Overview

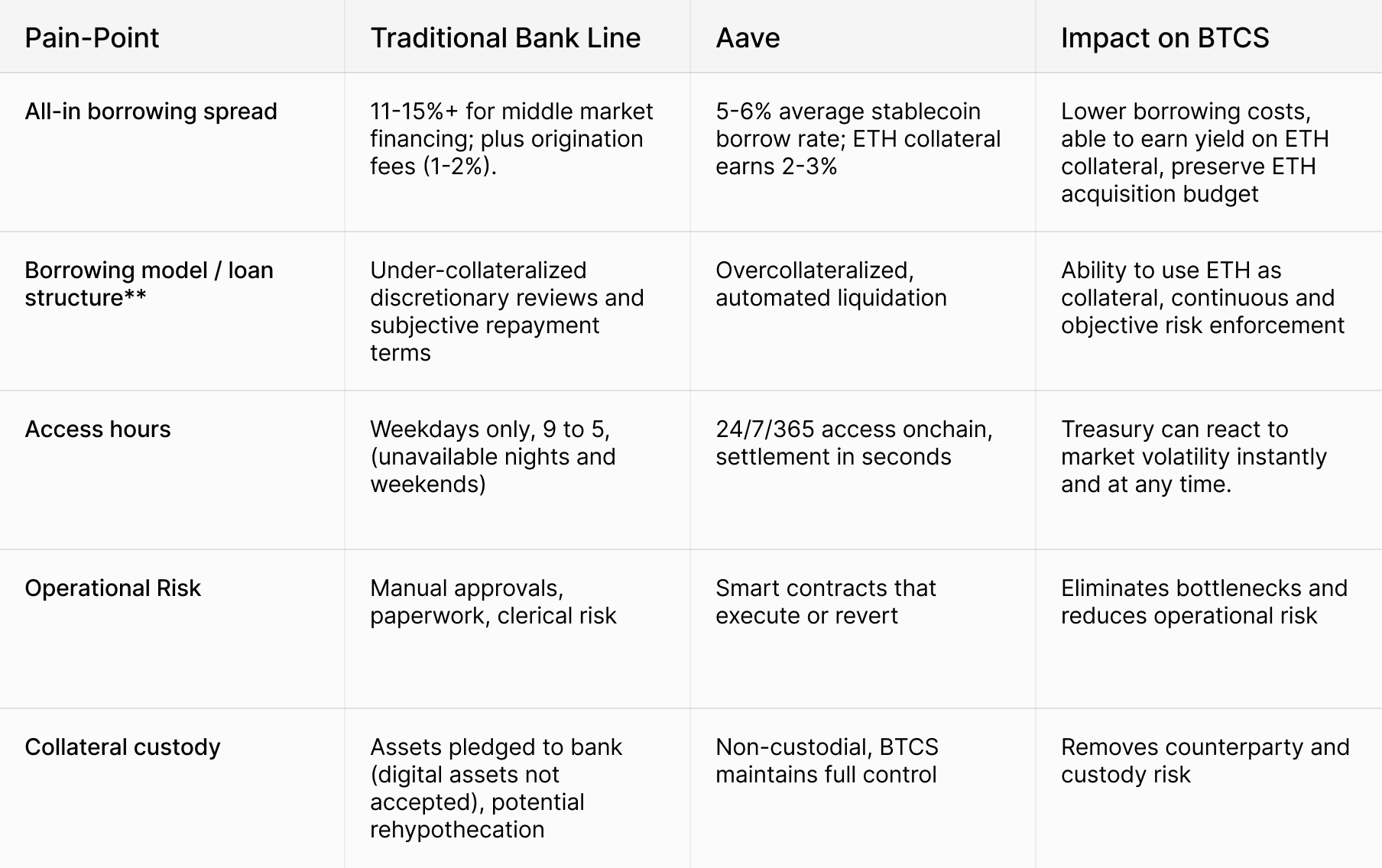

BTCS Inc., a publicly traded company (Nasdaq: BTCS) specializing in Ethereum infrastructure, aimed to expand its validator fleet and increase its holdings of Ethereum (ETH). To achieve this growth, the company required low-cost working capital. However, institutional investors offered unfavorable terms, and traditional financial avenues like bank credit lines presented significant challenges that were incompatible with the fast-paced, 24/7 nature of the blockchain industry:

- Interest rates for middle-market borrowers ranged from 11% to 14%, making it an expensive way to secure capital.

- Institutional investors and banks require extensive documentation, rely on slow, manual approval processes, and impose restrictive borrowing terms, including the inability to accept digital assets as collateral.

- Funds were only available during standard weekday banking hours, which restricted BTCS's ability to react to market conditions around the clock.

- The rigid nature of bank loans, with quarterly checks and limited adaptability, did not align with the dynamic and composable nature of crypto.

The Onchain Alternative: Aave

Instead of relying on institutional investors and banks, BTCS chose to use Aave markets on Ethereum for its credit needs. Aave operates entirely onchain, with all lending processes, including borrows, interest accrual, repayments, and risk management, executed through smart contracts.

This automated system provides BTCS with immediate and programmable access to liquidity while allowing the company to maintain full control over its digital assets. The benefits of using Aave include:

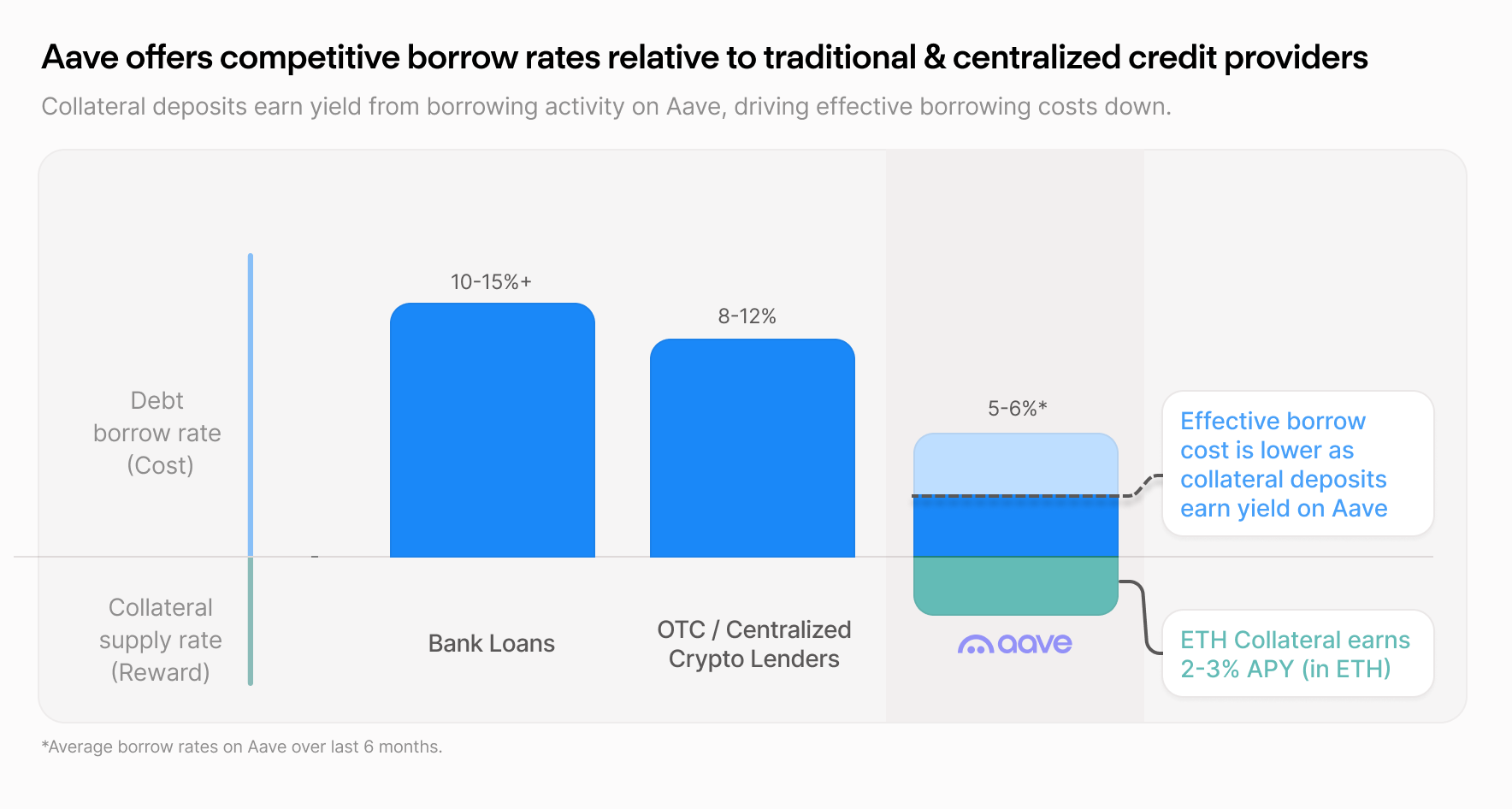

- A significantly lower average borrow rate of 5-6% on stablecoins as of September 2025.

- Funds can be borrowed or repaid at any time, including weekends and during volatile market periods.

- ETH collateral can be accessed at will by BTCS-controlled wallets, mitigating counterparty and custody risk.

- Operational efficiency with automated and scalable processes, saving on overhead and providing greater assurances around execution and resiliency.

- Full transparency and risk management capabilities as Aave allows for easy verification and traceability at any given time, unlike traditional centralized credit providers which operate with opaque processes.

“Aave offers a compelling combination of flexibility, attractive terms, and turnkey service that institutional investors and banks can’t compete with.”

— Charles Allen, CEO

How BTCS Uses Aave

- Deposit ETH as collateral on Aave

- Borrow USDT or GHO against ETH collateral within a health factor threshold

- Convert stablecoins into additional ETH using the Aave Swap Widget or DeFi protocols like CoW Swap

- Stake the ETH purchased with borrowed funds to earn staking rewards

This process allows BTCS to increase its ETH exposure over existing holdings. Deposited ETH earns yield generated from borrowing activity of other Aave users, and the newly purchased ETH using borrowed funds is then staked by BTCS to earn staking yield from network issuance and MEV rewards.

Aave gives BTCS on-demand access to liquidity while keeping core assets in place. BTCS can borrow against ETH or other eligible collateral, maintain market exposure, and continue to earn yield where supported. ETH deposits on Aave also earn yield from borrowing activity, reducing net borrowing costs—potentially even resulting in negative costs, depending on rates and leverage.

Borrowing terms are more flexible with Aave loans. Treasury can draw or repay 24 hours a day, including during volatile markets, with settlement occurring in seconds, not days or weeks. Borrowing and repayment on Aave does not come with any origination fees or early repayment penalties, unlike bank loans. Aave loans are perpetual with no tenor and no scheduled interest payments and no restrictive covenants.

Risk is enforced transparently onchain. Overcollateralization, health factor thresholds, and automated liquidations mitigate default risk. Aave’s transparency and verifiability provides advantages over centralized lending arrangements, which operate with opaque, subjective processes. Collateral remains in BTCS-controlled wallets, which removes custody transfers and rehypothecation risk.

Overall, borrowing on Aave is often more cost-effective than traditional bank loans. With Aave, BTCS can earn on its ETH deposits (not possible with banks and centralized lenders), which can significantly reduce or even result in negative net borrowing costs that cannot be matched. When also factoring the operational overhead, time-to-capital, restrictive loan terms, and absence of collateral interest in traditional systems, Aave offers a compelling advantage.

Takeaway

The 24/7 nature of crypto markets requires round-the-block financing options to match their constant activity. Aave meets the requirements of DATs like BTCS and other public crypto companies in ways that traditional credit providers and OTC desks cannot. Aave gives BTCS continuous, rules-based access to working capital while preserving asset exposure and custody. The result is faster execution, lower operational overhead, and enhanced yield generation and asset expansion.