Cap is a stablecoin protocol that provides credible financial guarantees through two products, the dollar-denominated cUSD and the yield-bearing stcUSD. Notably, Cap integrates with Aave to deploy idle capital and as a benchmark for its own yield generation, which has helped it grow to one of Aave's largest depositors.

Background

Cap, short for Covered Agent Protocol, is a covered credit system that issues cUSD, a stablecoin backed by a reserve of regulated stablecoins and tokenized money market funds.

The protocol outsources yield generation to a network of institutional operators who borrow from Cap's Credit Engine. These operators, which include banks, high-frequency trading firms, and market makers, generate yield through private credit.

To borrow, operators must secure coverage from risk underwriters in Cap's Financial Guarantee Market. Underwriters post escrowed capital that can be used to cover any losses in case of default.

cUSD can be staked to receive stcUSD, which earns yield from the protocol's yield strategies. A dynamic Hurdle Rate sets the minimum yield that borrowers must pay to lenders and stcUSD holders. All yield up to the Hurdle Rate is distributed to stcUSD holders, while any surplus is retained by the operator after fees.

How Cap Relies on Aave

Cap uses Aave for two primary functions, capital efficiency and as a benchmark rate. Cap's Fractional Reserve contracts automatically send idle capital from its reserves to Aave, which earns yield for stcUSD holders. This process maintains a liquidity buffer for cUSD redemptions and strengthens the peg stability of the stablecoin.

Cap also uses Aave's rates as a benchmark for its Credit Engine. The minimum yield threshold for operators is the higher of two rates, a preconfigured protocol benchmark rate or the dynamic market rate from Aave's USDC supply. This approach establishes a competitive floor for yield, which reflects the baseline opportunity cost of capital in the decentralized finance ecosystem.

Current Stats

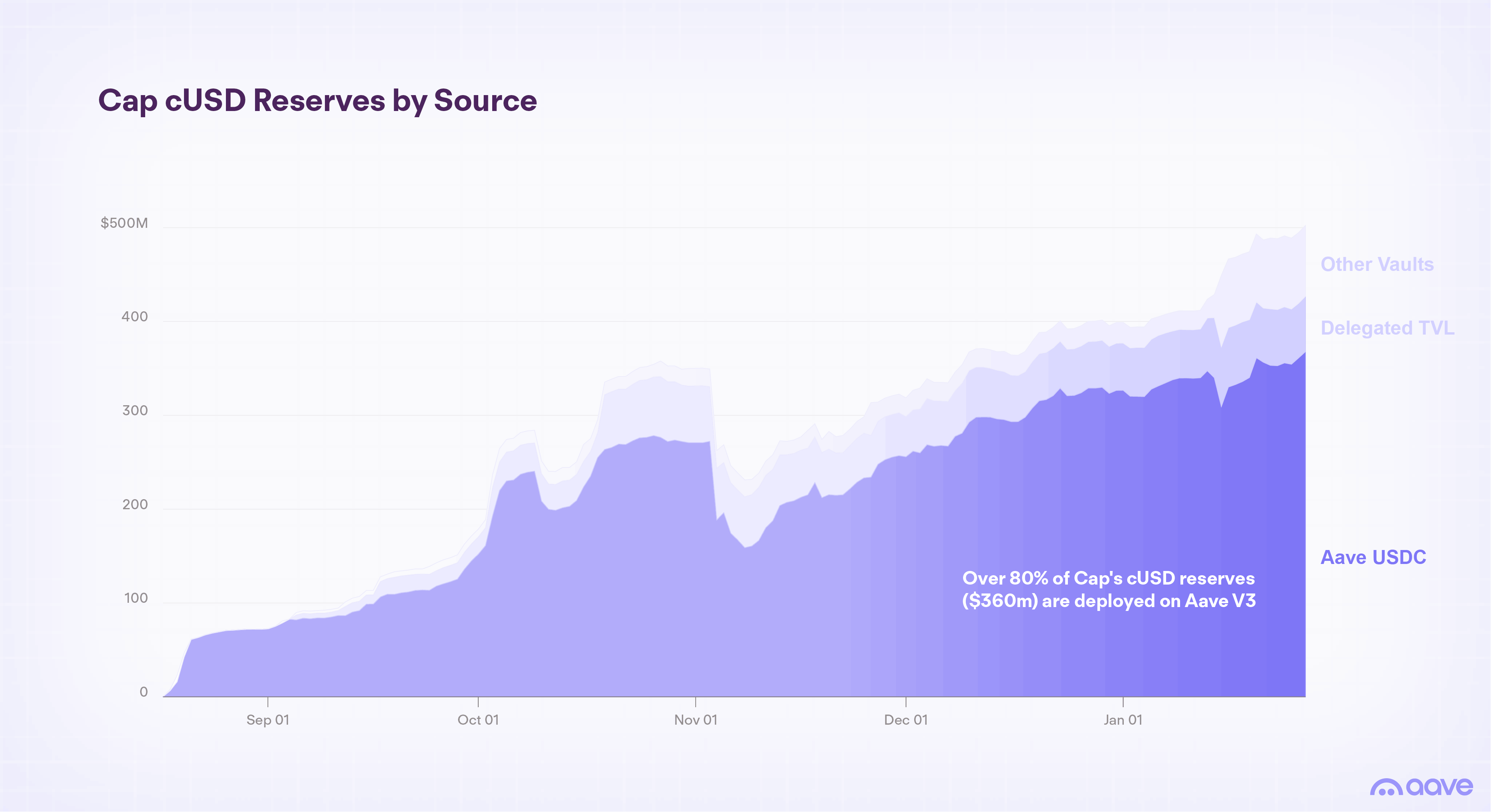

Since its launch in August 2025, the total value locked in the Cap protocol has grown to $500 million as of January 2026. Over 80% of Cap's cUSD reserves, or more than $360 million, are currently deployed on the Aave V3 Core Ethereum market. This makes Cap one of the largest suppliers of USDC to Aave.

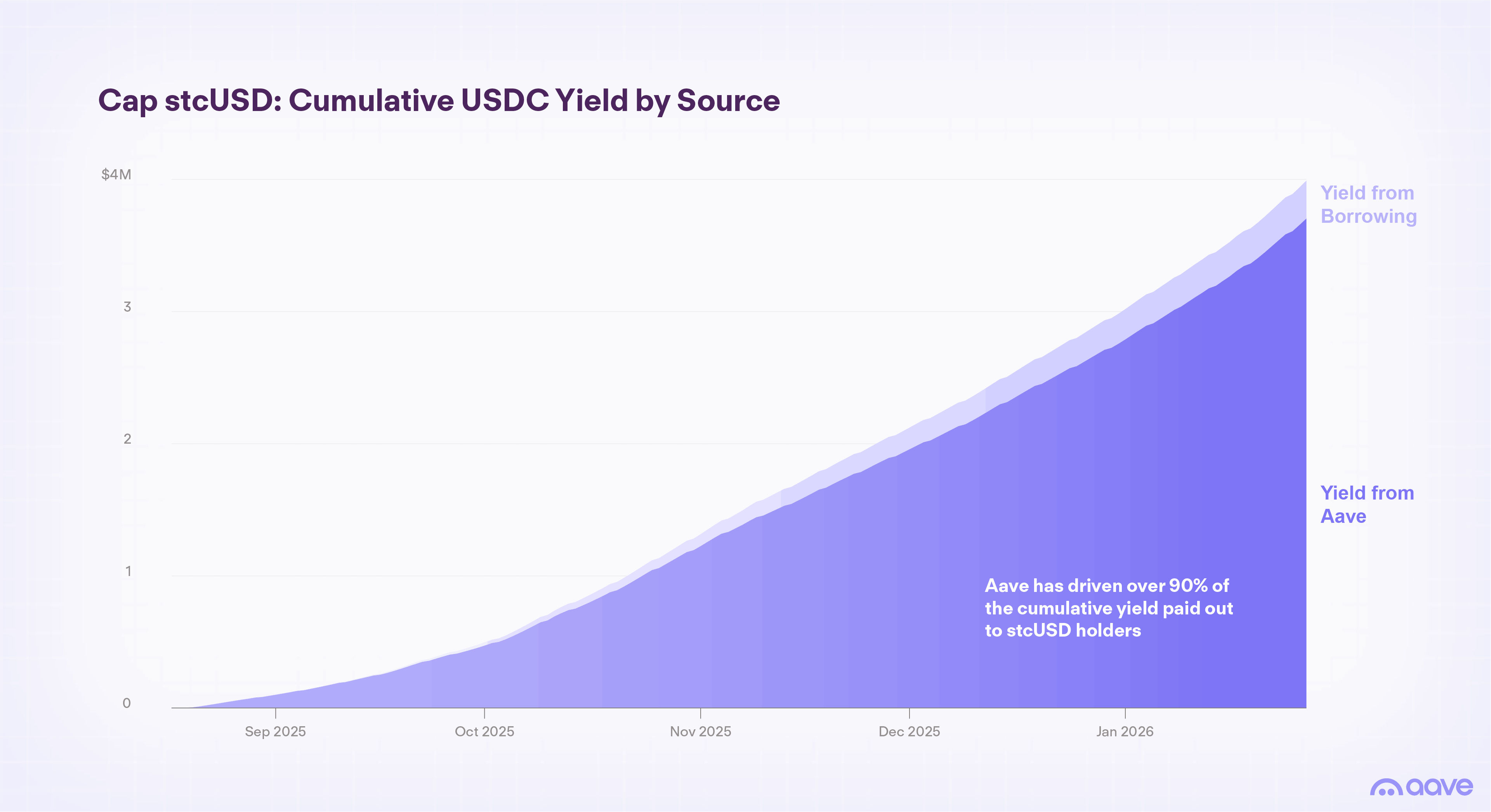

More than half of all cUSD is staked for stcUSD, which has generated $4 million in cumulative yield for token holders. The average hurdle rate over the past 90 days has been 5.2%. Aave is the primary source of this yield, accounting for over 90% of the total returns for stcUSD.

Outlook

Cap and cUSD represent an evolution in stablecoin design that moves toward sustainable, risk-managed yield with verifiable guarantees.

The protocol's integration with Aave for deploying idle capital and for benchmarking highlights a broader trend in DeFi. Participants in the DeFi market increasingly view depositing on Aave as the baseline opportunity cost for their capital allocation decisions.

In a maturing DeFi ecosystem, sustainable yields depend on deep, scalable liquidity. Aave's proven track record solidifies its position as the go-to benchmark for rates, risk pricing, and innovation.