Aave Labs launched Aave Horizon, a new lending market on Ethereum where institutions or other qualified users borrow stablecoins against real-world assets (RWAs).

Aave Horizon launches with a network of leading institutions across tokenized assets and stablecoins, supporting collateral from Circle, Superstate, and Centrifuge at launch. The network also spans Ant Digital Technologies, Chainlink, Ethena, KAIO, OpenEden, Ripple, Securitize, VanEck, and WisdomTree.

Why Aave Horizon

Today, tokenized RWAs give institutions exposure to traditional assets onchain, but they remain largely siloed from DeFi. These assets are underutilized and capital-inefficient, unable to serve as collateral and effectively isolated from onchain capital markets.

Aave Horizon changes this by enabling RWAs to serve directly as collateral within DeFi. Institutions can unlock stablecoin liquidity against their tokenized assets without needing to sell or redeem them, turning RWAs into productive building blocks within onchain finance.

For stablecoin lenders, Aave Horizon provides access to new onchain yield opportunities from a new risk profile. The result is a market that combines RWAs with DeFi, making them productive and integrated into decentralized finance.

How Aave Horizon Works

Built on Aave Protocol version 3.3, Aave Horizon is designed to meet regulatory requirements for permissioned RWAs. It operates as non-custodial lending infrastructure, where borrowing and lending are executed automatically through smart contracts.

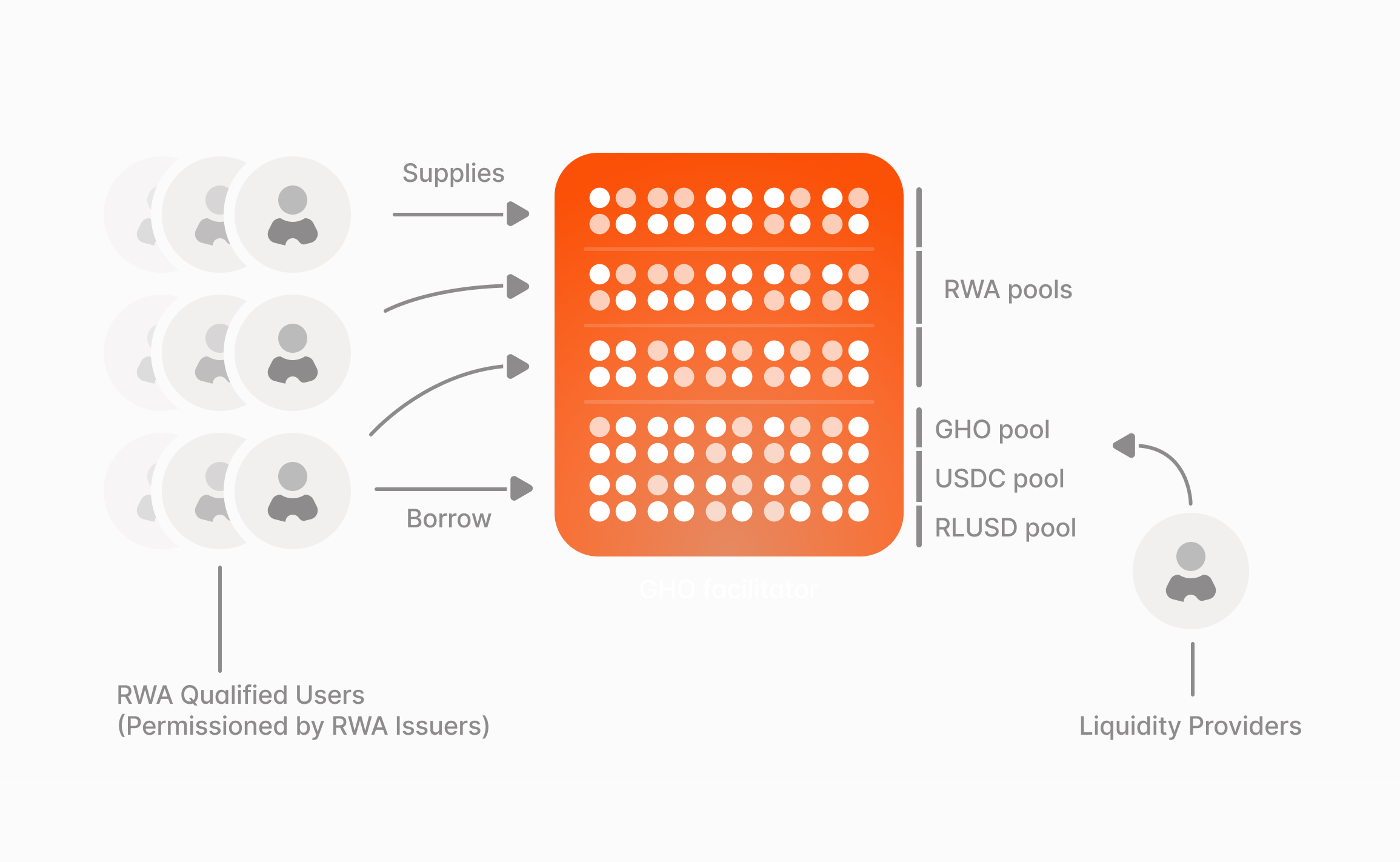

The Aave Horizon market is built to support two types of users. Qualified institutional investors can supply RWA collateral and borrow stablecoins, while anyone can supply stablecoins to earn yield from institutional borrowers.

How Borrowing Works

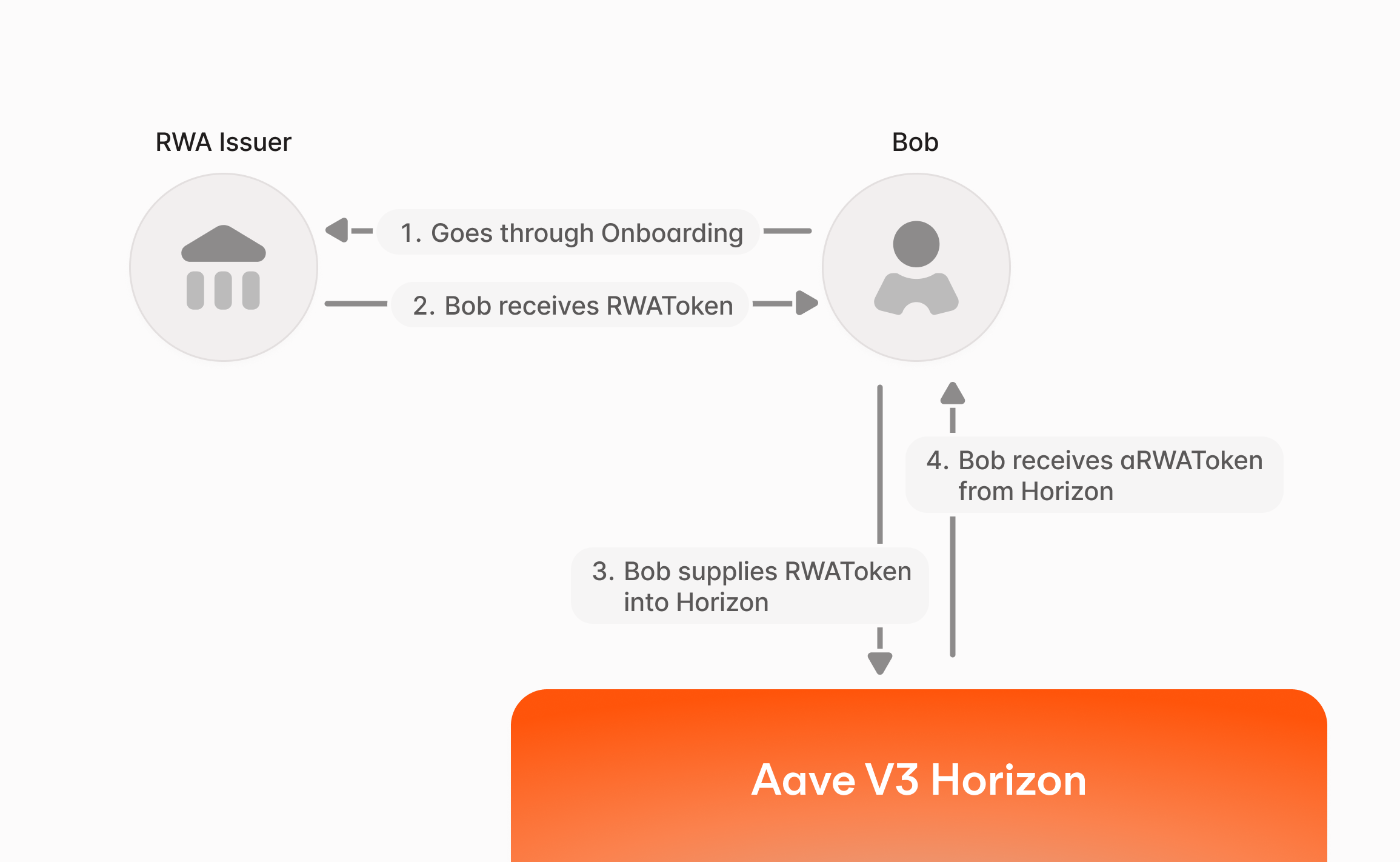

Depositing RWA as collateral on Aave Horizon is available to qualified investors who meet the requirements set by the RWA issuer. Each issuer is responsible for setting their own requirements and for managing permissionings around token access.

When the RWA token is supplied, Aave Horizon issues a non-transferable aToken that represents the collateral position. Users can borrow stablecoins up to a set percentage of their collateral value, with each collateral type having its own set loan-to-value (LTV) parameters.

How Lending Works

Supplying stablecoins to Aave Horizon requires no permissions. Anyone can supply RLUSD, USDC, or GHO for institutions to borrow. Users supply their chosen stablecoin to the market and receive an aToken representing their deposit. The aToken earns yield and can be withdrawn anytime.

Launch Partners and Assets

At launch, Aave Horizon includes RWA collateral options from Superstate (USTB and USCC) and Centrifuge (JRTSY and JAAA). Circle’s USYC will also be added soon. Stablecoin lenders can supply GHO, RLUSD, and USDC.

-

Circle's USYC provides qualified investors with the opportunity to earn U.S. dollar yields by investing in a diversified portfolio of high-quality, short-duration U.S. Treasury bills.

-

Superstate's USTB and USCC provide qualified investors with the opportunity to earn yields through short duration U.S. government securities and crypto carry strategies, respectively.

-

Centrifuge's JRTSY and JAAA provide qualified investors with the opportunity to earn yields through tokenized exposure to U.S. Treasury bills and AAA-rated collateralized loan obligations.

Aave Horizon has also adopted Chainlink SmartData, starting with the deployment of NAVLink. This delivers accurate net asset values for tokenized RWA collateral and enables real-time, overcollateralized stablecoin loans within a compliant DeFi framework.

All risk analysis for this market will be provided by Llama Risk. Chaos Labs will also be joining as a risk management provider.

Additional institutions in Aave Horizon’s network include Ant Digital Technologies, Ethena, KAIO (formerly Libre), OpenEden, Securitize, VanEck and WisdomTree.

Security

Aave Horizon includes several protective measures. Smart contracts execute deterministically without matching logic, order books, or quotes. The non-custodial architecture means users retain control and Aave Labs cannot move funds.

aTokens are non-transferable to respect issuer transfer restrictions. Administrative powers are limited and procedural, unable to approve trades or redirect funds. All privileged actions are transparent onchain and governed under standard operating procedures.

Issuers control whitelisting, KYC, and asset management.

Get Started

RWAs are DeFi’s trillion-dollar opportunity. Yet, tokenizing assets by itself is not enough to unlock the full benefits of DeFi if these assets face the same constraints as traditional financial instruments.

Aave Horizon provides a solution to turn RWAs into productive assets to be used across DeFi by addressing the compliance needs of regulated entities. Institutions get access to stablecoin liquidity against their RWA collateral, while DeFi users get access to yield from high-quality institutional borrowers. Trillions of dollars have yet to come onchain and Aave remains committed to being at the forefront of institutional DeFi.