The Liquidity Fragmentation Challenge

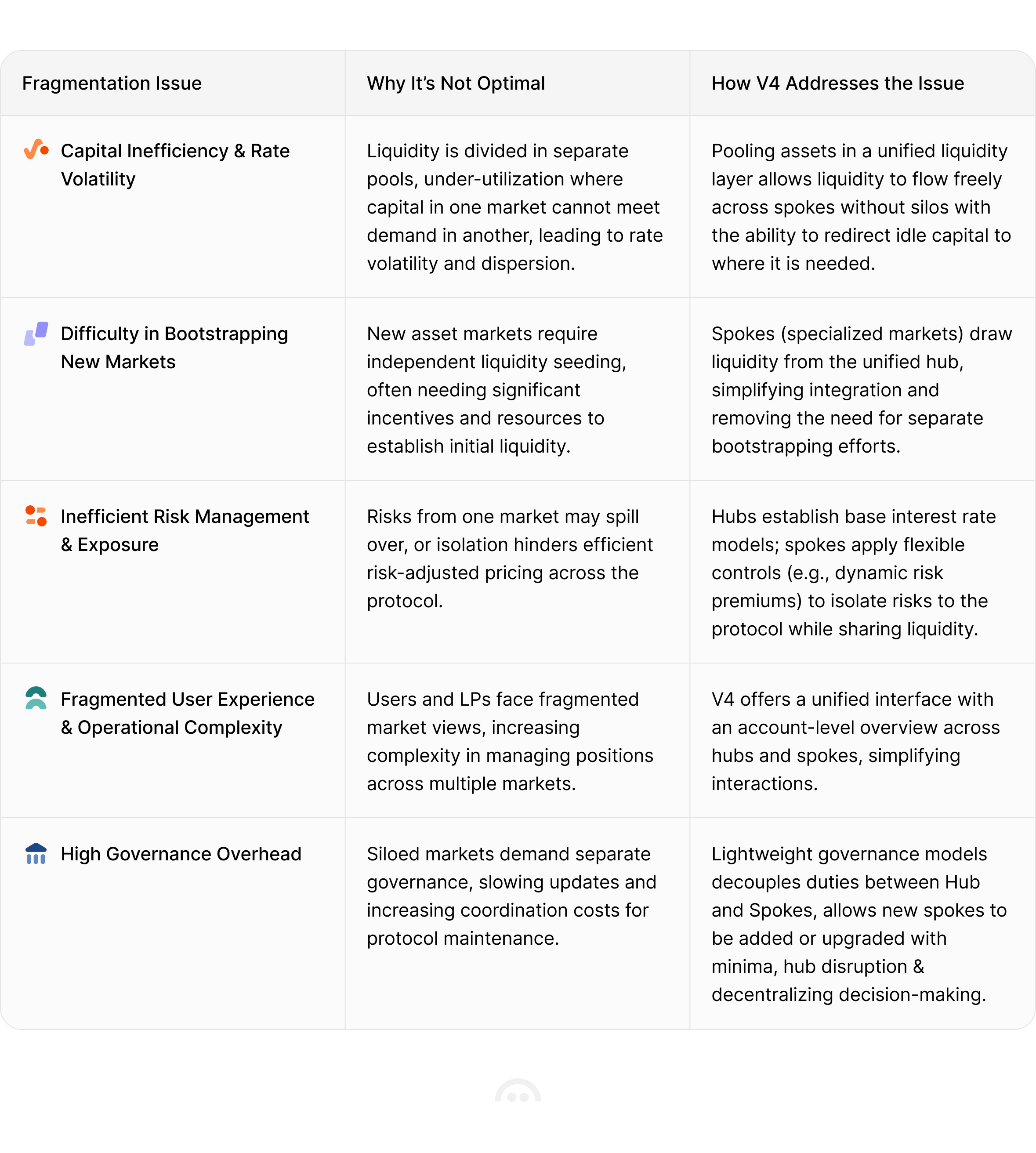

Built on open blockchain infrastructure, DeFi promotes rapid growth and experimentation by lowering barriers to entry for launching new protocols and markets. However, as the DeFi ecosystem continues to expand, it has led to fragmented or siloed liquidity across numerous protocols, networks, exchanges, and markets. This fragmentation prevents capital from flowing to where it can generate the most value, creating significant inefficiencies that ripple throughout the entire DeFi ecosystem.

For builders and asset issuers, launching new tokens or entering a new network requires "bootstrapping", an intensive effort to secure sufficient liquidity. In practice, this is typically achieved by "renting" liquidity through temporary incentive programs that create unsustainable dependencies. Liquidity providers (LPs), who supply assets to earn yields from trading fees or borrowing interest, face challenges in where to deploy capital across a divided ecosystem. This fragmentation creates complexity for end users and risks volatile yields for depositors and borrowers.

These challenges serve as major obstacles to broader DeFi adoption, especially from institutions if venues cannot scale to withstand large flows without triggering significant price or rate impacts. Even Aave V3, despite its technological innovations and market depth, isn't immune to the challenges of fragmentation as the creation of each new market requires individual bootstrapping efforts. Broader issues include risk spillovers, arbitrage inefficiencies, and governance overhead for risk managers.

V4's Approach: Unifying Liquidity Through Liquidity Hubs

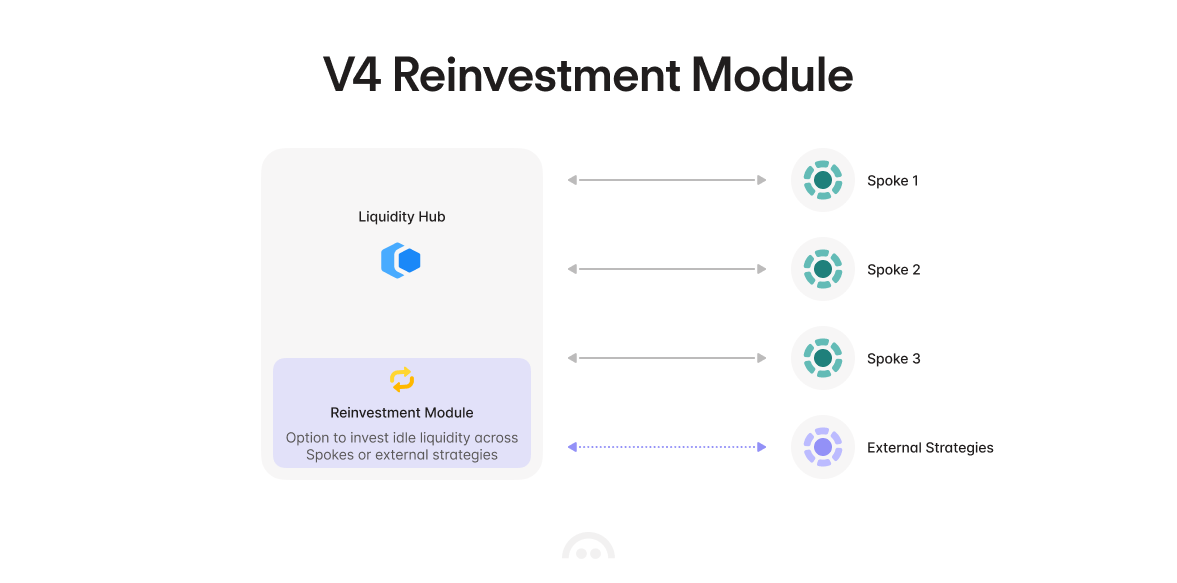

A unified liquidity layer aims to consolidate liquidity to address fragmentation, optimize lending efficiency, and foster innovation. Aave V4 follows this framework through its innovative Hub and Spoke architecture, centered around Liquidity Hubs that aggregate assets and direct liquidity to where it is needed, serving as a liquidity management layer and communication center.

Through this setup, V4 provides flexible risk management, easier support for unique asset classes, and stronger network effects through Hub-level pooling while containing operational complexities. An optional Reinvestment Module further enhances capital efficiency by allocating idle liquidity from the Hub to external strategies. This automated allocation, monitoring, and rebalancing creates seamless connectivity between capital and protocols, solving the fragmentation problem at its core by ensuring liquidity flows to where it's most productive.

With these advanced coordination capabilities, Aave V4 orchestrates capital more intelligently, creating a more robust and better connected system.

Tangible Benefits for DeFi Users and Ecosystem

Unified liquidity through V4's liquidity hubs is primarily a supply-side innovation, yet it delivers tangible benefits to all market participants and unlocks improved DeFi use cases:

-

Builders and Developers: The unified Hub liquidity eliminates isolated bootstrapping requirements for each new market. Token issuers and protocol integrators can launch rapidly without the traditional intensive capital "bootstrapping" process, improving project sustainability beyond initial incentive spending. Through V4, assets benefit from better composability, allowing for broader integrations and wider adoption.

-

Liquidity Providers: LPs gain access to more optimized yields through the unified Hub structure. Dynamic allocation through the Reinvestment Module maximizes utilization rates while reducing the operational complexity of managing multiple positions. LPs benefit from more consistent returns, eliminating the volatility and rate dispersion that comes from siloed markets.

-

Governance and Risk Managers: Governance is decoupled between Hubs and Spokes, allowing Hub configurations to set baseline parameters while Spokes can implement their own changes autonomously with minimal disruptions to existing user positions. Isolated risk management via Spokes encourages innovation as Spoke operators can implement changes rapidly without compromising the core Hub and protocol.

-

DeFi Users: The enhanced liquidity depth across markets means better availability and more competitive rates. A unified interface provides an account-level overview across all Hubs and Spokes, simplifying interactions and allowing users to discover opportunities, compare configurations, and manage positions from a single dashboard. Both lenders and borrowers benefit from more predictable rates and broader support for different assets. Greater scalability can support institutional-scale flows and allows for broader adoption.

Orchestrating a More Unified, Efficient System

In summary, a unified liquidity layer promotes capital reliability and long-term economic alignment between liquidity allocators and protocols. This framework enables more sustainable yield without capital leakage, creating more optimal experiences for supply-side participants and borrowers. V4's approach to unifying liquidity through its Hub and Spoke architecture blends efficient capital management with modular innovation, unlocking a more cohesive, scalable DeFi ecosystem.