Aave for Institutions: Lessons from JP Morgan & Project Guardian

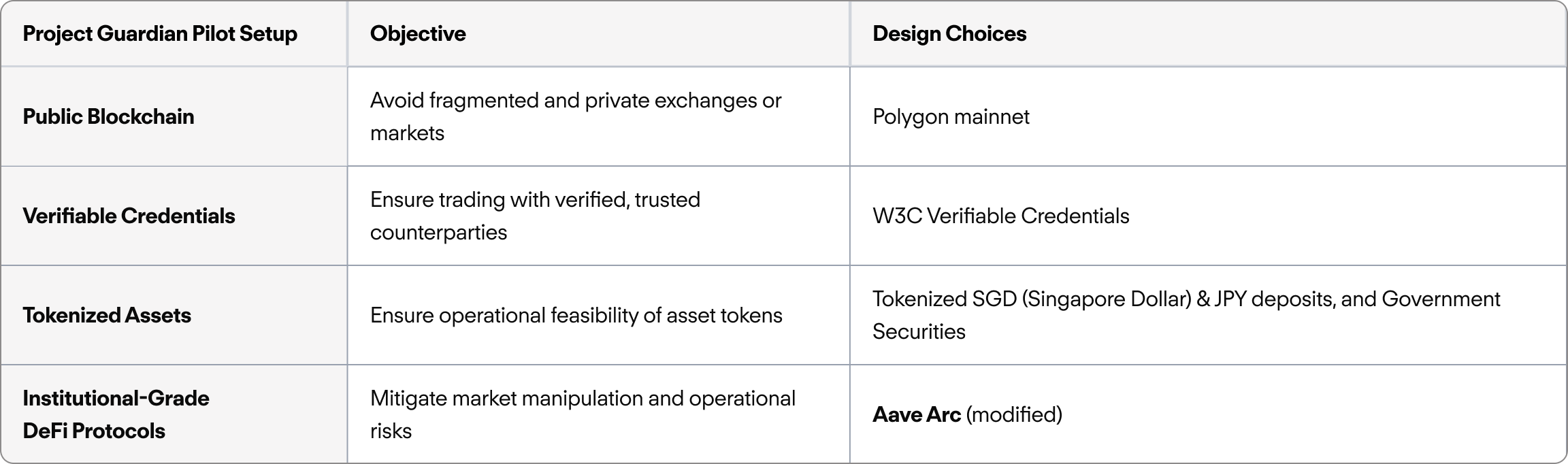

In 2022, JP Morgan's Kinexys blockchain team (fka Onyx) participated in Project Guardian, a collaborative effort led by the Monetary Authority of Singapore (MAS). Project Guardian was a sandbox initiative to test the feasibility of asset tokenization and DeFi applications, while managing financial stability. The project looks to explore four key areas: (i) open, interoperable networks or public blockchains, (ii) trust anchors to ensure trading with verified, trusted counterparties, (iii) asset tokenization including the operational feasibility of asset tokens, and (iv) institutional-grade DeFi protocols, including adapting open-sourced protocols to enforce transaction terms.

The first pilot under Project Guardian assessed DeFi's viability for FX markets in a regulated environment. Led by DBS, Kinexys by JP Morgan, and SBI Digital Asset Holdings, the pilot tested tokenized deposits of SGD (Singapore Dollar; issued by JPM) and JPY (Japanese Yen; issued by SBI).

The Design Choices

The transactions took place on Polygon's mainnet, and adapted open-source DeFi protocols including Uniswap and a modified version of Aave Arc – a permissioned liquidity protocol for institutions and the predecessor to Aave Horizon, our recently launched institutional version of Aave supporting tokenized assets as collateral. The modified deployment of Aave Arc was paired with authorized W3C Verifiable Credentials issued by trusted financial institutions to ensure compliant access was limited to the authorized pilot participants.

On the modified version of Aave Arc, the FX transaction was structured as "lending" the SGD tokenized deposit in exchange for the JPY tokenized currency. The transaction leveraged Aave's core features, including its liquidity pools and automated logic for execution, while addressing the key constraints of the pilot participants.

Findings from the Study

Overall, the setup demonstrated Aave's flexibility to support the robust regulatory requirements and validated DeFi's potential for FX efficiency while maintaining safeguards. The Aave protocol was adapted for institutional needs, ensuring compliance standards without revealing identities by incorporating W3C Verifiable Credentials. The modified version of Aave enabled atomic settlement and real-time value transfer to support back office operations.

The pilot study concluded "Institutional DeFi is feasible, but work is needed to drive adoption at scale", highlighting three key focus areas of institutional DeFi including: (i) establishing legal & regulatory uncertainties, (ii) establishing shared standards, and (iii) envisioning target market structure.

Applying These Learnings to Designing Aave Horizon

The insights from the Project Guardian initiative have been instrumental in shaping Aave Horizon, the successor to Aave Arc for supporting institutional DeFi using tokenized real-world assets (RWAs). Compared to Aave Arc, which was a fully permissioned version of Aave V2 (all participants whitelisted), Aave Horizon was deployed as a hybrid model with a primary focus on integrating RWAs like tokenized money market funds, maintaining regulatory compliance at the asset level. Anyone can supply stablecoins to Aave Horizon though supplying permissioned RWAs as collateral to borrow against is limited to qualified institutions only. Aave Horizon effectively unlocks liquidity and utility for tokenized RWAs and has quickly grown to become the largest RWA market with over $550m in supplied assets.

Aave Horizon is a proving ground for how regulated DeFi markets and tokenized RWAs can coexist on public blockchains. As standards for verifiable credentials, identity attestations, and tokenized funds mature, Aave Horizon's architecture offers a template for institutional participation at scale, bridging the gap between TradFi capital markets and DeFi.