Savings accounts haven't changed in decades, but the cost of living has. You still deal with limited withdrawals, waiting periods to access your own money, and interest paid out over long time horizons. Banks built online access and mobile apps, but your money still sits there barely keeping up with inflation while they use it to earn far more than they pay you.

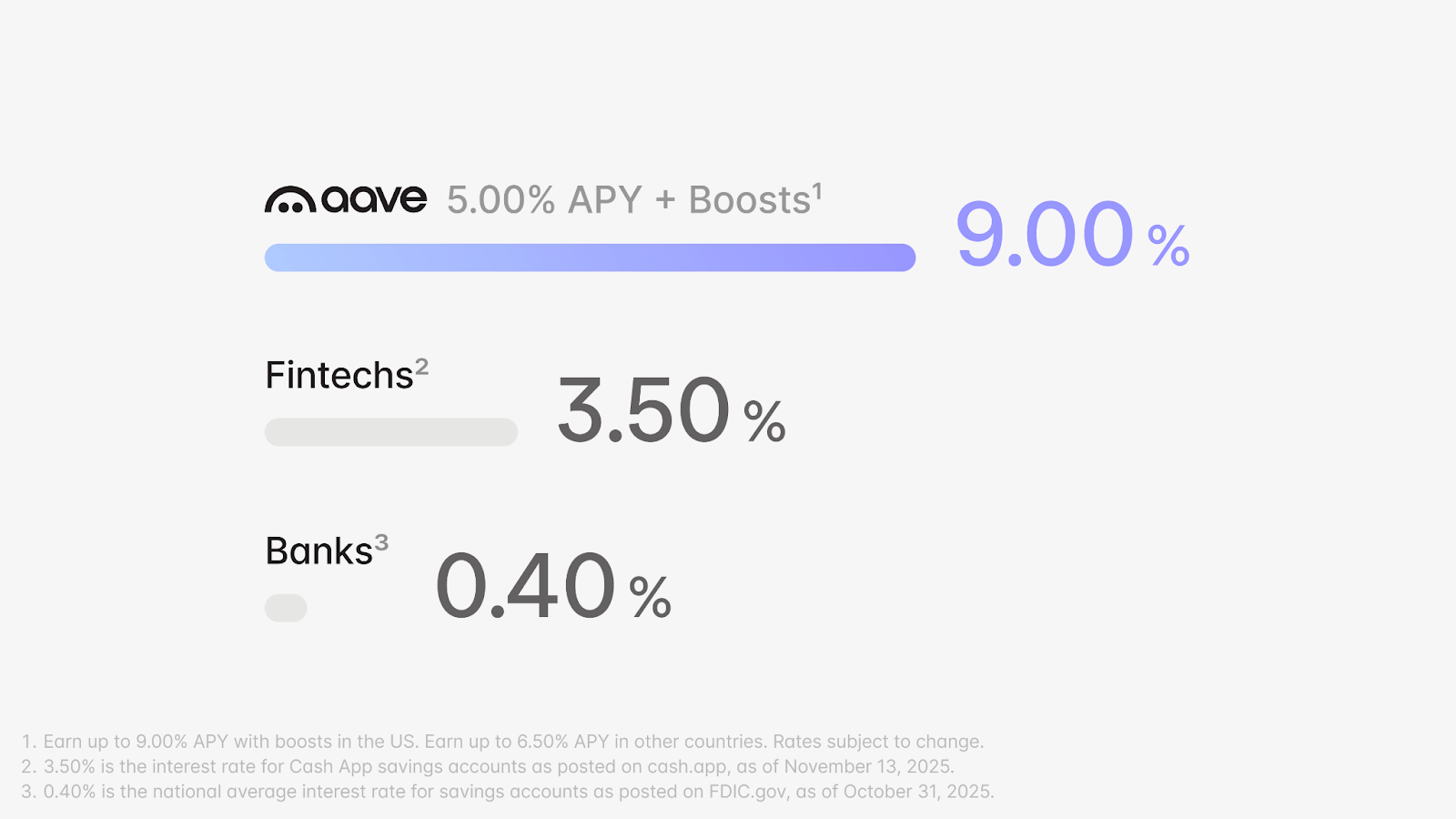

Regular savings accounts pay around 0.4% APY on average. Even the best high-yield options typically offer just 3% to 4% APY, and they often come with more restrictions than basic accounts. When inflation runs higher than your interest rate, you're losing purchasing power every year. Your savings shrink, even if the number in your account slowly ticks up.

It should be easier to save for college, that nicer car, or your dream house down payment. That's why we're building Aave App.

A Better Way to Save

Aave App offers up to 9% APY by verifying your identity, setting up automatic deposits, or inviting friends. Much higher than the average savings rate.

Unlike traditional savings accounts, your interest compounds every second, so you watch your savings grow in real time instead of waiting for a monthly, quarterly, or even yearly payout. You can open the app at any time and see exactly how much interest you've earned down to the cent.

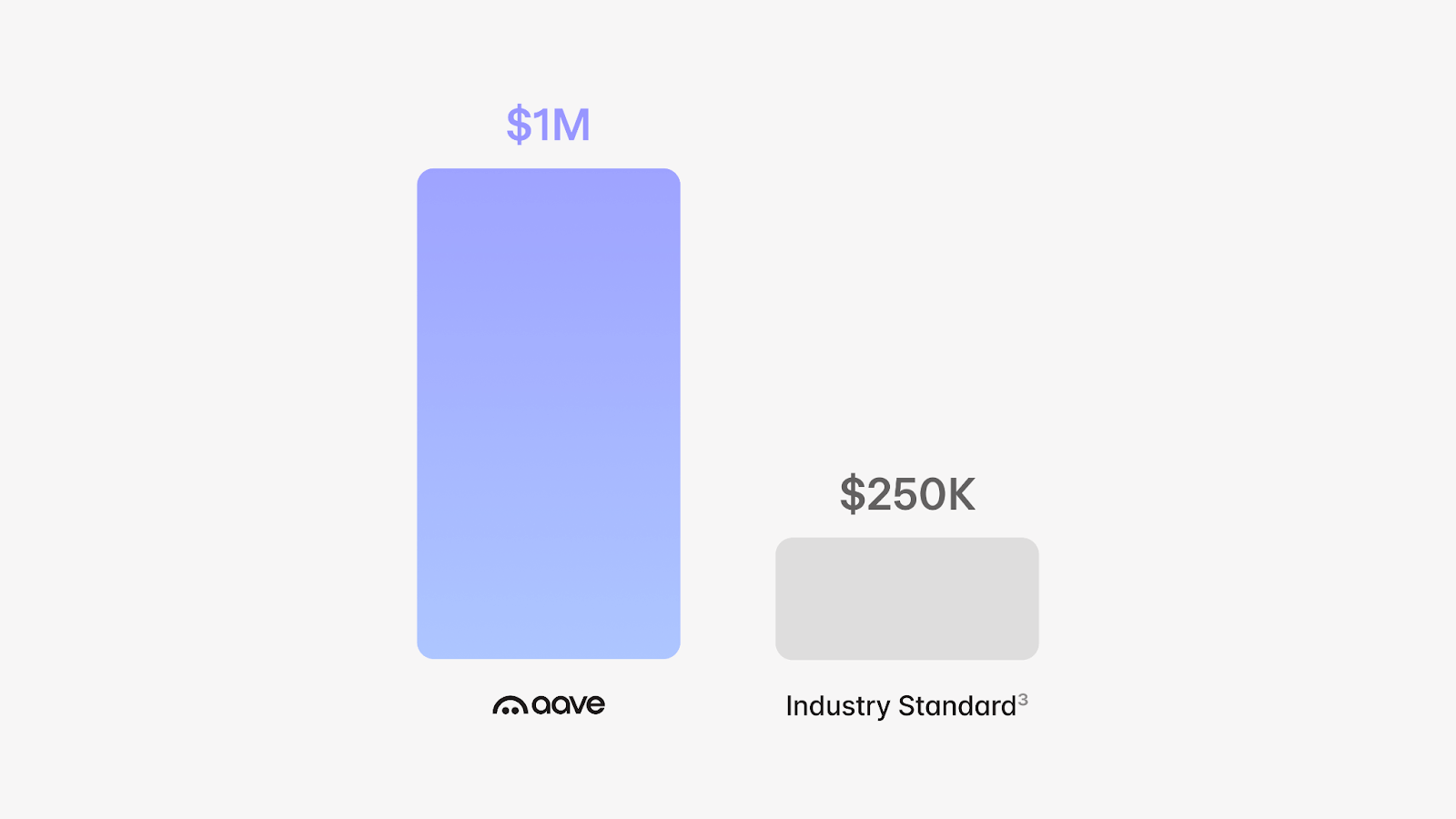

We also know how important your hard earned money is. Aave App offers up to $1 million in balance protection. More of your savings are covered, giving you real peace of mind as you build wealth.

Hit Your Goals

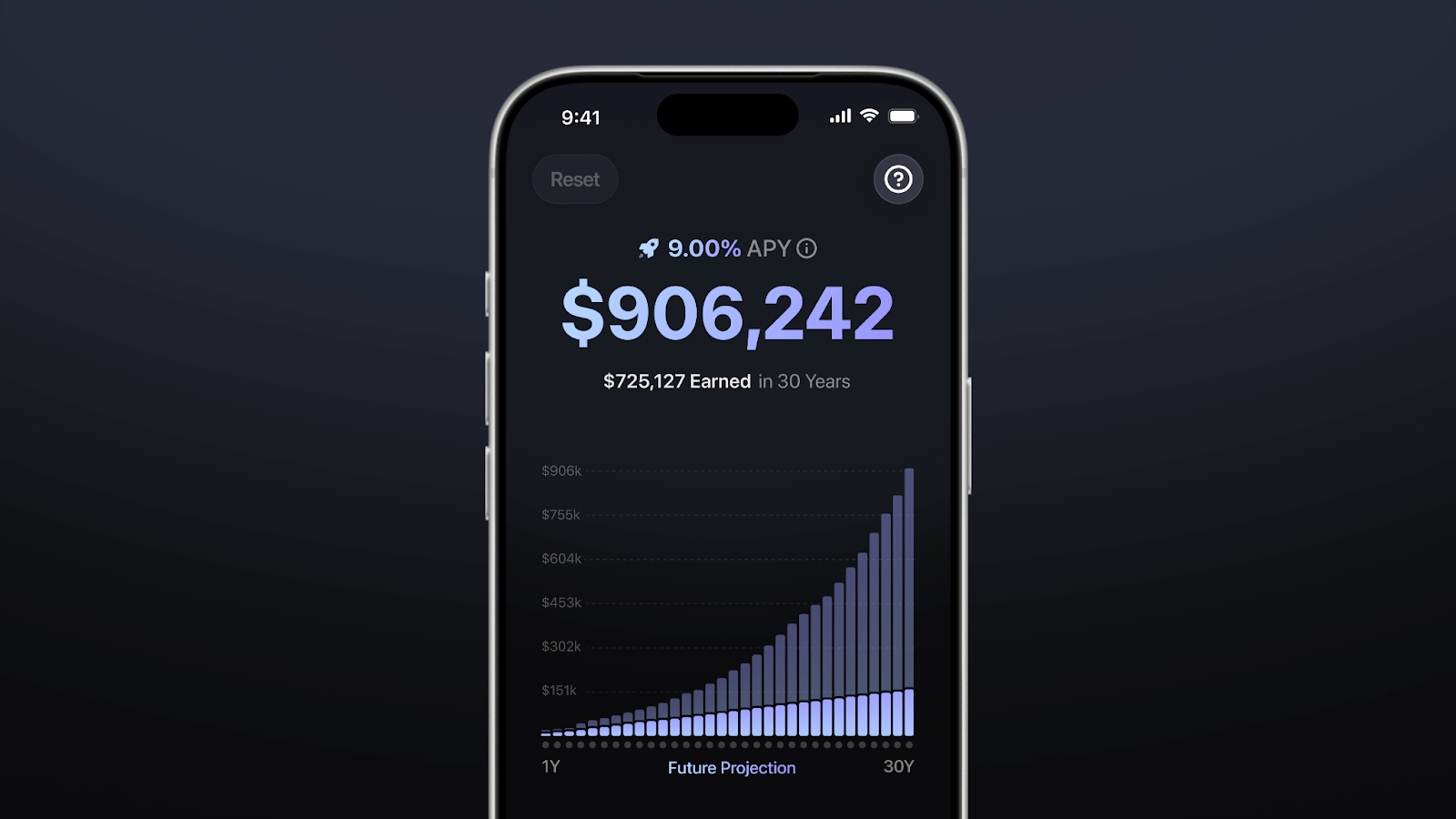

We want to change the way you save and give you control over your future. Inside Aave App, you can simulate your earnings and see exactly how your savings will grow over time. Plug in different deposit amounts, adjust your timeline, and watch the projections update instantly.

You'll know how much you're depositing, when it's going in, and what you'll have in a year, five years, and beyond.

You can also set up recurring deposits with the app's Auto Saver feature to reach your savings goals with ease. Whether you're saving for a down payment, building an emergency fund, or planning for your future you can see your progress in real time and adjust as you go.

Auto Saver works in the background, moving money from your bank account to your Aave App account automatically, so you never have to think about it. For committing to your savings goal with Auto Saver, you’ll earn an extra 0.5% APY.

Deposit From Anywhere

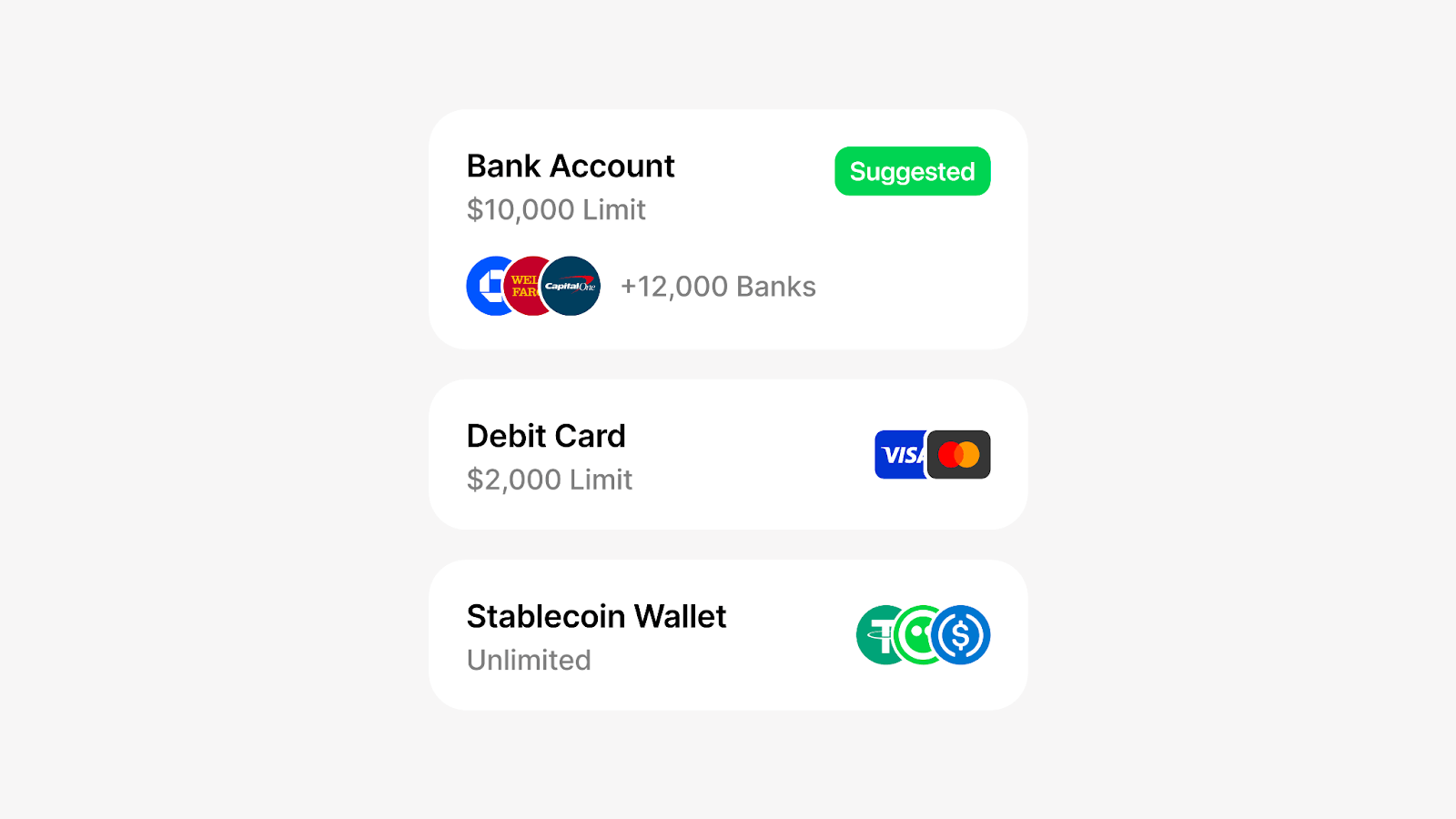

Accessibility matters most to us. With Aave App, you can deposit money anytime, anywhere, using whatever method you like best. Aave App supports over 12,000 banks and debit cards, while also supporting stablecoin deposits. Link your existing bank account in minutes and start earning higher rates on your savings without switching banks or opening new accounts.

Your money is yours, and you should be able to access it when you need it. You can withdraw anytime you want without delays. No notice periods, penalties, or fine print.

Join the Waitlist

We're excited to introduce a newer, smarter way to save, powered by Aave. Aave is trusted by 2.5 million users and counting, with over $70 billion in active deposits and over $3 trillion in lifetime deposits.

Smart Money saves with Aave.