Arbitrum and Aave ("the A-team") prove that combining the leading DeFi rollup with the most battle-tested lending infrastructure creates exceptional user engagement, swift uptake of advanced product features, and powerful flywheel effects amplified by well-designed incentives.

Background on Arbitrum

Arbitrum, developed by Offchain Labs, is an Ethereum rollup, a Layer 2 (L2) scaling solution that bundles transactions and moves execution off the Ethereum base layer to increase throughput and overall network capacity. Its mainnet, Arbitrum One, launched in August 2021, delivering better performance with faster execution and reduced transaction fees which regularly cost under $0.01.

Arbitrum is known for technical innovations like Orbit (a customizable framework for deploying app-specific chains using Arbitrum’s tech stack) and Stylus (multi-language support), its leading decentralization progress among L2s, and its robust DeFi ecosystem.

Arbitrum has solidified its position as the “home of DeFi,” with $17 billion in total value secured (ranks first among L2s per L2Beat), $3 billion in TVL (second among all L2s), and $8 billion in stablecoins (ranks fifth among ALL chains). Earlier this year, Robinhood deployed tokenized US stocks, ETFs, and commodities on top of Arbitrum One to enable commission-free trading with 24/5 access for EU users, and announced plans to develop Robinhood Chain, its own L2 blockchain powered by Arbitrum’s tech.

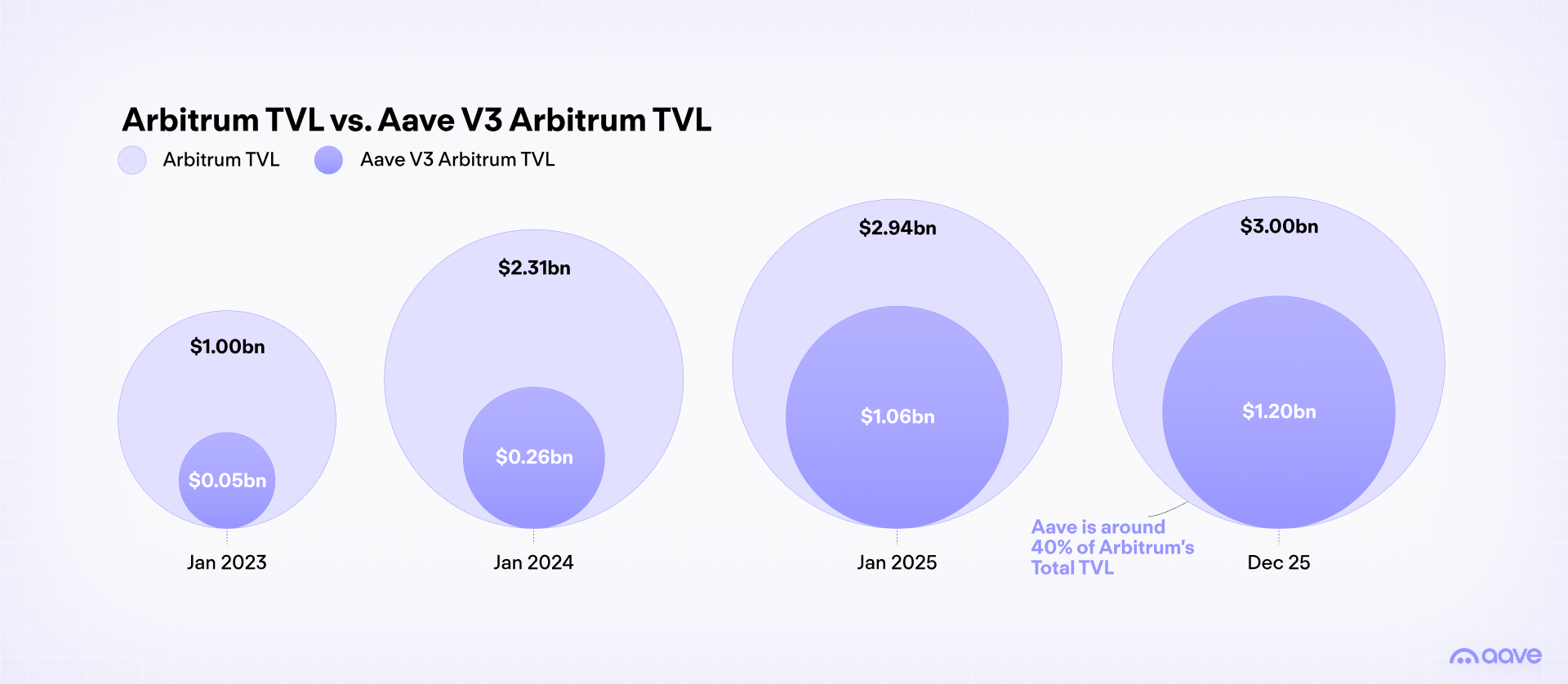

In March 2022, Arbitrum became one of the first deployments of Aave V3, which was initially rolled out cross-chain across several blockchains before launching on Ethereum.

Aave V3 Arbitrum Market

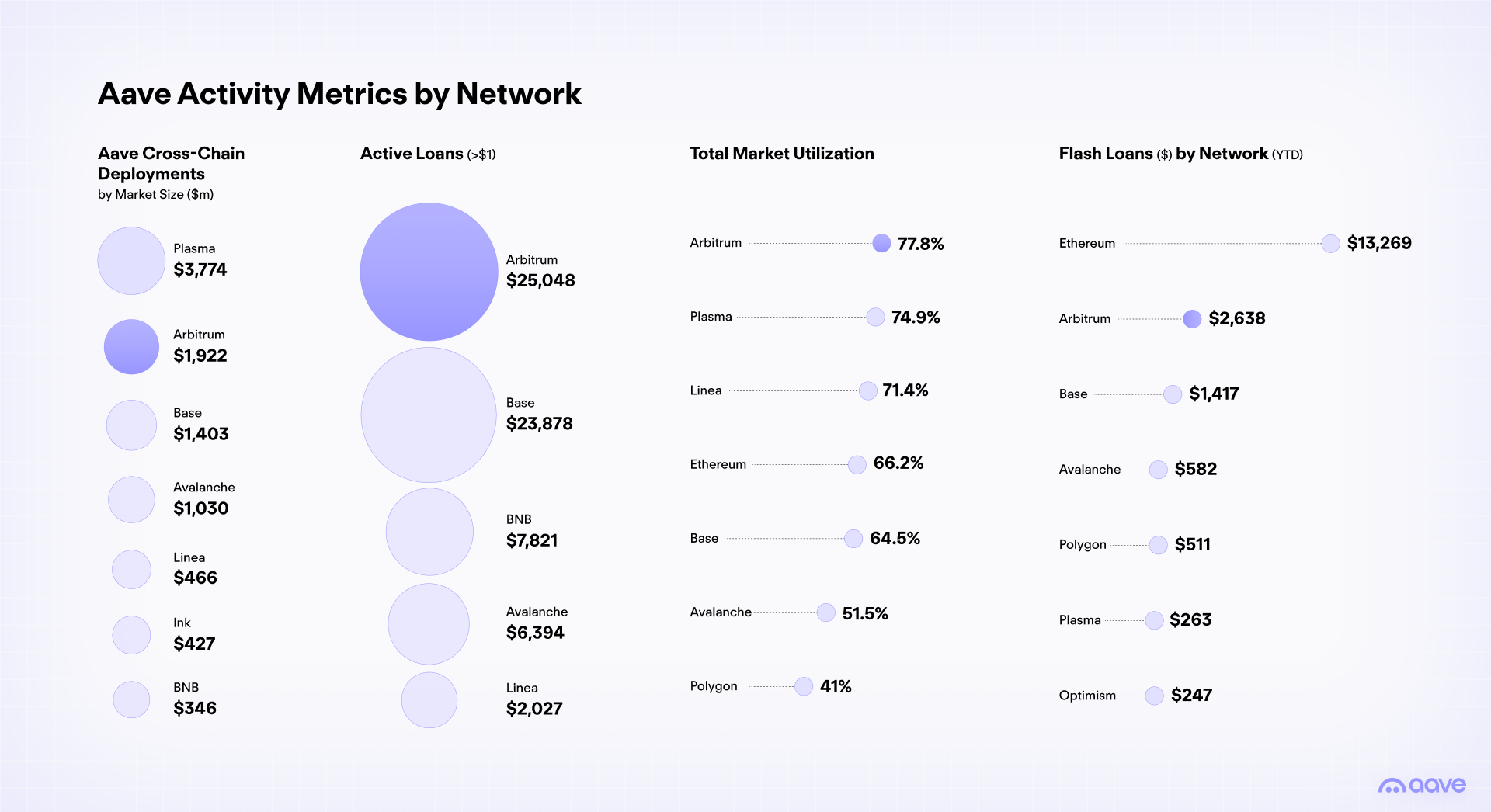

The Arbitrum V3 market has grown to become one of the largest cross-chain deployments of Aave V3. As of December 2025, Aave V3 on Arbitrum ranks as Aave’s second-largest cross-chain deployment with $2.2 billion in supplied assets and $1 billion borrowed, which account for approximately one-fifth of Aave’s total market size outside of Ethereum.

Arbitrum users tend to be active DeFi users, exhibiting robust borrowing demand with strong adoption of advanced tooling on Aave. Other key metrics and stats as of December 2025:

- Active Loans: Across all blockchains that Aave is deployed, Arbitrum currently ranks first in total active borrowers (with positions >$1) with over 25k borrowers with positions >$1.

- Utilization Rate (%): Arbitrum has maintained a consistently high utilization rate (78%), which currently ranks highest across all Aave markets.

- Flash Loans: Arbitrum ranks second among all Aave Markets in both volume and transaction count of flash loans. More users on Arbitrum make use of the Aave Swap adapter, which combine Aave’s Flash Loans with swaps powered by Paraswap or CoW Swap to perform what are normally multi-step operations in a single transaction (e.g., repay borrow positions using collateral, swap borrow borrowed assets, and swap and withdraw).

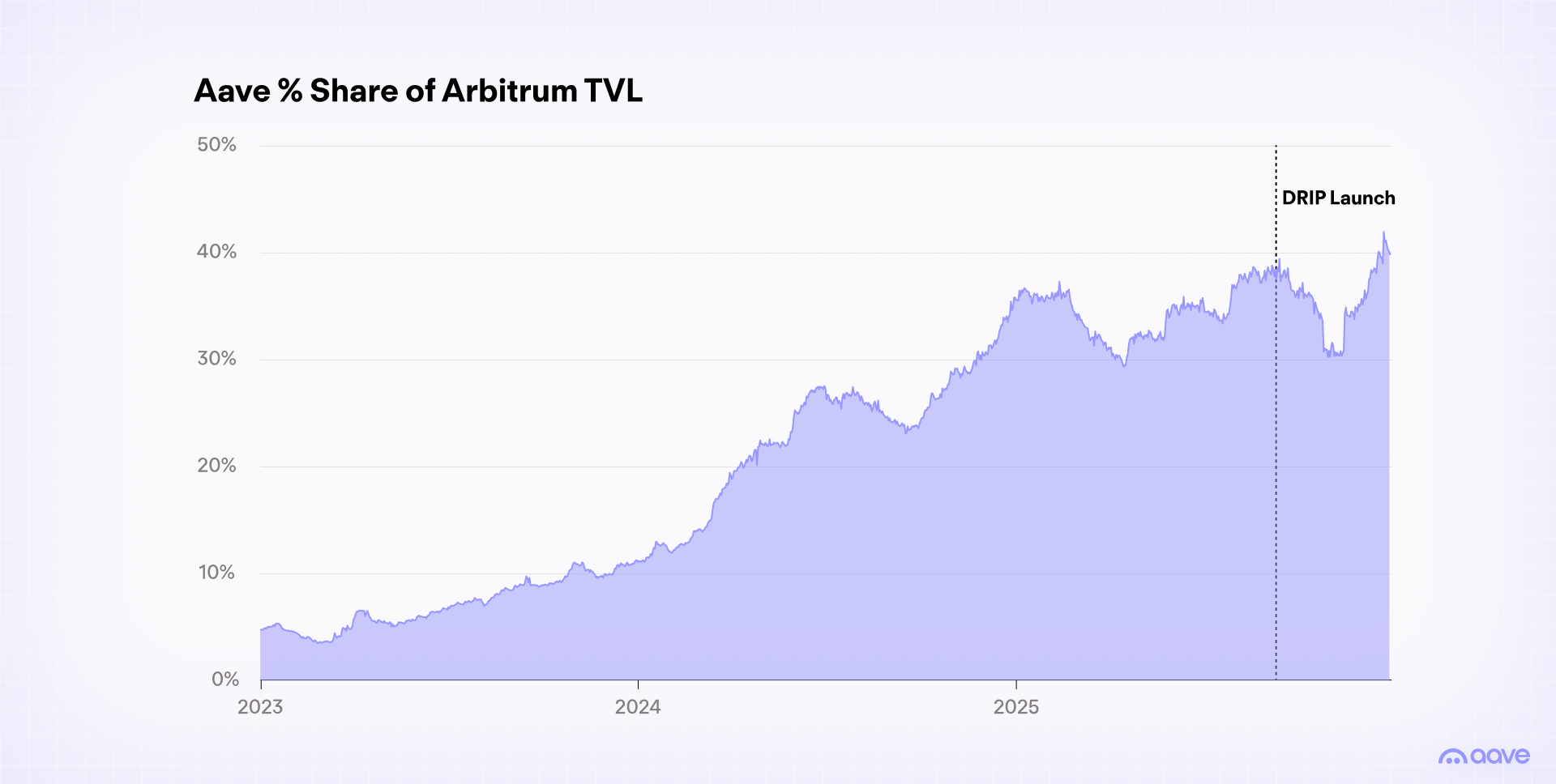

For Arbitrum, Aave V3 is its largest DeFi protocol, accounting for ~40% of its total TVL as of December 2025. Aave’s share of Arbitrum’s TVL has steadily increased over time as after starting in the mid-single digits as of 2023.

Arbitrum DRiP Incentives Campaign

In September 2025, the Arbitrum DAO launched the DeFi Renaissance Incentive Program (DRiP), designed by Entropy Advisors and powered by Merkl. The DRiP initiative aims to drive DeFi adoption on Arbitrum in a sustained manner by rewarding targeted and measured actions rather than directing rewards to specific protocols. In total, DRiP will distribute up to 80m ARB tokens across four seasons, each designed to target a specific DeFi vertical.

Season One targets leveraged looping on Arbitrum’s lending markets and runs for 20 weeks with a planned end date of January 20, 2026. Aave was selected as one of participating lending protocols for the inaugural season of DRiP, which distributed ARB incentives to users that supplied eligible ETH and stablecoin assets on Aave to facilitate “looping” or leveraged lending positions that take advantage of the positive spread between the supply & borrow rates of correlated assets.

Aave V3 supports looping through Efficiency Mode (E-Mode), which enables higher borrowing capacity for correlated assets including yield-bearing stablecoins and liquid restaked tokens (LRTs). For example, Aave V3 users on Arbitrum can borrow WETH against deposits of Ether.fi’s weETH or Renzo’s ezETH with a maximum loan-to-value (LTV) of 93% using E-Mode vs. just 72% without E-Mode.

DRiP Incentives Show Promising Results on Aave

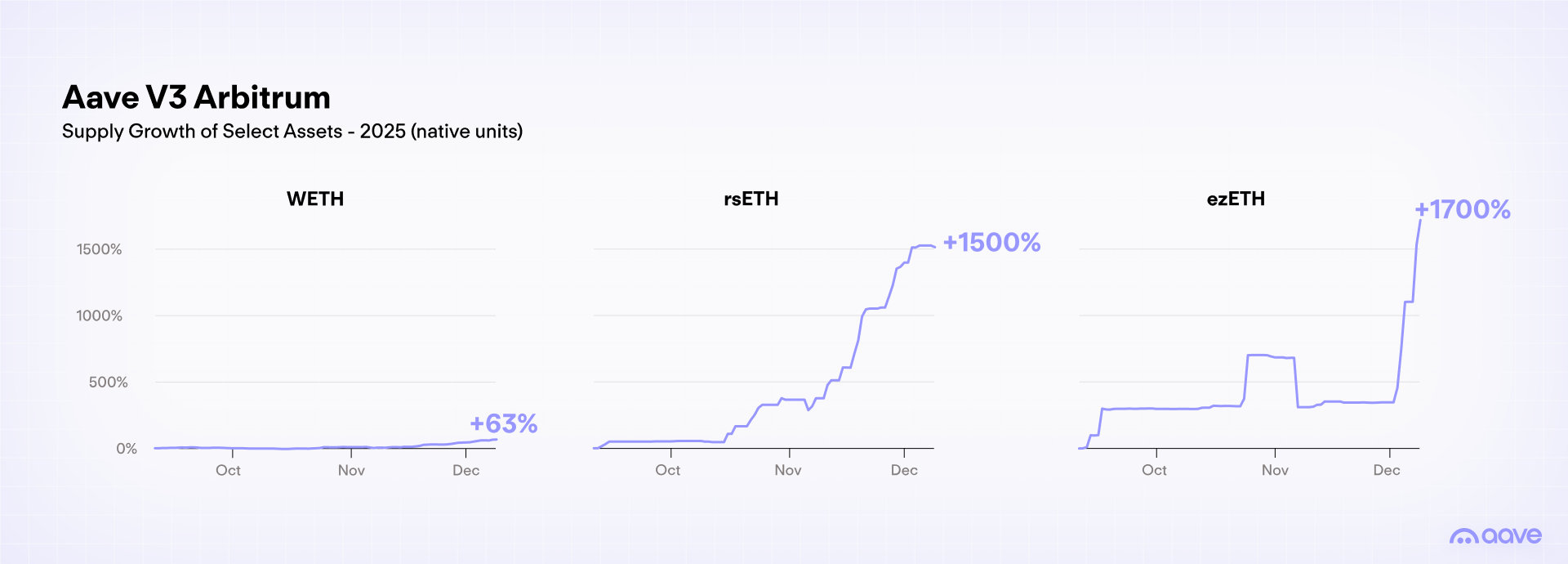

While we are still in the first of four DRiP seasons on Arbitrum, we have already started to see promising results from the distribution of ARB rewards so far. Even as falling asset prices have led to lower market values compared to the start of the program in September, we still find growth of assets when measured in native units and share gains for Arbitrum when compared to other markets

Asset Growth: DRiP incentives have supported sustained supply growth on Aave across select assets. When measured in native units, WETH deposits on Aave grew by 66% while deposits of LRTs like Kelp’s rsETH and Renzo’s ezETH each grew by over 1500% from their starting amounts. rsETH and ezETH also added $250m and 100m, respectively, in market value on Aave.

Borrowing Utilization: Aave V3 on Arbitrum has maintained a consistently high utilization rate throughout the duration of the DRiP campaign, including through the October 10 flash crash that was crypto’s most severe liquidation event ever, wiping out nearly $20 billion in leveraged positions. As utilization rates have fluctuated across Aave markets on other chains, Arbitrum took over as the leading Aave market in utilization rate as of early December, reflecting robust and consistent borrowing demand from its user base.

Arbitrum Market Share Gains: Across Aave’s cross-chain deployments, Arbitrum made share gains in total market liquidity, moving up to the second largest non-Core Ethereum market. Arbitrum’s liquidity value has shown strong resiliency in recent months, which is a positive reflection of the DRiP incentive structures and Arbitrum’s committed userbase, especially relative to other chains that have launched more recently and have been looking to attract new users.

It’s also worth noting that over the course of DRiP Season One, Aave has also made share gains on % of DeFi TVL on Arbitrum. Arbitrum’s % share had initially slipped during the first weeks of the program from 38% to 30% as ARB incentives were also directed toward other lending protocols The migration of liquidity to Aave over time has pushed Aave’s share to 42% of Arbitrum’s TVL, revealing user preference for more established protocols against other lending providers even with more competitive rewards.

Aave on Arbitrum Takeaways

The partnership between Arbitrum and Aave has proven to be a powerhouse in DeFi. Aave V3 on Arbitrum has solidified its position as one of Aave's largest cross-chain markets with the highest active borrower count across all Aave deployments and strong adoption of advanced features like flash loans and E-Mode looping. DRiP Season One has driven meaningful results through Aave incentives on Arbitrum, which became Aave’s leading market in utilization (>75%) as users have demonstrated remarkable resilience through crypto's severe October 2025 flash crash. These results position the Aave V3 Arbitrum market as the premier venue for sustainable, high-engagement DeFi growth.