Currently, Aave V3 operates separate markets that can't share liquidity. The Core market holds c. $60 billion and serves as the main Ethereum market with the largest selection of assets. The Prime market holds c. $2B billion serves the lower end of the risk curve. However, each operates independently, meaning the billions in USDC deposited in Core can't be borrowed by users in Prime, even though it's the same asset.

That’s because the system keeps the relationship between a market’s risk configuration and its liquidity closely tied. This creates a "chicken-and-egg" problem for new markets.

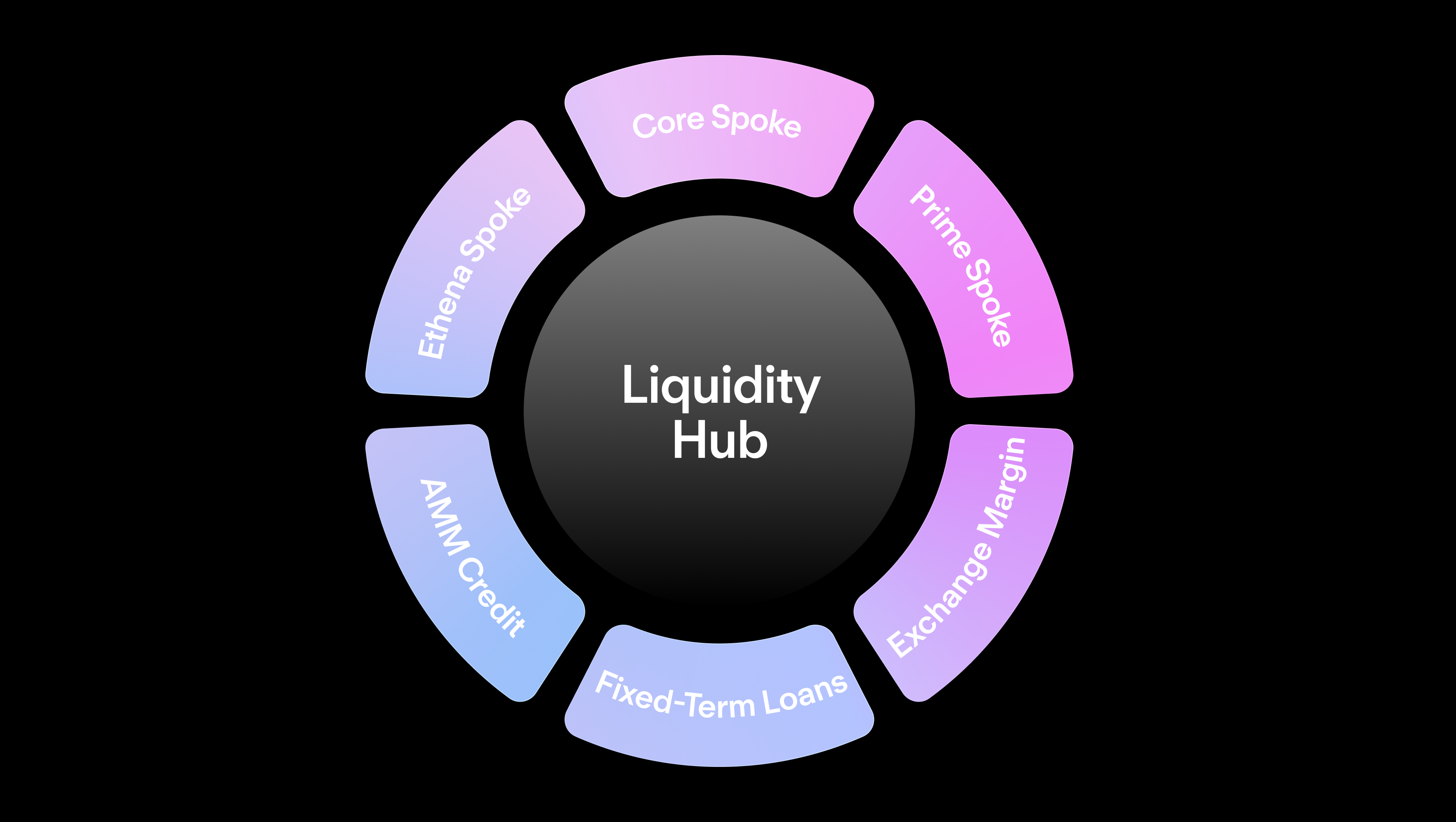

Every specialized market requires bootstrapping its own liquidity from zero, even though Aave already has tens of billions of assets sitting in other markets. V4 solves this by connecting specialized Spokes to shared Liquidity Hubs, so new markets can access Aave's existing depth from day one.

How V4 Fixes This

V4 separates liquidity storage from market logic by introducing Hubs that hold assets and Spokes that implement specialized lending rules. Multiple Spokes can draw from the same Hub based on demand and credit line allocations set by governance. So, when you build a Spoke, you're connecting to existing liquidity rather than starting with empty pools.

Consider the possibilities this creates: a Pendle market that accepts Principle Tokens (PTs) as collateral could allow users to borrow USDC from the same Hub that serves “Core” market users. A specialized Uniswap LP Spoke could access ETH liquidity that's simultaneously available to other markets. Each Spoke implements its unique features and risk parameters while sharing the underlying liquidity depth that makes Aave DeFi’s go-to lending network.

This removes the bootstrapping problem that forces every new market to compete with existing successful markets for the same deposits.

What Spokes Enable

This architecture allows for markets that simply weren't viable through V3. Custom markets can serve assets like Ethena's sUSDe and related Pendle PTs without fragmenting Aave's overall liquidity. Institutional users can get the collateral segregation they require while still accessing the borrowing capacity of shared Hubs.

The flexibility extends to entirely new financial primitives. Secondary markets for debt positions become feasible when Spokes can customize how assets are handled. Credit against AMM positions can dynamically track pool composition and volatility to adjust loan-to-value ratios appropriately. Fixed-tenor credit markets can match supply and borrow intentions by duration while allowing unmatched liquidity to continue earning yield from the underlying Hubs.

For builders, creating a Spoke lets them focus on innovation rather than infrastructure and liquidity acquisition. Developers define their market parameters, implement specialized features, and connect to appropriate Hubs. They inherit Aave's proven liquidation systems, governance frameworks, and risk management without rebuilding these components or bootstrapping deposits.

This approach empowers the broader DeFi community to build on Aave rather than competing with it. Service providers and integrators can create specialized experiences while accessing deep liquidity, expanding innovation within the Aave ecosystem rather than fragmenting it across separate markets.

Why This Evolution Matters

As more Spokes connect to shared Hubs, the entire system becomes more efficient. Liquidity gets better utilization across diverse use cases. Users access specialized features without fragmenting their assets across multiple isolated markets. Innovation happens on top of proven infrastructure rather than starting from scratch repeatedly. Each successful Spoke makes the platform more attractive to the next builder, creating positive feedback loops rather than zero-sum competition.

V4 makes it possible to serve specialized communities without fragmenting liquidity or forcing each new market to compete with existing successful markets for the same users and deposits.

This represents Aave's natural progression from multiple isolated markets to unified liquidity infrastructure. The protocol can serve specialized needs while maintaining the capital efficiency and security that made it successful.

For builders who want to create lending experiences that serve specific communities, V4 provides the foundation. The infrastructure and development tools are almost ready, and a new era of DeFi innovation will begin.