Since 2022, Aave and Lido have collaborated to create a unique DeFi liquidity flywheel that has grown to billions of dollars in size. This case study explores the evolution of the Aave-Lido collaboration and their roles as DeFi's leading platforms by TVL.

Lido: Trusted Leader in Liquid Staking Infrastructure

Lido is the leading Ethereum staking provider, pioneering liquid staking to enable users to earn rewards without sacrificing liquidity or managing complex infrastructure. By addressing traditional ETH staking barriers (e.g., the 32 ETH minimum requirement and asset lock-up), Lido transforms staked ETH into a productive asset usable across DeFi.

When users stake ETH through Lido, they receive stETH, a rebasing token where the balance increases daily to reflect staking rewards. For DeFi integrations, Lido also offers wstETH (wrapped stETH), a non-rebasing version where the token's value increases instead of its balance. This makes wstETH simpler for protocols like Aave to integrate since the balance stays constant.

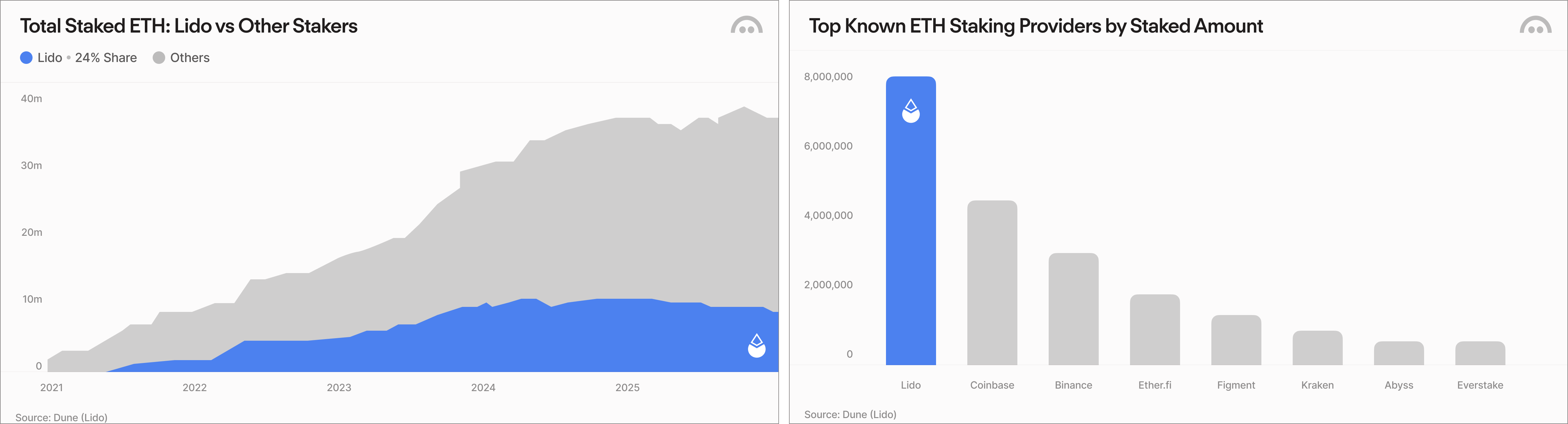

Today, ETH staked via Lido contracts account for roughly a quarter of all staked ETH, surpassing the combined staking volumes of centralized exchanges like Coinbase and Binance.

stETH & wstETH as Productive Collateral on Aave

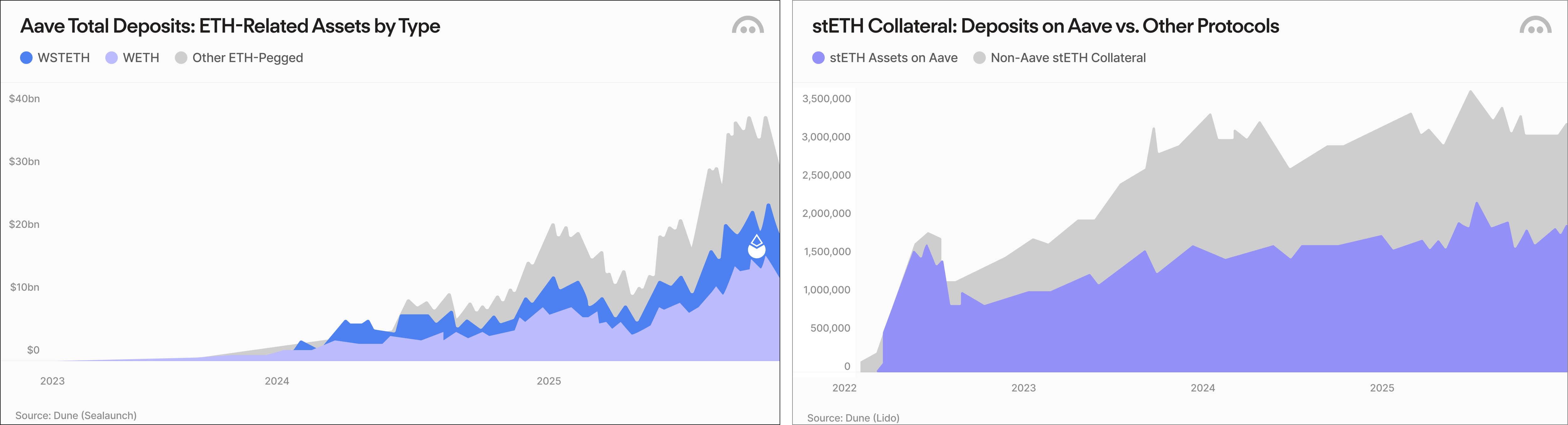

The Aave-Lido collaboration began in 2022 when stETH was accepted as collateral on Aave V2. Users could deposit stETH, earn staking rewards on it, and simultaneously borrow other assets. The staking rewards effectively lowered their borrowing costs compared to using regular ETH as collateral. Support for wstETH was added with the launch of Aave V3 later that year.

In July 2023, the Aave DAO approved a proposal to convert a portion of its Treasury's "unproductive ETH" into wstETH to generate yield and optimize its balance sheet by putting idle capital to work. This strategic move by the DAO signaled confidence in liquid staking tokens and in Lido as a provider.

In addition to its use as productive collateral, wstETH is used for leveraged staking strategies on Aave for users to amplify their staking yields. Users can deposit wstETH, borrow WETH against it, convert the WETH to more wstETH, and repeat the cycle, a process called "looping." Each loop increases their exposure to the underlying staking rewards. Aave V3's Efficiency Mode (E-Mode) made this more capital efficient by allowing higher borrowing capacity for correlated assets like WETH and wstETH.

As of October 2025, wstETH has become the third-largest collateral asset on Aave, underscoring its role as productive collateral for borrowers. For Lido, Aave is also the preferred venue for wstETH collateral, accounting for two-thirds of lending deposits used in DeFi.

Dedicated Aave V3 Lido Market Optimized for Leveraged Yield

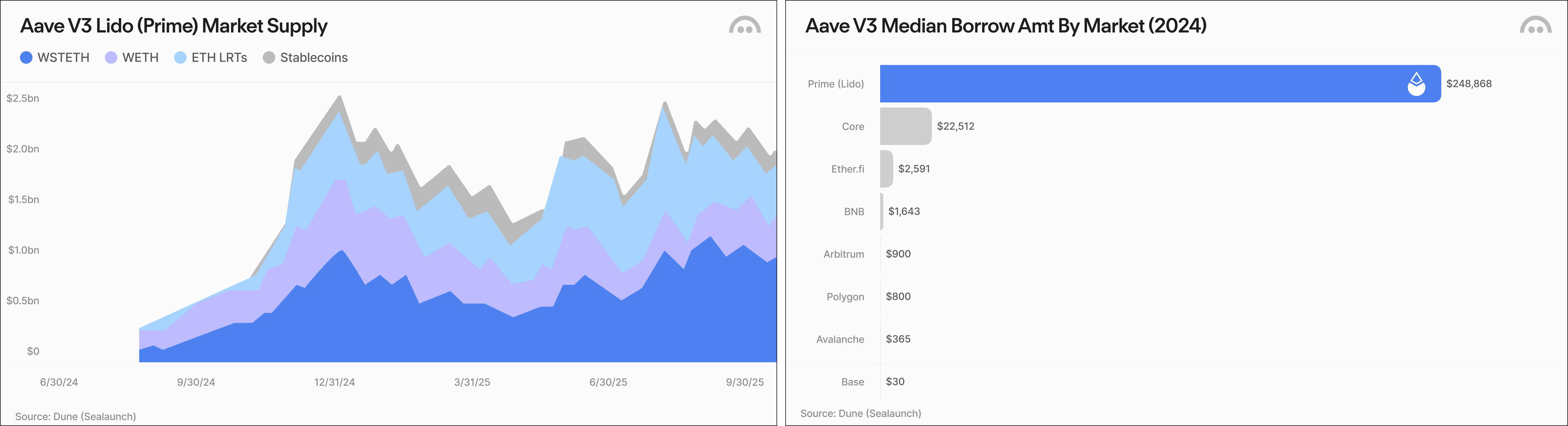

As wstETH usage surged, the Aave DAO launched a dedicated Aave V3 Ethereum Lido market, optimized for leveraged yield strategies with wstETH. This market offered tailored interest rate curves for wstETH/WETH pairs, loan-to-value ratios up to 95% (significantly higher than the main market), higher liquidation thresholds to accommodate leverage, and isolated risk from the main Aave market (i.e. the "Core" instance).

The Aave V3 Lido Instance was the pilot for new “Liquid E-Modes” configurations, which unified liquidity between separate markets, enabled soft onboarding of new assets with isolated risks, and allowed borrowers to access more leveraged yield opportunities across markets. The user base of the Aave V3 Lido Instance was characterized by much larger transaction volumes with greater leverage ratios than other Aave markets. In the first six months post-launch, the median borrow amount in the Lido market was $248,000 - over 10x higher than the Core market.

In December 2024, the Aave V3 Lido Instance was rebranded as the Prime Instance, maintaining its focus on high capital efficiency for leveraged yield strategies while supporting a broader range of collateral assets. The Prime Instance currently holds over $2 billion in supplied assets and has maintained high utilization rates (e.g., WETH utilization regularly averages more than 90%) as borrowers make use of the more lenient risk parameters for yield stacking opportunities.

The creation of this dedicated market showcased Aave's ability to optimize for specialty use cases and attract significant liquidity to scale up assets while effectively isolating risks from spreading to the larger protocol. Higher borrowing rates for looping strategies were contained without major disruption to other Aave users across other markets.

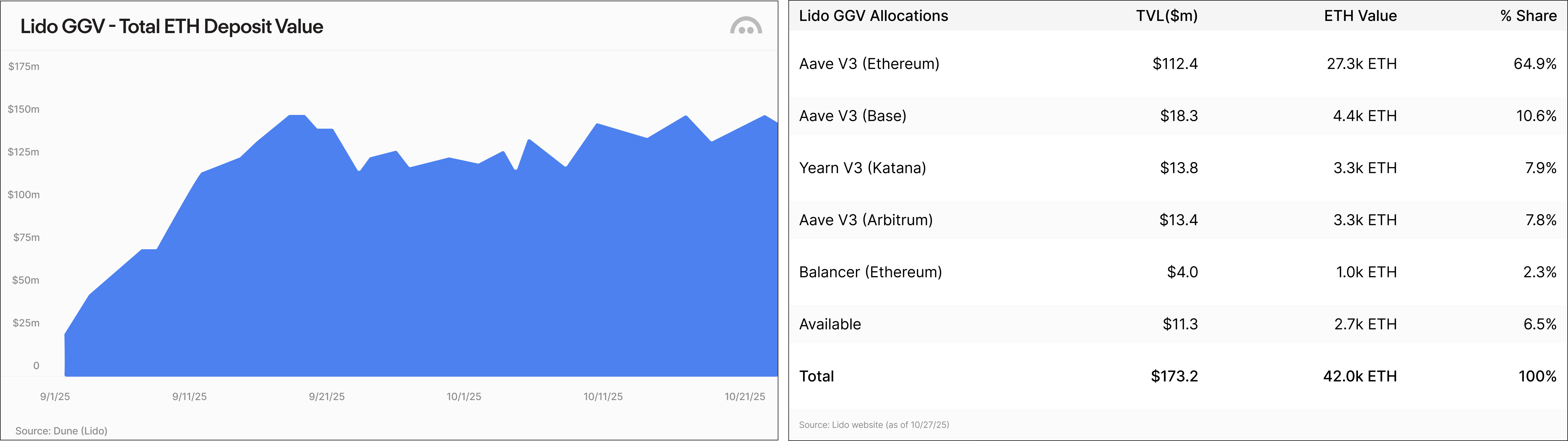

Lido GGV – Aave-Powered Automated Yield Vault

In September 2025, Lido introduced the Golden Goose Vault (GGV) within its new "Earn" feature, offering one-click access to diversified, high-yield strategies across "blue-chip" DeFi protocols like Aave, DEXes, lending platforms, and yield optimizers. This integration highlights Aave's flexibility in supporting automated vaults. GGV leverages Aave's markets for liquidity and yield, automating compounded returns for ETH or wstETH deposits with minimal user effort.

As of November 2025, GGV has attracted over 40,000 ETH in deposits, equating to more than $175m in TVL at current prices. The vault has generated an average return of ~5% APY, providing investors additional returns beyond native staking rewards.

While Lido's GGV strategies span many of the leading DeFi protocols, over 80% of the vault's allocations have been directed to Aave V3 markets (including on Mainnet and L2s like Linea, Base and Arbitrum). GGV's significant reliance on Aave stems from: (i) Aave's proven reliability and battle-tested infrastructure, (ii) its multi-chain presence to support Lido's deployments of wstETH across networks, and (iii) its deep liquidity and sustainable yields to meet the scale requirements of a major operator like Lido.

Outlook

Aave and Lido have collaborated to redefine capital efficiency in DeFi. Lido's liquid staking transforms ETH into a productive asset, while Aave supports its growth as collateral, enables high-efficiency leveraged yield strategies, and powers automated vaults like GGV. Lido's innovative yield-optimizing efforts have significantly influenced the development of Aave V4, which will enable new ways to maximize yield and liquidity in DeFi.