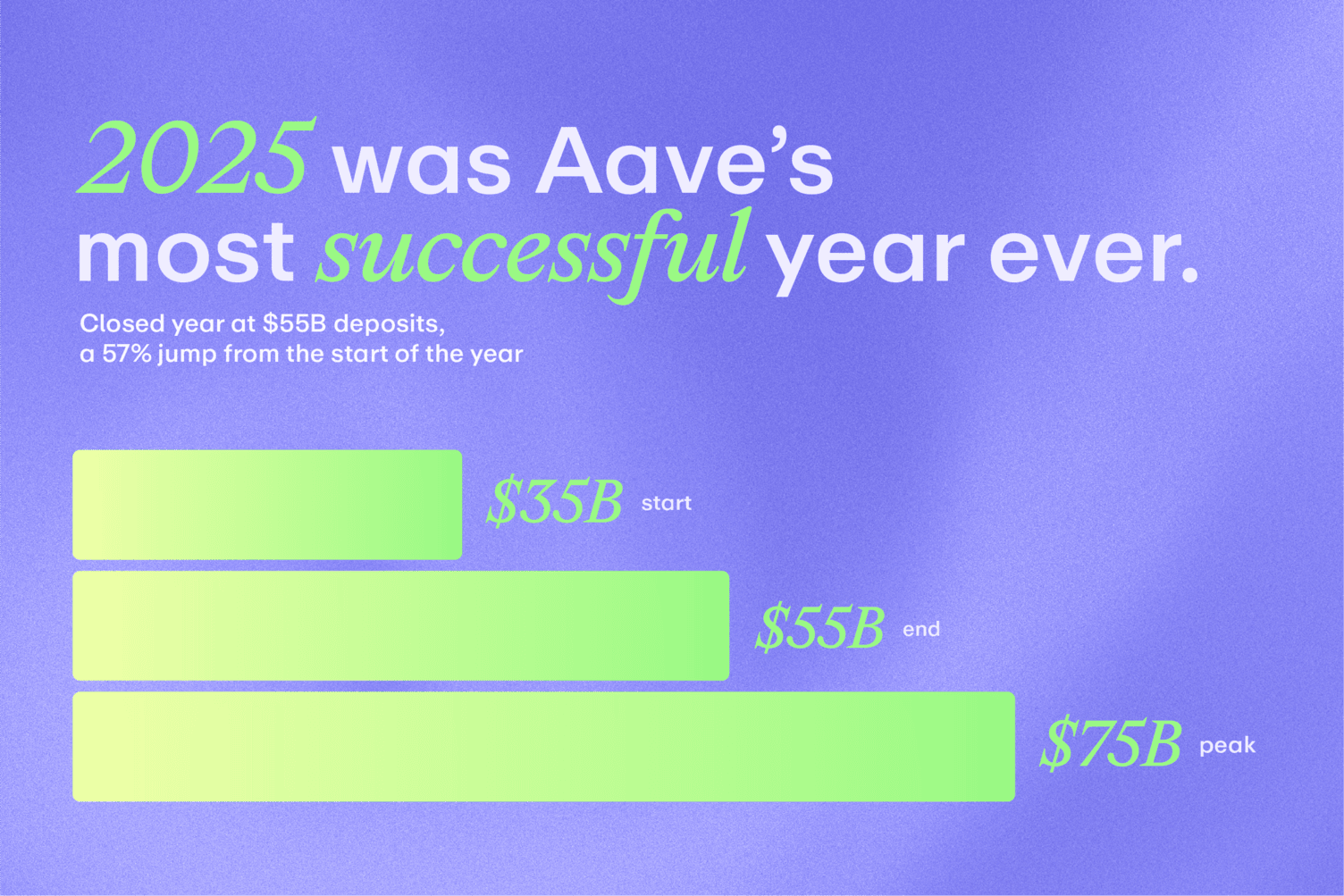

2025 was Aave's most successful year in its eight-year history. The protocol reached a peak of $75 billion in deposits, the highest ever for a DeFi protocol, and ended the year at $55 billion, a 57% increase from the start of the year.

Deposit growth was matched by a sharp rise in market dominance. Aave's share of total DeFi TVL climbed from 17% to 29%. As the broader DeFi market expanded, Aave captured an even larger share, and by year-end, nearly a third of all DeFi TVL sat on Aave.

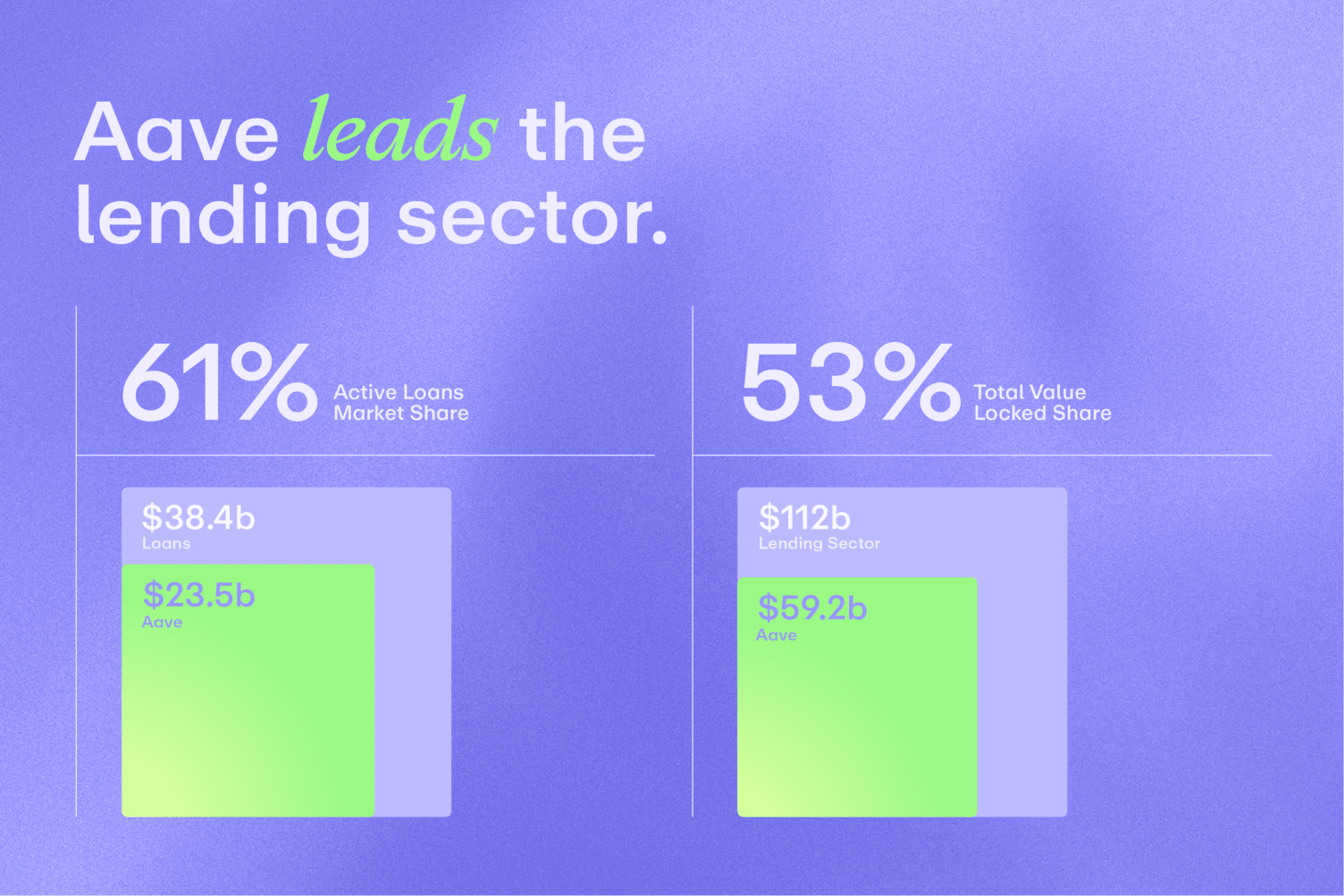

Looking at the lending sector as a whole, Aave was the clear leader. By the end of 2025, the protocol accounted for 61.5% of active loan market share, 52.4% of total value locked, and 43.2% of lending-sector revenue.

Better yet, Aave surpassed $3 trillion in all-time assets supplied and $950 billion in all-time loans created.

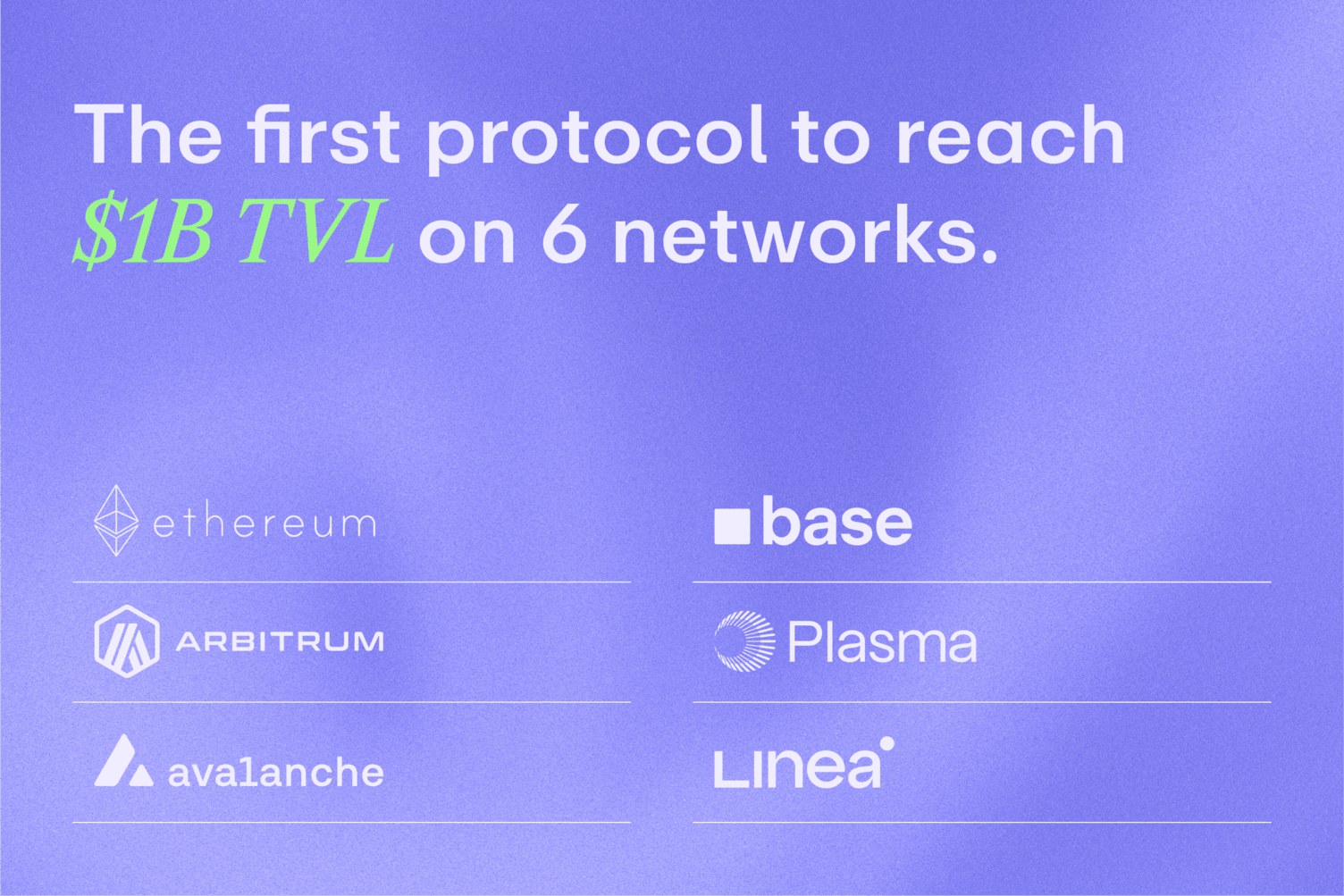

The protocol also thrived in DeFi's increasingly cross-chain world, becoming the first to reach $1 billion in TVL on six different networks: Ethereum, Arbitrum, Avalanche, Base, Plasma, and Linea. A complete rewrite of the protocol in Move for the Aptos network underscored Aave's commitment to winning DeFi's cross-chain future.

Aave was the destination for the most in-demand onchain assets in 2025. It ended the year holding $8.8 billion in USDT, $5.6 billion in USDC, $7 billion in BTC-pegged assets, and $26 billion in ETH-pegged assets. As demand for low-risk yield and deep liquidity increased, Aave became the default choice.

With so much value flowing through the protocol, safety mattered more than ever. Aave handled over $1.1 billion in liquidations across more than 100,000 events without a single issue. Given the market volatility of 2025, this level of transparent performance stood out.

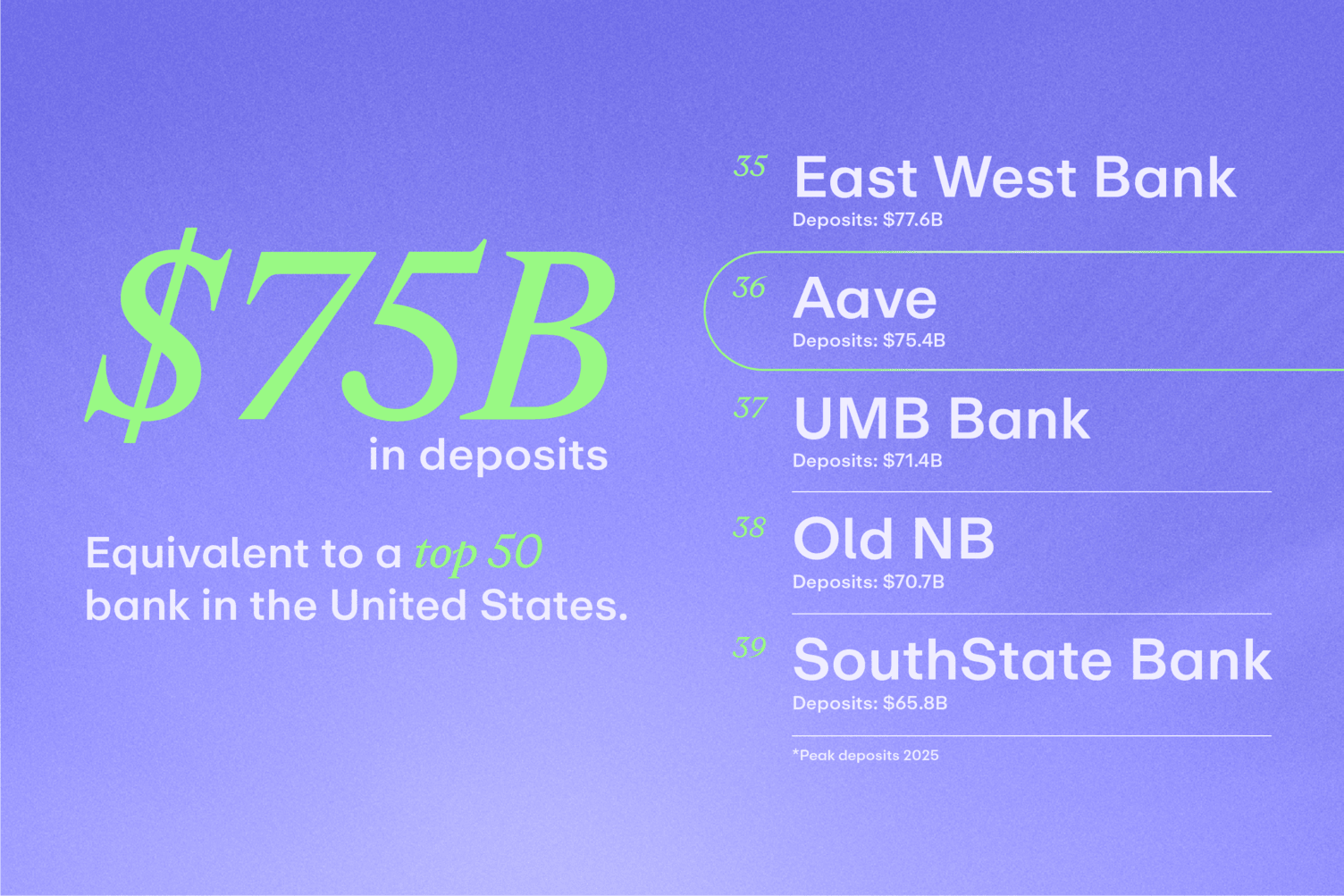

Unprecedented safety and scale pushed Aave onto the global stage. At peak TVL in 2025, Aave held $75 billion in deposits. At that level, Aave would rank among the top 50 banks in the United States, the world's largest financial market.

The Aave Effect

Aave's success is best understood through the "Aave effect," which was on full display in 2025. This can be seen across the Aavethena partnership, Maple's syrupUSDT, Ripple's RLUSD, and the Plasma network launch.

Aavethena

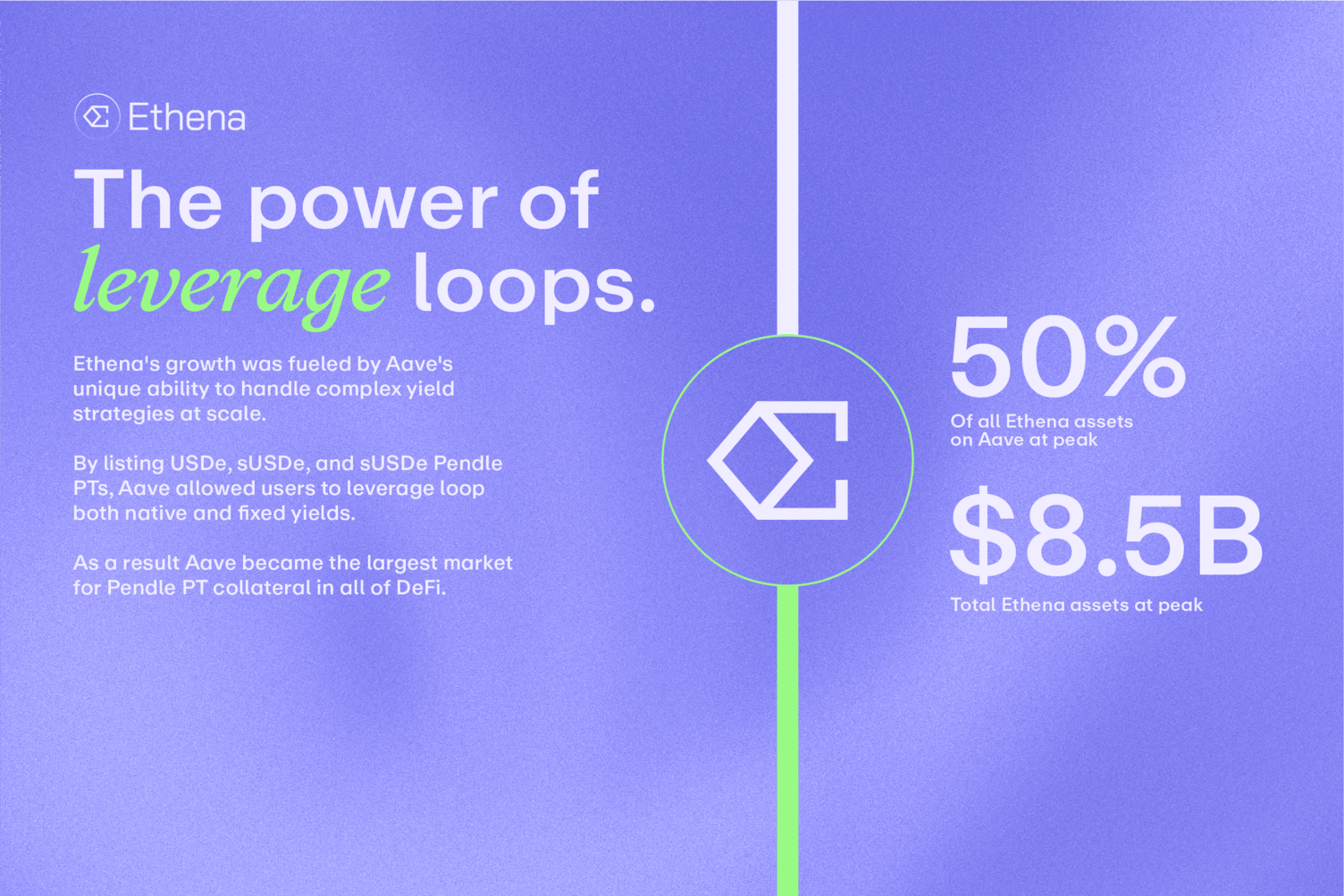

Ethena's USDe was one of the fastest-growing stablecoins of 2025, driven largely by its native yield and the Aavethena partnership. At its peak, Aave held over 50% of Ethena's stablecoin supply across USDe, sUSDe, and sUSDe Pendle PTs.

These listings allowed Ethena users to leverage loop native yield. When Aave later added sUSDe Pendle PTs, users could leverage loop fixed yield as well. Soon after, Aave became the largest market using Pendle PTs as collateral in DeFi. The partnership brought $8.5 billion in Ethena-related assets to Aave, showing that only Aave could support yield strategies at this scale.

Maple syrupUSDT

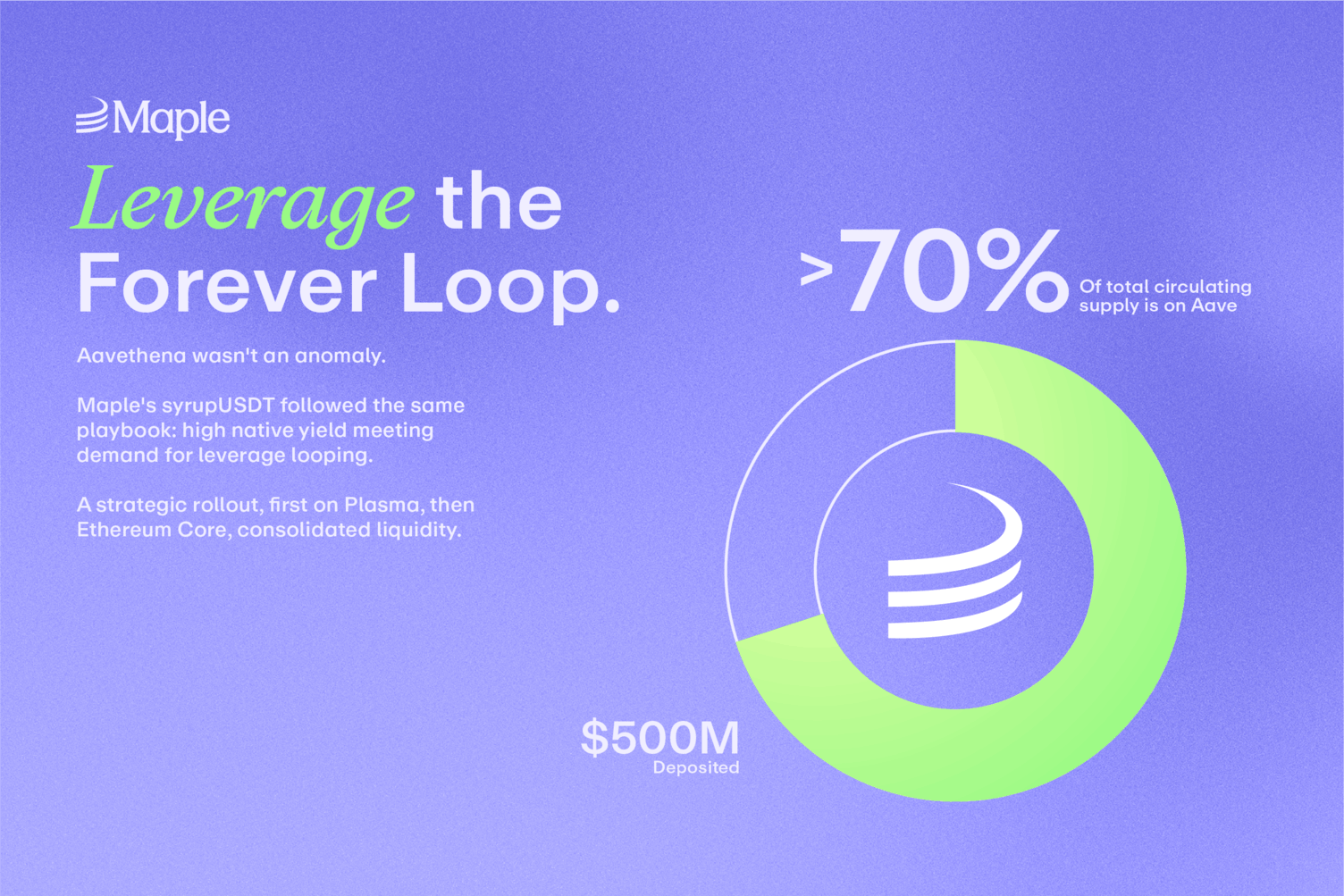

Aavethena was not the only large-scale yield strategy to scale on Aave in 2025. Maple's syrupUSDT also offered native yield with strong demand for leverage looping.

In October, syrupUSDT was onboarded to Aave on Plasma, followed by the Ethereum Core market in December. By year-end, Aave held $500 million of syrupUSDT, more than 70% of its circulating supply.

Ripple RLUSD

Twice is a coincidence, three times is a pattern. Ripple's RLUSD was another breakout stablecoin in 2025, with Aave playing a central role in its growth.

It was onboarded in April at roughly $250 million in circulating supply. By year-end, RLUSD's circulating supply had grown to $1.3 billion, with $800 million deposited on Aave.

A direct correlation emerged between a stablecoin's success and its reliance on Aave as a primary adoption venue. That is the Aave effect.

Plasma Launch

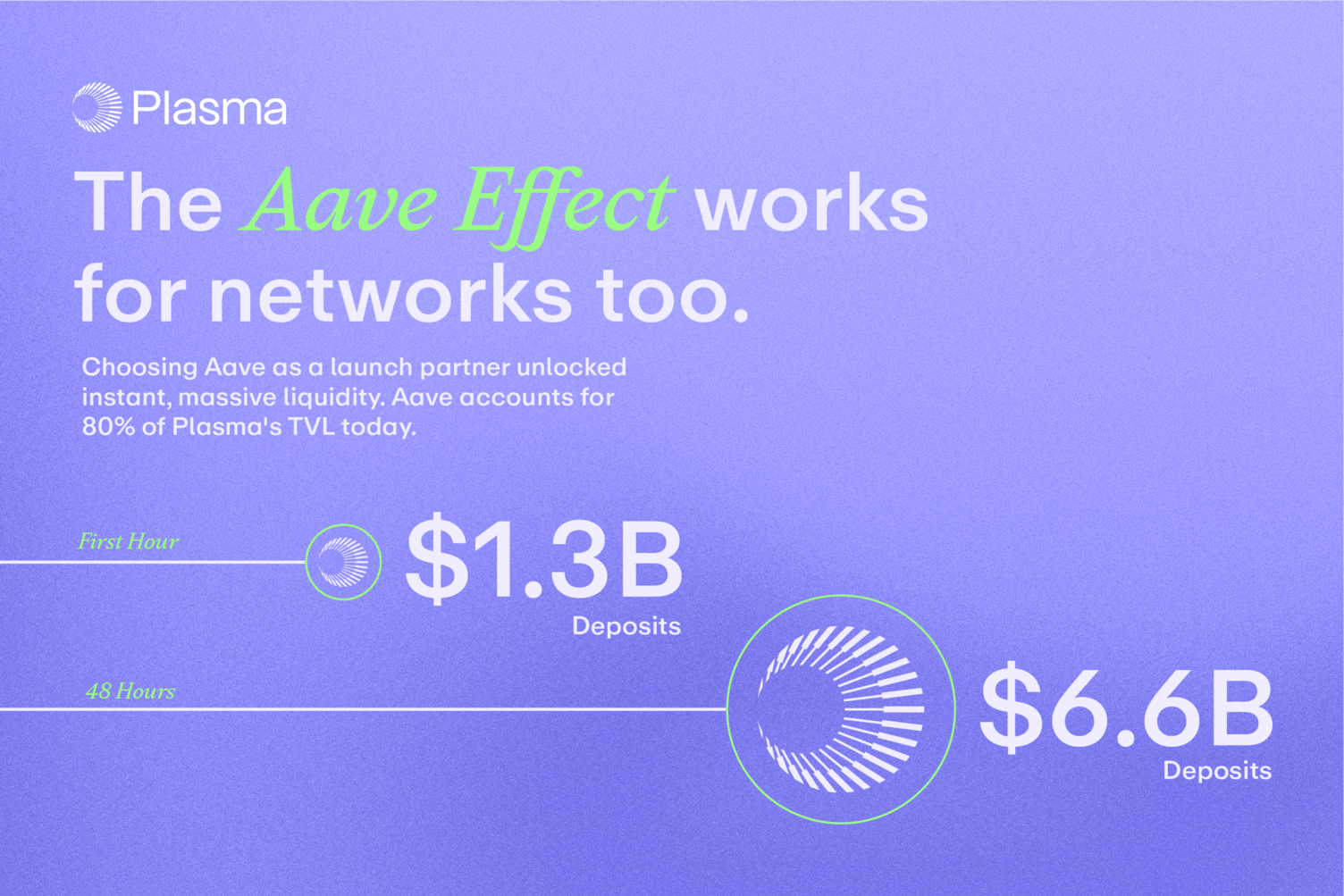

The Aave effect isn't just for assets, it works for networks too. Plasma was a breakout L1 in 2025 and chose Aave as a tier-one launch partner from day one.

When Plasma launched in September, assets flowed in immediately. The Aave Plasma market attracted $1.3 billion in deposits in its first hour. Just 48 hours later, deposits reached $6.6 billion, over $1.5 billion per day. This made Plasma Aave's fastest-growing market ever. By the end of the year, more than 80% of Plasma's TVL was earning yield on Aave.

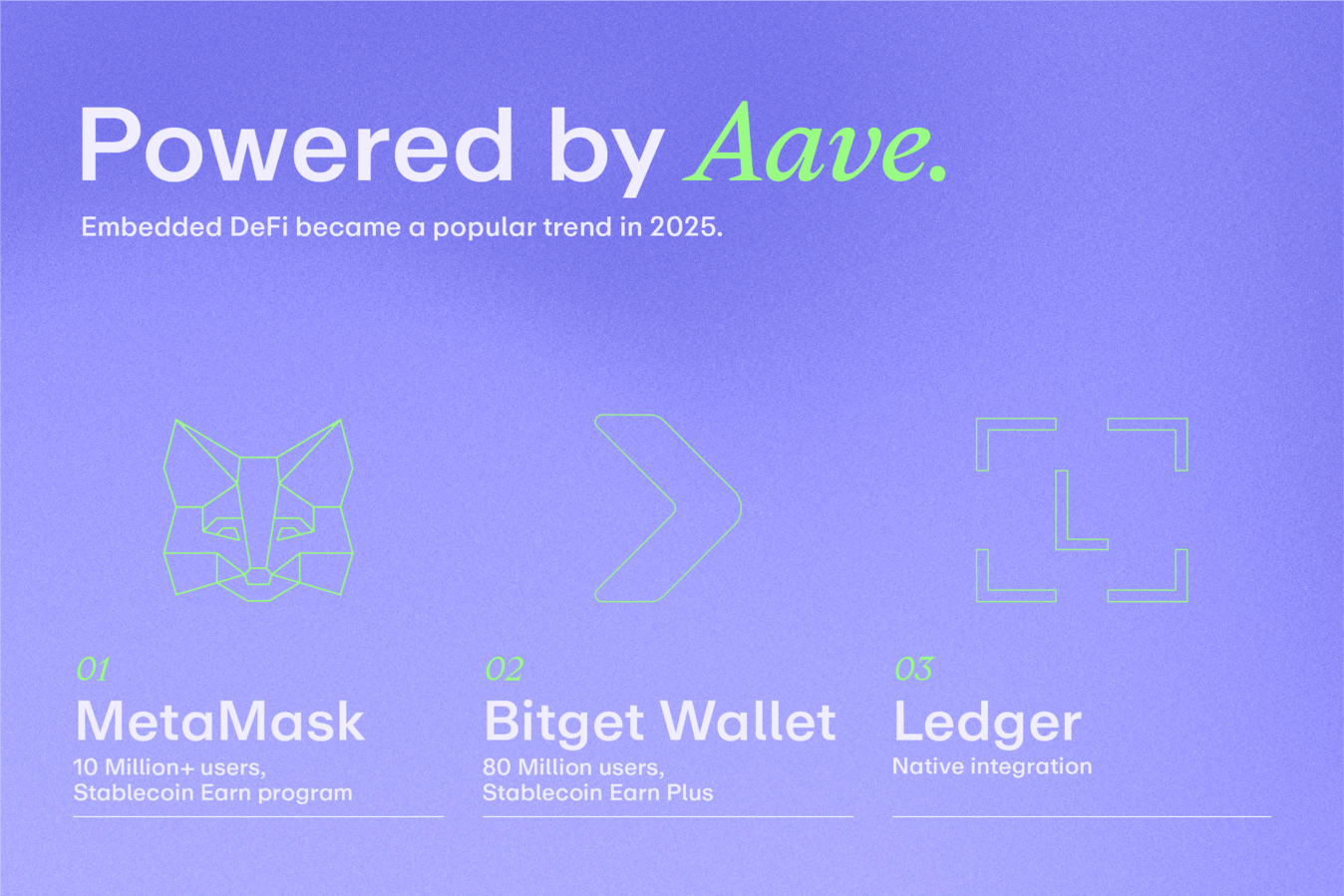

Powered by Aave

The influence Aave had on both networks and assets led to a defining theme of 2025: embedded DeFi. Aave's infrastructure became a core component inside wallets and fintech applications around the world.

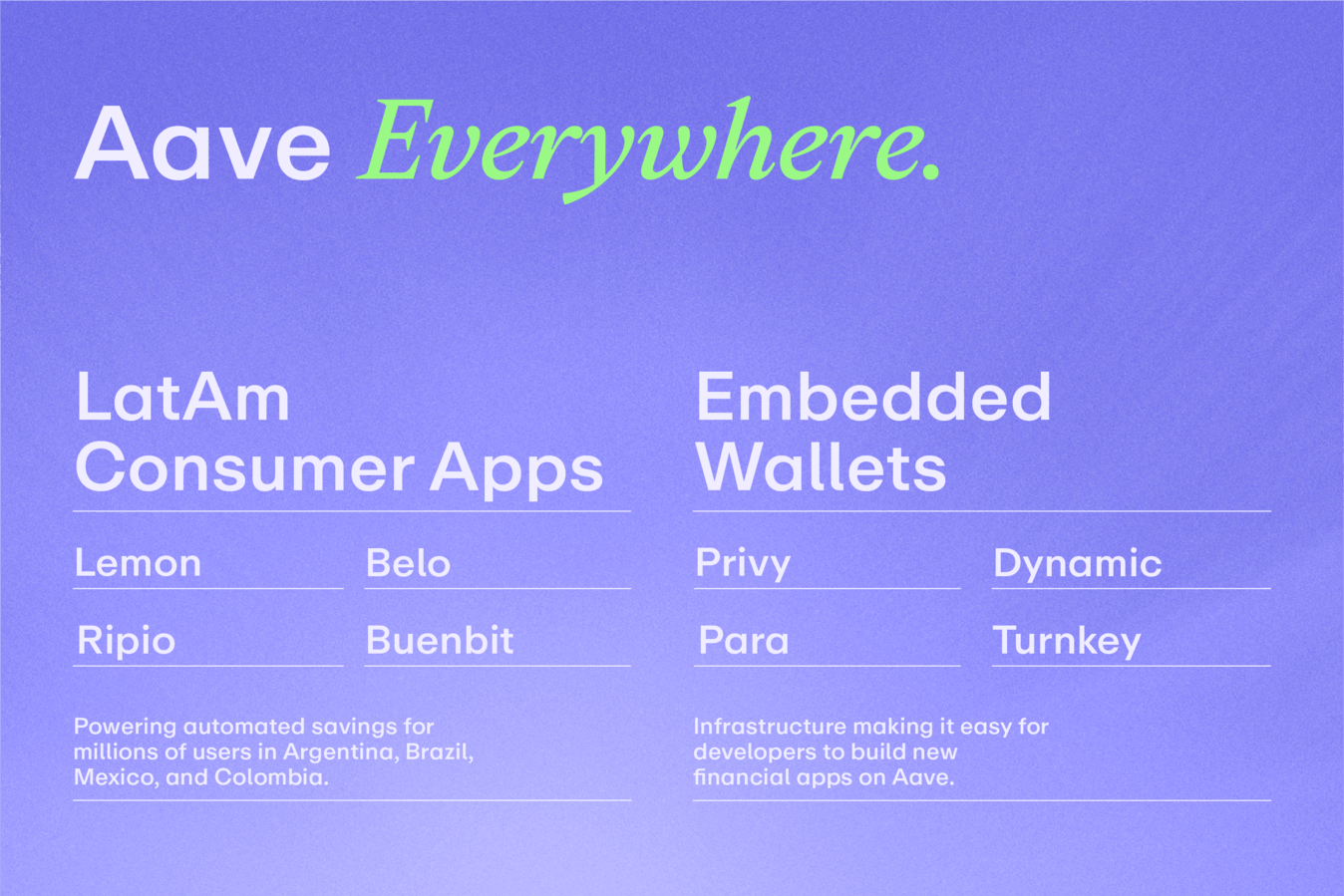

Major wallets such as MetaMask used Aave to power Stablecoin Earn programs. Bitget Wallet let their 80 million users earn yield through Stablecoin Earn Plus, also powered by Aave. Ledger and Tangem added native Aave integrations to their hardware wallet apps.

Aave's reach also expanded into Latin America's fintech ecosystem. Apps including Lemon, Ripio, Belo, and Buenbit used Aave to offer automated stablecoin savings to millions of users across Argentina, Brazil, Mexico, and Colombia.

Embedded wallet providers such as Privy, Para, Dynamic, and Turnkey integrated Aave directly, making it easier for developers to build financial applications on Aave's lending infrastructure.

GHO's Breakout Year

GHO had a breakout year in 2025. Total supply grew to nearly $500 million, driven by cross-chain deployments and new facilitator integrations. This growth turned GHO into a meaningful revenue driver for the Aave DAO, generating over $14 million in annualized revenue by year-end.

Savings GHO (sGHO) launched in July, allowing holders to earn native savings yield funded directly by protocol revenue, with no fees, lockups, or slashing risk. By year-end, more than 54% of circulating GHO was staked as sGHO, totaling over 265 million GHO and demonstrating strong product-market fit.

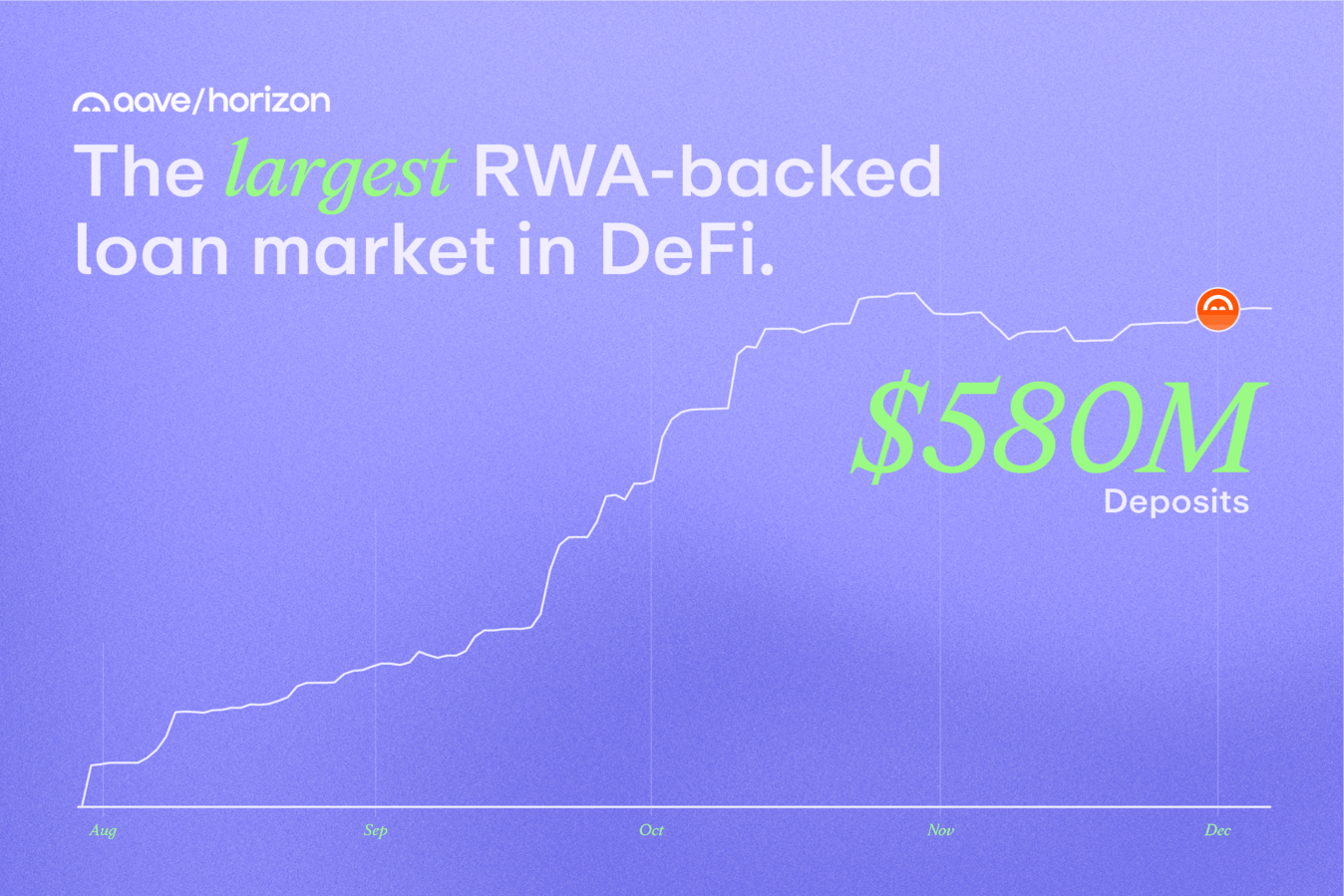

Aave Horizon RWA Market

Real-world assets went mainstream in 2025, and Aave once again became a primary destination.

In August, Aave Labs launched Aave Horizon with institutional partners including VanEck, Circle, Securitize, Ripple, WisdomTree, Superstate, Centrifuge, Ant Digital Technologies, Hamilton Lane, Ethena, KAIO, and OpenEden. Aave Horizon is purpose-built for RWAs, working directly with issuers so assets are natively supported with proper permissions. The supply side remains fully permissionless, allowing anyone to provide stablecoins to earn yield from institutional borrowers.

Following launch, Aave Horizon quickly became the largest RWA-backed lending market in DeFi. It ended the year with over $570 million in deposits and is positioned to continue growing. RWAs represent a $500 trillion asset class, and Aave Horizon brings them onchain through Aave.

Aave V4

After two years of development, Aave V4 launched on testnet in 2025. It is Aave's most significant protocol evolution to date and positions the protocol to onboard the next several trillion dollars in onchain assets.

V4 introduces a new Hub and Spoke architecture, risk premiums for improved risk-adjusted rates, a redesigned liquidation engine, and more. This architecture enables Aave to safely support new trust assumptions while isolating risk.

It also expands Aave beyond purely crypto-native collateral, enabling permissioned RWA lending, borrowing through qualified custodians, integrations with brokerage and margin accounts, and additional use cases previously out of reach.

V4 will launch on mainnet in 2026.

Aave App

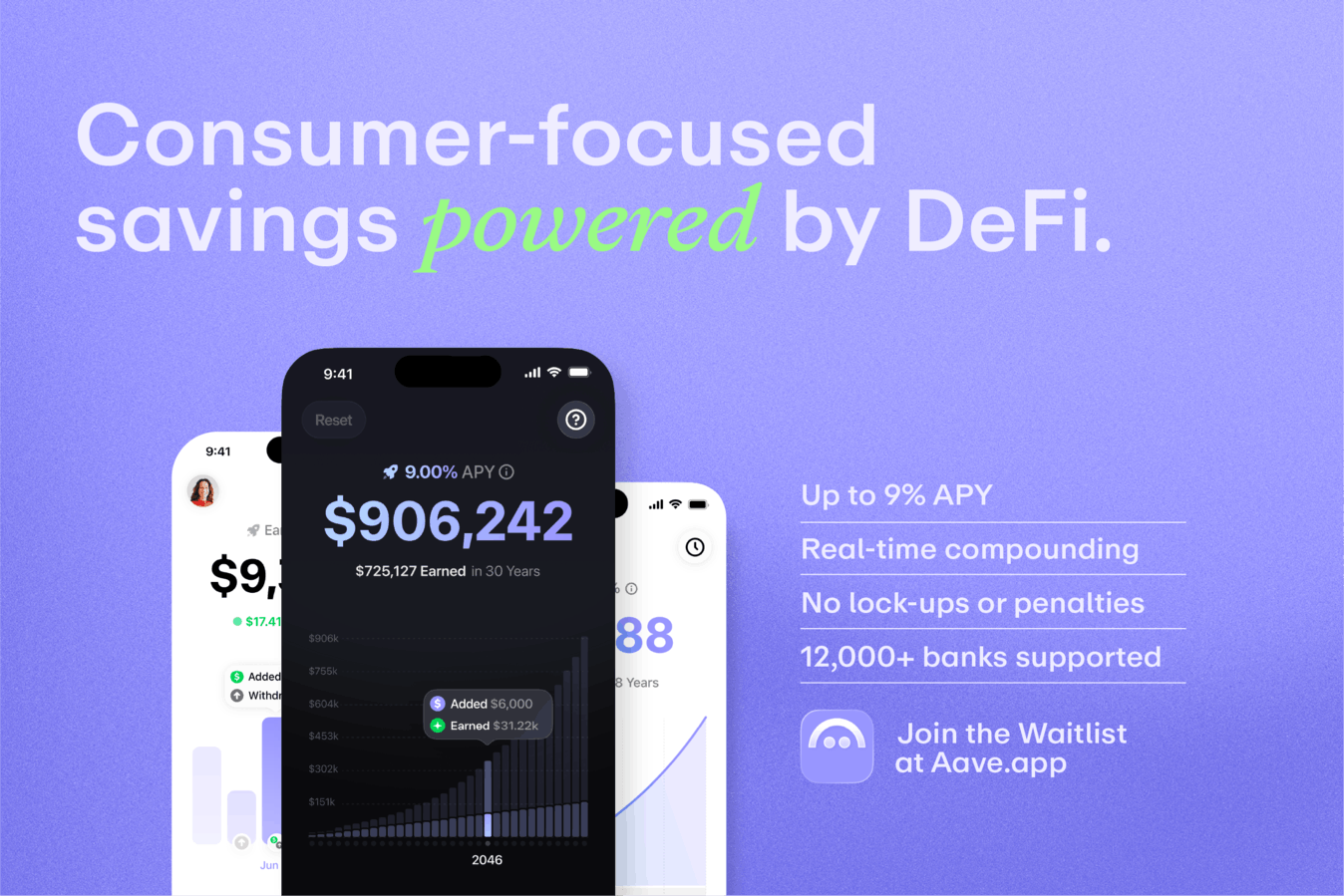

One of the most significant DeFi announcements of the year was Aave App, a consumer-focused savings product powered by Aave.

Aave App is a mobile app that offers a high-yield savings alternative with up to 9% APY. Interest compounds in real time, with withdrawals available at any time. The app supports deposits from more than 12,000 banks, debit cards, and stablecoins, and includes up to $1 million in balance protection.

An Aave Labs subsidiary, Push Virtual Assets Ireland Limited, secured Crypto-Asset Service Provider authorization under the EU's MiCAR framework from the Central Bank of Ireland. This allows for zero-fee stablecoin on- and off-ramps into Aave App and, in the future, other Aave ecosystem applications.

Heading into 2026, Aave stands out as one of the few DeFi protocols positioned to reach millions of mobile users.

p.s. You can sign up for the waitlist here.

Aave Will Win

Aave heads into 2026 with a clear, three-pronged strategy to bring the next trillion dollars in assets and millions of new users onchain. The protocol's future rests on becoming the backbone of onchain credit, the gateway for real-world assets, and the simplest way for anyone to access DeFi-powered savings.

Aave V4 will provide the foundation, with a new architecture built to allow any institution, fintech, or company to plug into Aave's deep, reliable liquidity. At the same time, the Aave Horizon market will onboard the world's largest financial players by expanding Aave's reach into the $500 trillion market for real-world assets.

Finally, the Aave App will bring DeFi to everyone, making high-yield savings accessible and mainstream for millions of mobile users. These initiatives are a unified push to build the foundational credit layer for the onchain economy.

Aave will power it all.