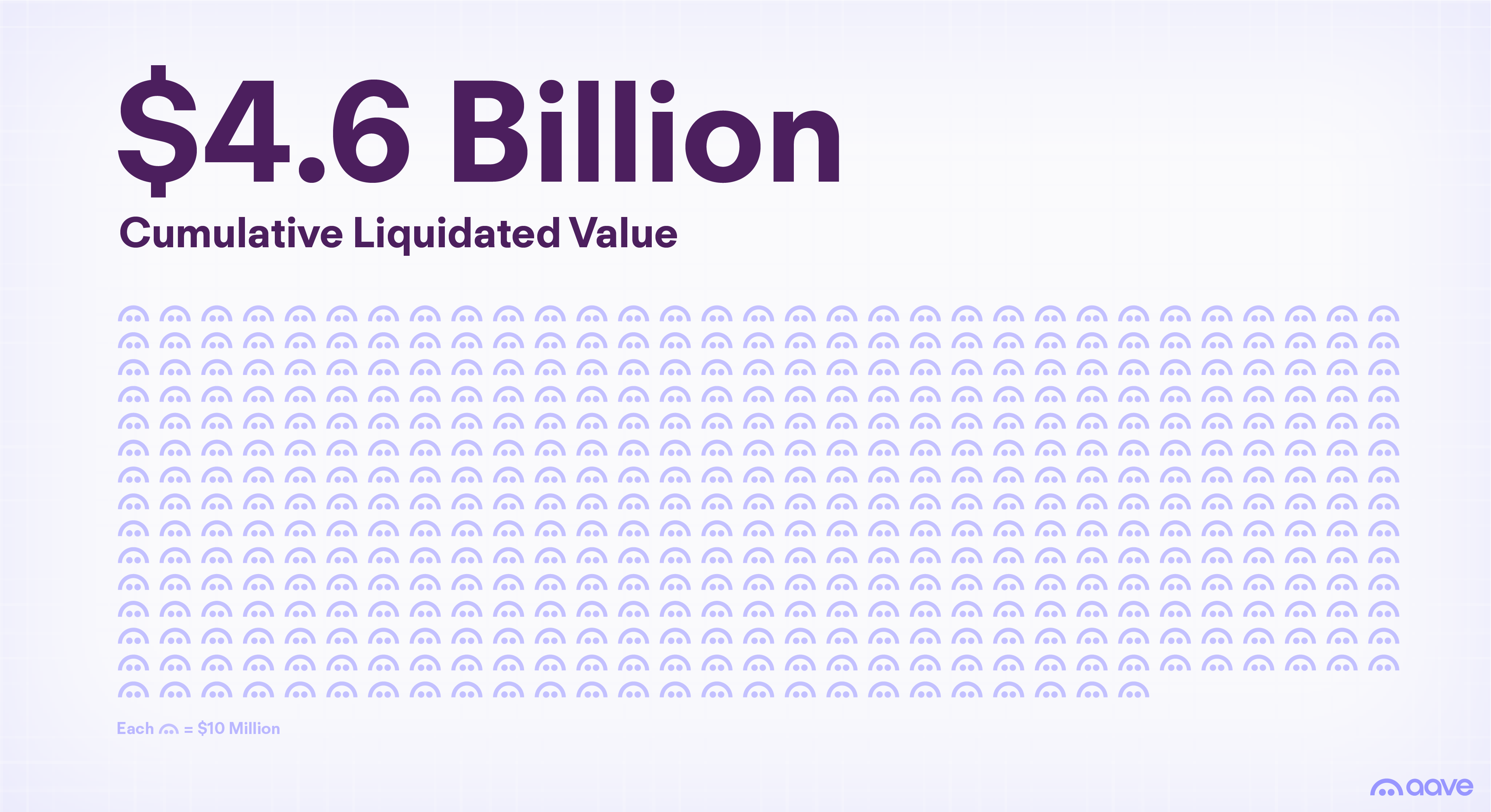

From Aave's launch in 2020 through the first week of February, the protocol processed over 310,000 liquidations, totaling $4.65 billion in value. This represents about 3.3% of cumulative borrow transactions (9 million txs) and 0.45% of the all-time borrowing volume ($982 billion).

Major Liquidation Events on Aave

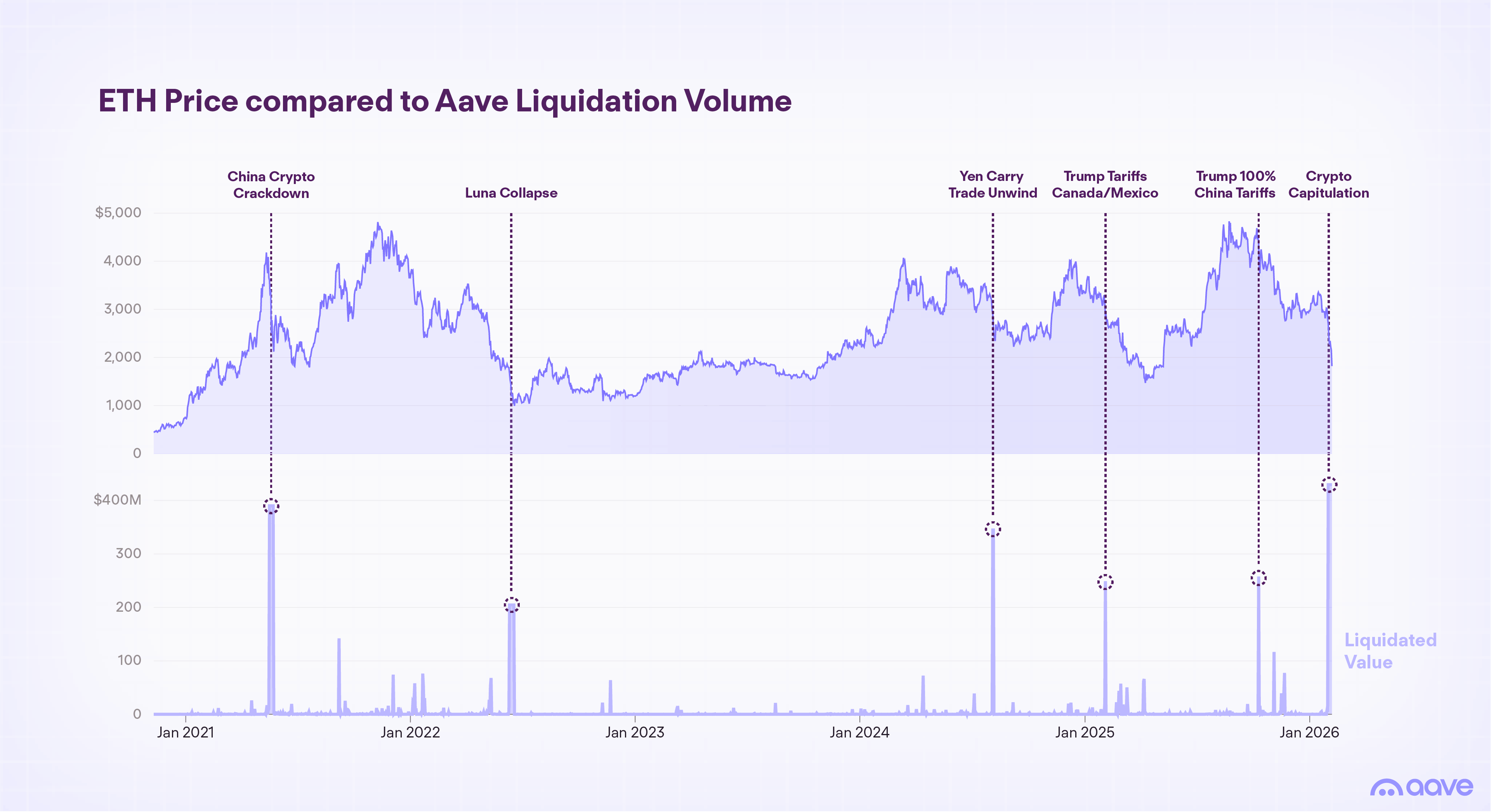

Liquidations typically surge during sudden, steep price drops in the crypto market. Below is a summary of key events, with a combined view of liquidation volumes, number of positions affected, and average sizes for comparison:

Aave's first major liquidation events occurred in May 2021 triggered by China's bans on crypto transactions and Tesla's environmental concerns about Bitcoin. The severe downturn wiped out over $1 trillion, or roughly half of crypto's total market value, over a week. During this period, $362m in value was liquidated on Aave V2 across over 5,500 events, averaging ~$65,000 per liquidation.

Since the 2021 event, major deleveraging episodes on Aave have become less severe in percentage drawdown terms and more distributed across positions, driven by wider DeFi adoption, structural market improvements, and advanced protocol mechanics. The Luna Collapse in June 2022 saw the largest number of Aave user positions liquidated at over 32,000 over a week-long period – nearly 6x as many liquidated positions than the 2021 China crypto crackdown event but only 60% of the total volume, reflecting a growing DeFi user base.

During the sudden market crash on October 10, 2025, more than $250 million was liquidated on the day. The average liquidation amount ($68k) was also higher than that during the 2021 China crypto crackdown event, though across fewer liquidated positions. Aave demonstrated exceptional resilience under market stress, processing $1.7 billion in stablecoin withdrawals while $700 million of USDC and USDT in liquidity remained available throughout the event.

Most recently in 2026, the crypto market experienced a sharp selloff that started on January 31 following hawkish sentiment over the nomination for new Fed Chair and large-scale forced selling in crypto, with prices of BTC and ETH falling down 10-20% on the day. The selloff persisted throughout the week, taking BTC and ETH as low as $60,000 and $1,750 on February 5 (down 30-40% over the 7-day period).

Aave liquidations tied to this capitulation event (Jan 31 - Feb 5) totaled $429 million in volume (breaking the previous record from May 2021) across ~12,500 transactions. Though this liquidation event set a new record high for Aave in dollar terms, the impact was less severe when measured in percentage terms relative to total Aave deposits/TVL, which has grown substantially since 2021. Liquidations on Aave were processed with no downtime or system failure, reinforcing the resilience of Aave.

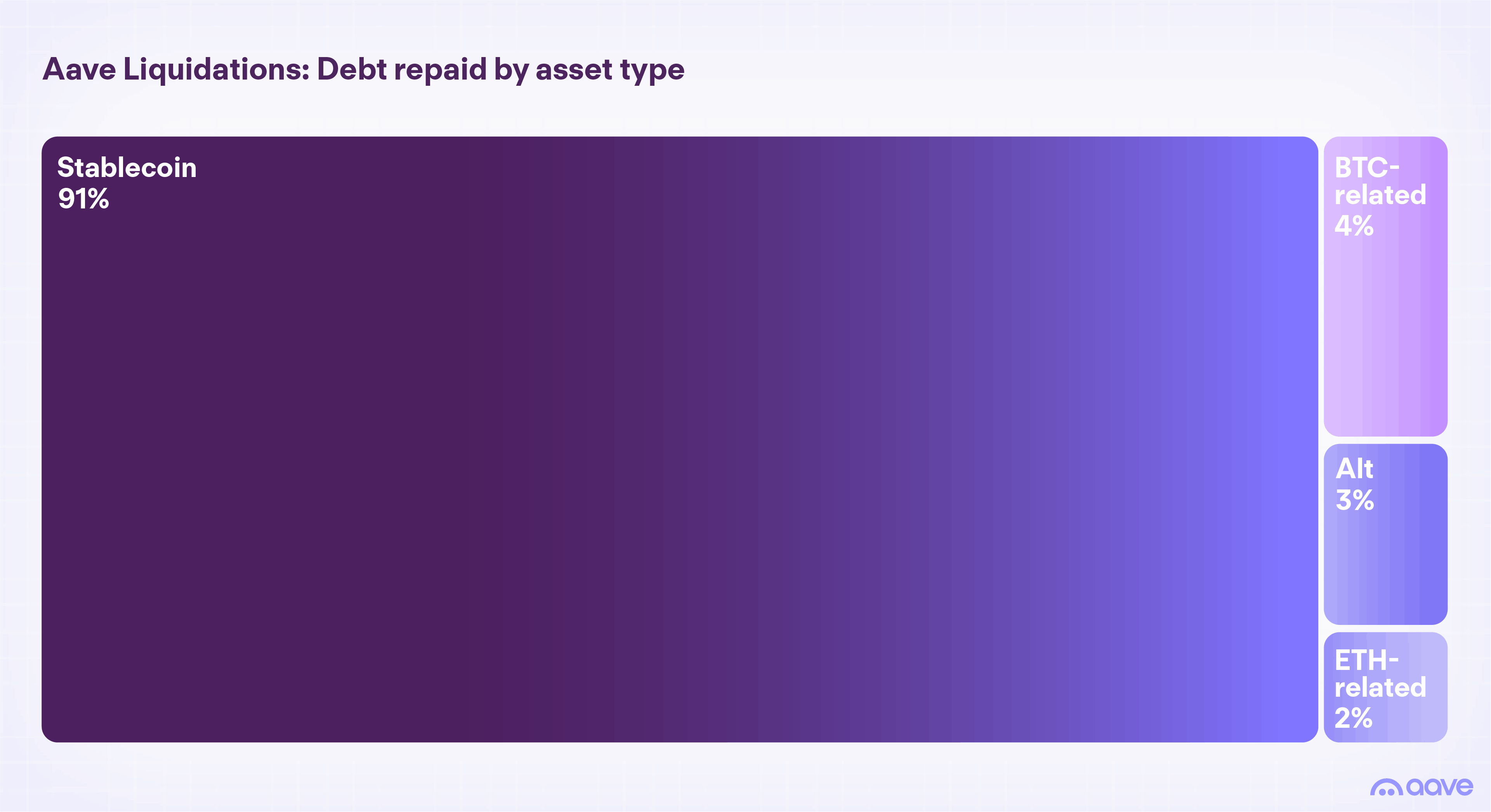

Aave Liquidations & Debt Repayments By Asset Type

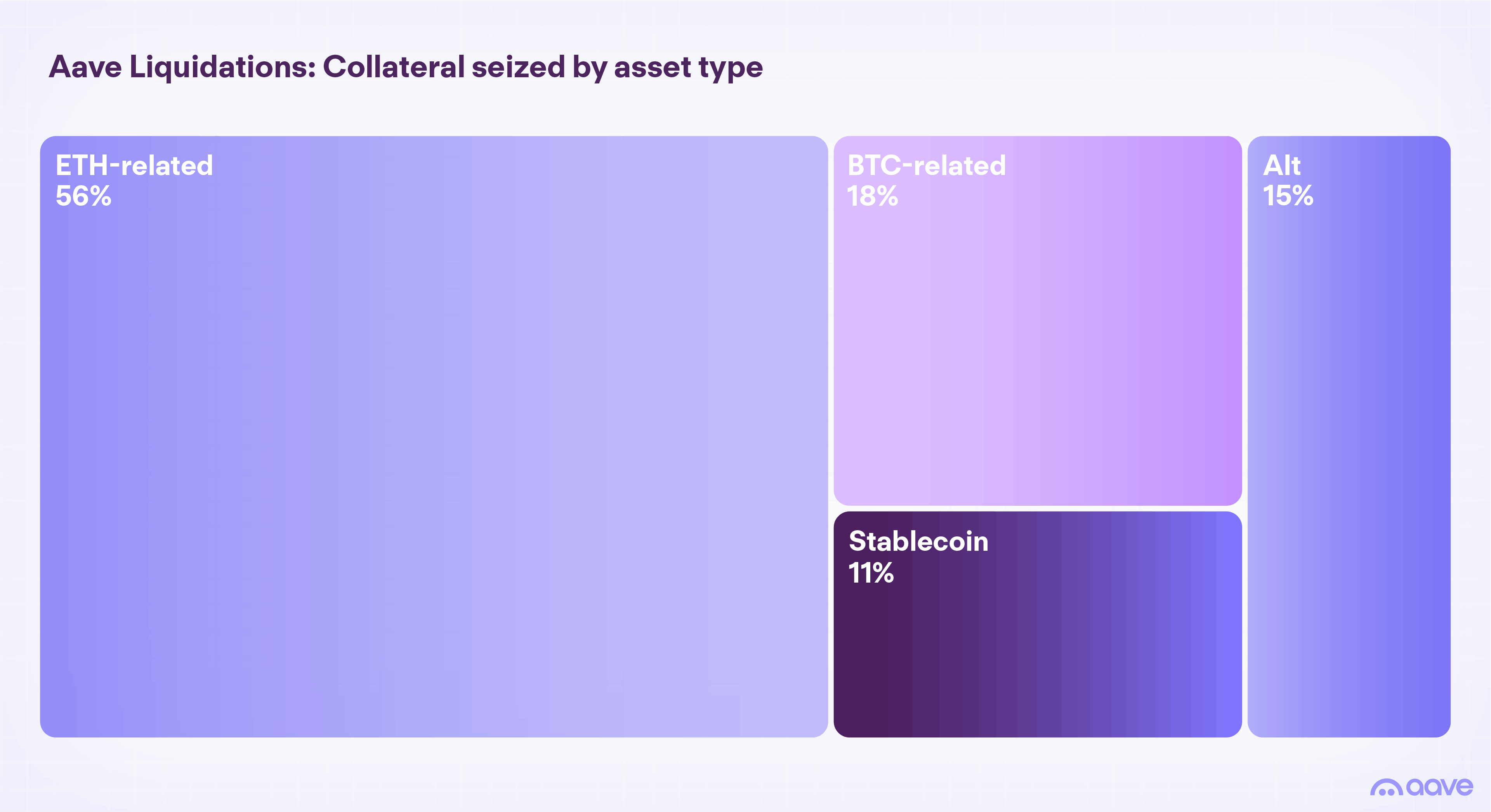

During deleveraging events, ETH- and BTC-related assets are most impacted by value, as they dominate collateral positions. However, longer-tail assets ("alts") often account for 10% or more of liquidated value, despite comprising a smaller share of deposits, due to their higher volatility.

In terms of debt repayments from liquidations, stablecoins make up over 90% of the total value. Notably, ETH-related debt repayments (1.6% of total repaid) are nearly three times lower than BTC-related ones (4.4%), suggesting DeFi users may be more inclined to short BTC (by borrowing it) than ETH.

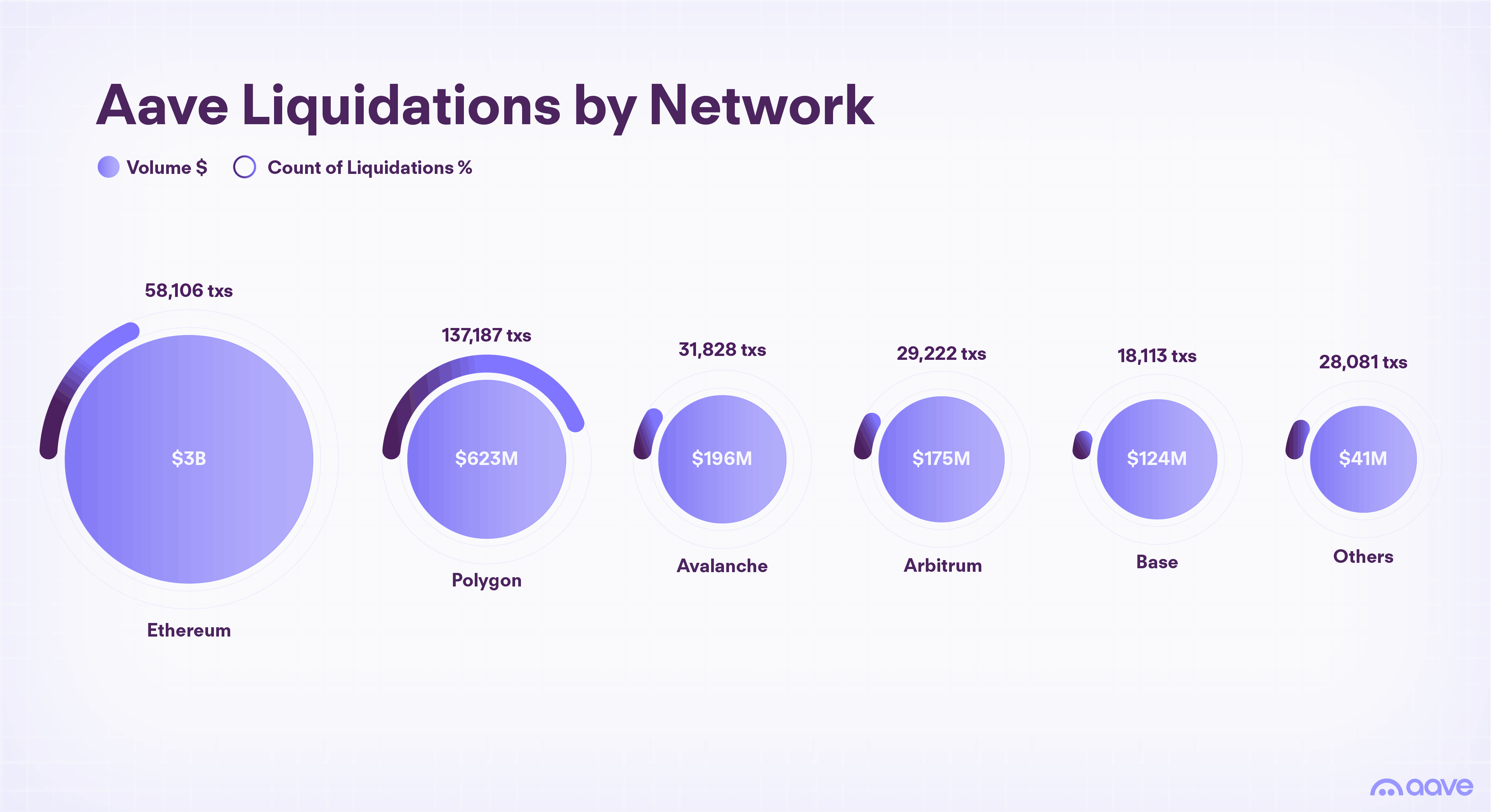

Aave Liquidations by Network

Across all networks, three-quarters (75%) of Aave's total liquidation volume (in USD terms) has occurred on Ethereum, where the average liquidation size exceeds $50,000. In contrast, positions on non-Ethereum networks typically feature much smaller averages, falling in the mid-four figure range (~$4,000–$7,000).

However, when measured by the total count of liquidation events across all Aave markets, the pattern reverses with non-Ethereum networks accounting for the majority of transactions (80%). Polygon alone accounts for nearly half (46%) of the total count on Aave, outpacing Ethereum and all other networks by a wide margin.

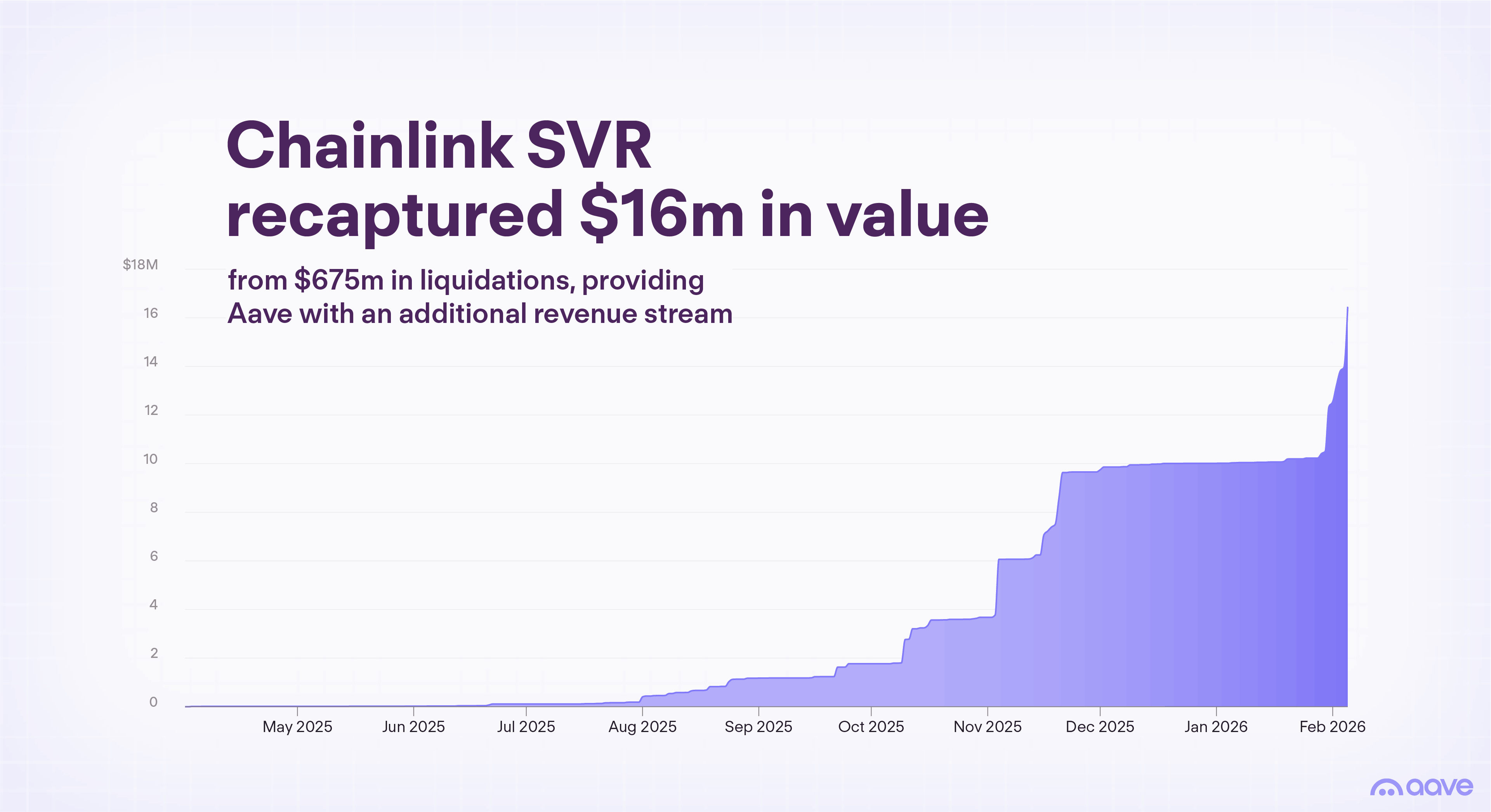

Chainlink SVR Integration

In March 2025, Aave integrated Chainlink SVR (Smart Value Recapture) into the Core Ethereum market, enabling Aave to recapture value from liquidation-related MEV (i.e., Oracle Extractable Value or "OEV") that historically has been leaked to network validators (external searchers and block builders). SVR allows Aave to recapture a portion of this value through bids on backrunning liquidation transactions, creating a new revenue stream for the Aave DAO.

The rollout expanded gradually across Ethereum markets, with promising early results. In the first nine months through early February 2026, SVR handled $675m in liquidations across ~3,900 events, recapturing ~$16m in total revenue (split 65% to Aave and 35% to Chainlink). This represents an average recapture rate of 73% of total non-toxic MEV from liquidations.

Enhanced Resilience through Added Safety Layers

To ensure liquidations are processed orderly, risk managers continuously tune lending parameters based on market conditions. Beyond overcollateralization and automated liquidations, capitalized backstops serve as an added layer of protection for the protocol in the unlikely event of a deficit (where the collateral value drops below the debt value due to extreme price volatility or oracle/smart contract failures, etc.).

-

Umbrella (introduced in June 2025; replaces the Aave Safety Module) is a first-loss insurance fund for the Aave V3 Core market, containing over $250 million in staked assets (WETH, USDC, USDT, GHO) which can be slashed to cover any protocol debt.

-

The Aave Treasury is a diversified portfolio accrued from protocol revenue with ~$200 million across many assets supported by Aave markets. The Treasury acts as a secondary reserve for the protocol.

Aave stands out among lending protocols with these dedicated liquidity backstops, which provide lenders with an extra layer of protection compared to other competitor protocols, where residual losses beyond liquidations are more often borne directly by suppliers.

Outlook

Liquidations remain a vital safeguard, protecting the Aave protocol and lenders during volatility. Historical data highlights Aave's resilience, with $4.6 billion in liquidations processed efficiently across multiple crypto cycles and many market stress events. Ongoing optimizations continue to enhance liquidation efficiency and protocol safety. In less than a year, Chainlink SVR has recaptured $16 million in previously leaked value, benefiting the DAO directly.

Looking forward, Aave V4 introduces a revamped liquidation engine for greater efficiency and borrower leniency. Features like partial liquidations (targeting specific debt repayments instead of full closures) and variable bonuses incentivize liquidators to prioritize high-risk positions, reducing risk of accumulating bad debt.

As crypto markets mature and DeFi adoption grows, price volatility has trended downward, creating a more stable environment for all participants. Still, as market stress events inevitably occur, Aave continues to prove its resiliency through orderly liquidations to safeguard its users.