Aave V4 introduces an all-new Hub and Spoke architecture that fundamentally changes DeFi lending. In this blog post we'll provide an overview of how it compares to Aave V3, how it works, and what benefits it will bring.

Note: Aave V4 is still in development.

Aave V3 Basics

To start, we’ll quickly review Aave V3’s architecture.

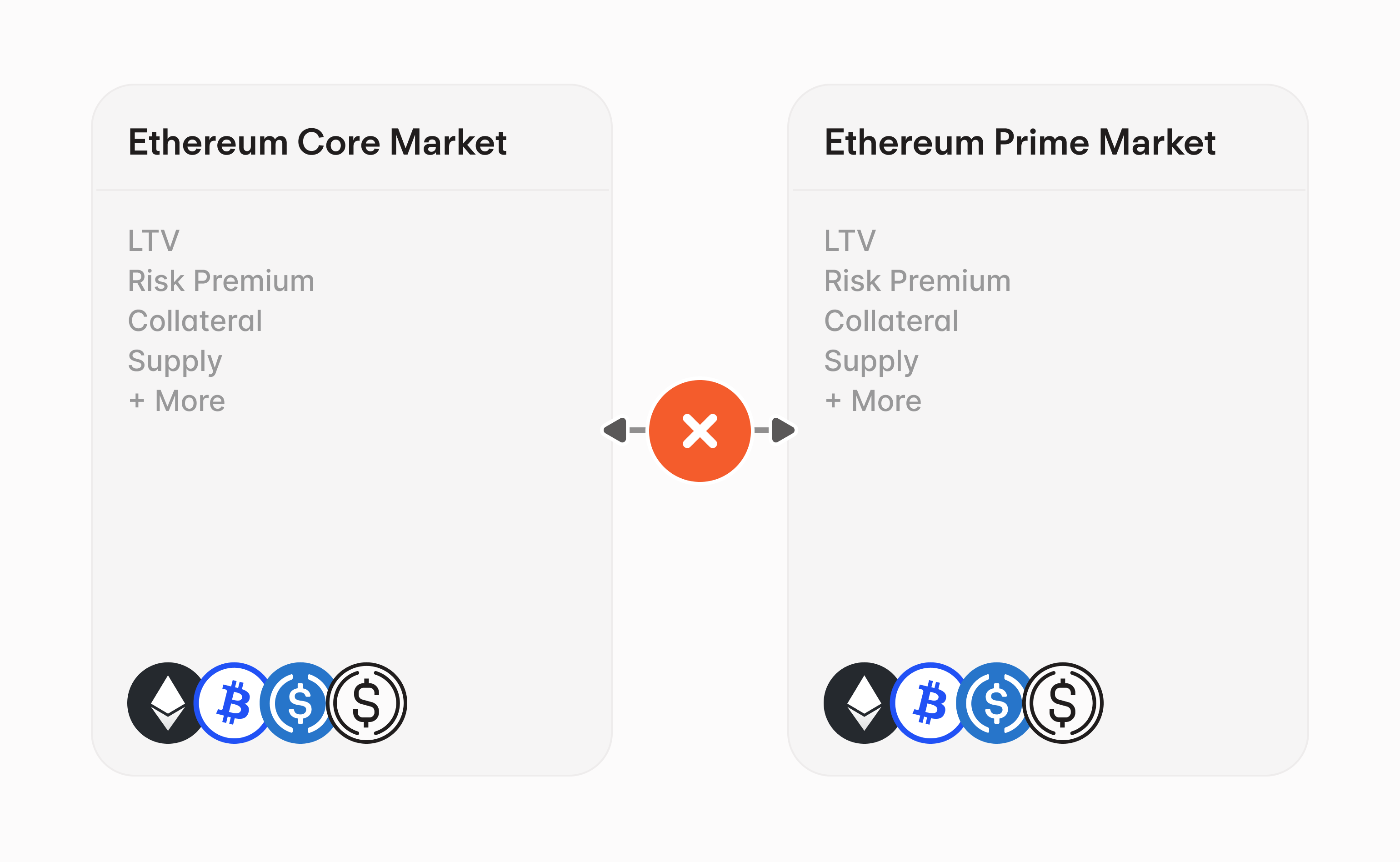

In V3, the protocol uses independent markets across different networks. Each market (like Core and Prime on Ethereum) has its own isolated liquidity pool and distinct asset mix, creating a unique risk profile. When users supply assets to Aave V3, they supply them to a specific market. Those assets can only be borrowed within that market. For example, assets supplied to Ethereum Core can only be borrowed by Ethereum Core users.

This structure has tradeoffs. Liquidity in one market can’t be used to meet borrowing demand in another. That creates friction when launching new markets with a unique risk profile or special features, since each one requires bootstrapping its own liquidity, which in turn creates fragmentation. It also limits economies of scale for borrowing and makes it harder to support novel assets or implement unique borrow configurations, which end up siloed and harder to use.

Keep all of this in mind as we walk through Aave V4’s architecture.

Liquidity Hub Overview

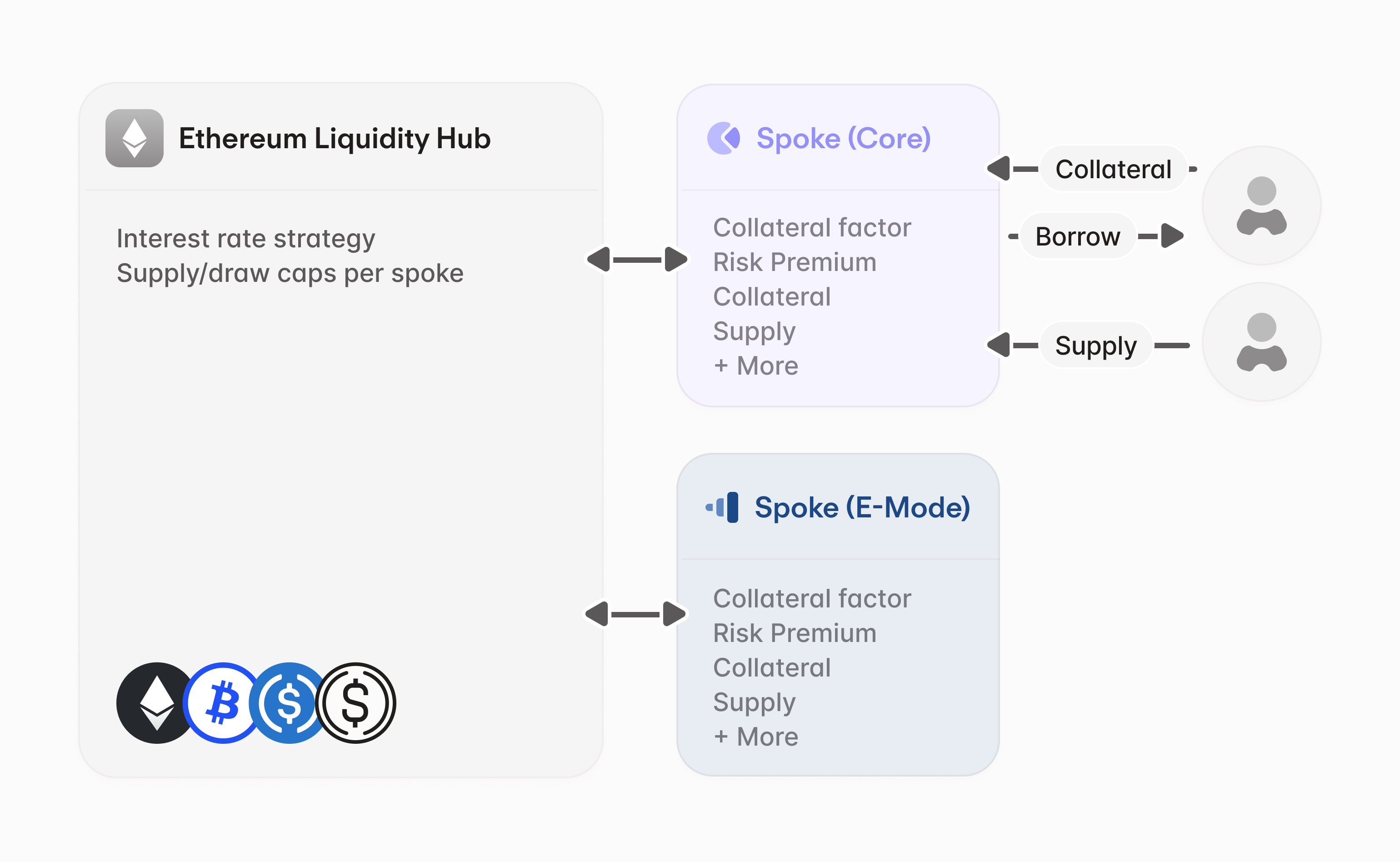

In V4, liquidity is no longer siloed by market. Instead, all assets are stored in a unified Liquidity Hub per network.

The Liquidity Hub acts as the central source of liquidity. It tracks which Spokes are authorized to access which assets and enforces limits on how much liquidity each Spoke can draw from the Liquidity Hub. It also enforces core accounting rules: total borrowed assets must never exceed total supplied assets, etc.

When users supply assets to Aave V4, those assets are stored in the Liquidity Hub, but the user doesn't interact with the Hub directly. Instead, the Liquidity Hub works behind the scenes, while users interact with various Spokes as an entry point to the protocol. The Liquidity Hub tracks all assets using a share-based system that makes calculations more efficient and keeps everything within proper limits as interest accumulates over time.

Each L1 or L2 will have at least one Aave V4 Liquidity Hub, with the potential for multiple Hubs per network. Spokes allow for greater experimentation within these ecosystems without liquidity becoming a limiting factor. This design makes it easier to support new risk profiles and enable innovation without fragmenting liquidity, while also providing a way to seed liquidity for new Spokes.

Spokes Overview

Spokes are the component of Aave V4 that users interact with directly. Each one connects to a Liquidity Hub and provides specific lending and borrowing functionality. When users supply or borrow assets, they always do so through a Spoke, not the Hub.

Each Spoke has its own rules and risk settings. They can be optimized for stablecoins, staked ETH derivatives, or higher-risk assets. Certain Spokes may also focus on specific borrowing strategies or support special collateral types like LP shares.

Behind the scenes, Spokes handle the movement of assets to and from the Liquidity Hub. They also manage user positions, track collateral, integrate with price oracles, and include safety controls that allow operations to be paused if needed.

Specialized Spokes in V4

To show what this looks like in practice, we can look at a few examples of Spokes with various risk configurations.

E-Mode, which allows for higher borrowing power when using correlated assets (like different stablecoins), becomes a separate Spoke with specific settings for those asset groups. For example, an E-Mode Spoke for stablecoins would allow you to borrow more against USDC when borrowing USDT, since they're both expected to maintain a similar value. Running E-Modes as Spokes improves risk isolation and makes implementation cleaner. Each E-Mode Spoke can be independently configured and managed, allowing for more controlled exposure to tightly correlated assets.

Isolation Mode, which limits how newer or riskier assets can be used as collateral, could be implemented as a dedicated Spoke. This Spoke can operate with its own parameters and access controls. A Liquidity Hub would determine how much liquidity is made available to the Isolation Spoke by setting a cap on the amount it can draw. This allows the protocol to safely list newer tokens without exposing the entire system to potential risks.

Additionally, RWA Spokes can be designed to support real-world assets as collateral with tailored risk controls. For example, an RWA Spoke could be built to handle tokenized treasury bills, applying stricter access, custody, or redemption rules.

And lastly, Vault Spokes can be set up to allow borrowing from isolated vaults where collateral is not directly supplied to the protocol. For example, a user could borrow against assets held in a Safe. Since risk management and collateralization are handled entirely within the Spoke, these assets do not need to be supplied directly to the Hub.

Benefits of the V4 Architecture

This architecture introduces several new design paradigms to Aave, each with their own set of benefits.

Capital is no longer fragmented across markets on the same chain. Instead, all liquidity flows through Liquidity Hubs, which increases utilization and unlocks better rates for both suppliers and borrowers. Governance also becomes lighter. New Spokes can be added or upgraded without disrupting the rest of the system.

This architecture also opens the door for innovation that would be more difficult on Aave V3 or lending markets. Anyone can build a Spoke. If it adds value, it can tap into the Liquidity Hub as a credit line, letting builders create specialized markets while accessing the biggest liquidity network effects in DeFi.

If you're interested in building a Spoke, reach out.