Liquidations are one of the most important mechanisms in any lending protocol. Since its launch, Aave has processed nearly 295,000 liquidations worth over $3.3 billion. These liquidations protect the protocol from bad debt and keep the system healthy.

Aave V4 introduces a redesigned liquidation mechanism that improves on V3's approach. In this post, we'll review how liquidations work in Aave V3, explain the new V4 liquidation engine, and explore why this approach is better.

Aave V3 Liquidations

In V3, when a borrower's health factor drops below 1, a liquidator can repay a portion of the borrower's debt and claim a portion of their collateral as a reward. The amount a liquidator can repay is determined by a fixed close factor.

This means that liquidators always repay up to a fixed close factor percentage of the borrower's debt and seize a corresponding amount of collateral, receiving a static liquidation bonus in the process. The default close factor is 50%, but this extends to 100% under certain conditions, such as when the health factor falls below 0.95 or when dust collateral or debt is involved.

This system is straightforward and effective at protecting the protocol from bad debt. But it has limitations. The fixed close factor means that borrowers are often over-liquidated. Even if a small repayment would be enough to restore a healthy position, the liquidator still can repay a fixed amount of the debt. The static bonus also does not reflect the true risk of a position. Liquidators receive the same bonus percentage regardless of how far underwater a position is, which means there is no extra incentive to act quickly on the riskiest positions.

The Aave V4 Liquidation Engine

In V4, liquidations work differently. Instead of repaying a fixed percentage of the debt, liquidators can repay at most enough to return the borrower's health factor to a specific level called the Target Health Factor. This target is set by governance for each Spoke and gives the protocol more control over how liquidations are handled.

When a liquidation occurs, the protocol calculates how much debt needs to be repaid to bring the borrower back to the Target Health Factor. In typical cases, the liquidator repays only up to that amount, not a fixed close factor. This means borrowers are not over-liquidated, and liquidators can act more efficiently.

V4 also introduces a variable liquidation bonus. The bonus paid to liquidators changes based on the borrower's health factor. The lower the health factor, the higher the bonus. This creates a Dutch-auction-style system where the relative reward for liquidation increases as the risk to the protocol increases. Liquidators are incentivized to act quickly on the riskiest positions, which improves the overall health of the protocol.

Behind the scenes, the protocol uses several parameters to manage this process. The maxLiquidationBonus sets the maximum bonus a liquidator can receive for a given collateral type. The healthFactorForMaxBonus defines the health factor below which the maximum bonus applies. And the liquidationBonusFactor determines the minimum bonus at the liquidation threshold. These parameters define the relationship between health factor and bonus, allowing governance to fine-tune the system.

Handling Dust Debt

One of the challenges in any liquidation system is dealing with dust debt, or small leftover debt positions that are not economically viable to liquidate. In V3, there is complex logic governing the handling of dust, dependent on thresholds both for the amounts before and after a liquidation. This prevents dust, but it also creates situations where positions cannot be fully liquidated in one go.

V4 takes a different approach. If the debt or collateral remaining after a standard liquidation would be below the DUST_LIQUIDATION_THRESHOLD (e.g. $1,000), and the liquidator indicates they want to repay the entire position, the protocol dynamically adjusts the maximum amount of debt that can be liquidated. This requires the liquidator to fully clear the position, preventing dust from accumulating.

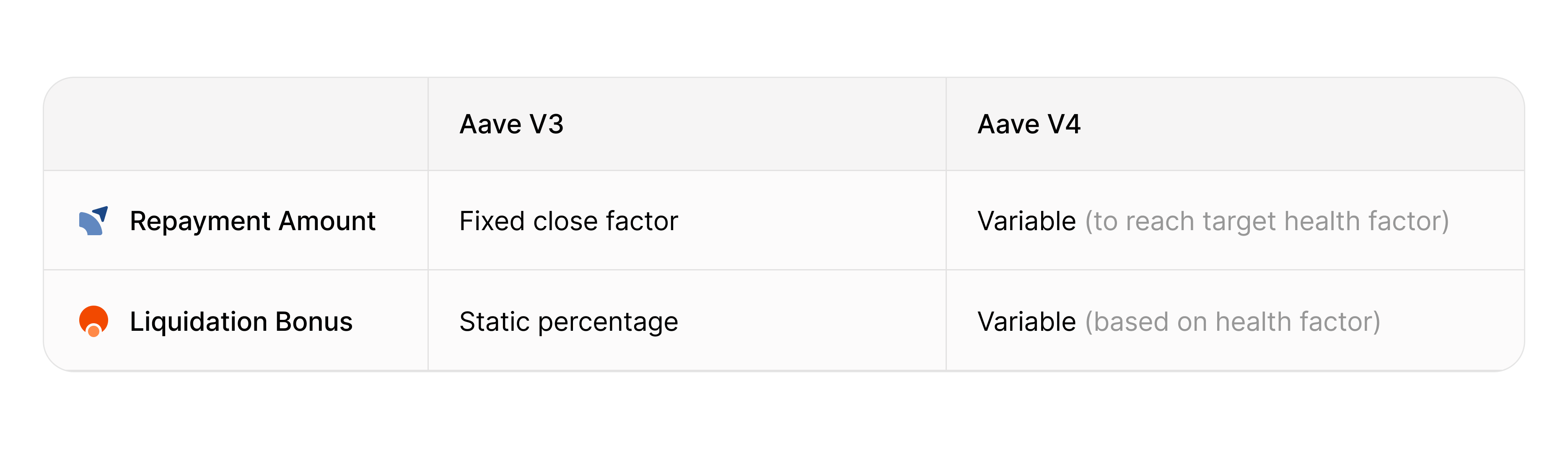

A Side by Side Overview

Ultimately, the changes in V4 create a more refined and efficient liquidation process. In V3, the maximum repayment amount is fixed at 50% of the debt in most cases. In V4, the repayment amount is variable and calculated to bring the borrower back to the Target Health Factor set by governance. This means only the necessary debt is repaid, preventing over-liquidation.

The liquidation bonus also works differently between the two versions. In V3, the bonus is static and does not change based on the borrower's health factor and instead requires a governance decision. In V4, the bonus is variable and increases as the health factor decreases, creating better incentives for liquidators to act on riskier positions.

Why This Matters

The new liquidation engine in Aave V4 makes the protocol more competitive and user-friendly. The adaptive repayment amount means borrowers are not over-liquidated. If only a small amount of debt needs to be repaid to restore a healthy position, that is all the liquidator is allowed to repay. This is fairer to borrowers and more capital-efficient.

The variable liquidation bonus creates better incentives for liquidators. Positions with lower health factors, which pose more risk to the protocol, now offer a higher liquidation bonus. This encourages liquidators to act quickly on the riskiest positions, which reduces the chance of bad debt accumulating. In a market downturn, when liquidations spike, this mechanism makes sure that the most dangerous positions are cleared first.

The simplified handling of dust debt and collateral also makes the system more reliable. In V3, small leftover debt positions can be difficult to manage and can accumulate over time. V4's design allows liquidators to more easily fully clear positions, preventing these inefficiencies. The new liquidation engine is also more gas-efficient, making liquidations cheaper to execute on average compared to V3.

These changes result in a more precise and capital-efficient liquidation process that better protects the protocol from bad debt while improving the experience for both borrowers and liquidators. The system is more flexible, more fair, and better aligned with the true risk of each position. Given the scale of liquidations on Aave, with up to hundreds of millions of dollars liquidated each month, these improvements will have a meaningful impact on the protocol's health and user experience.