Say hello to Aave App

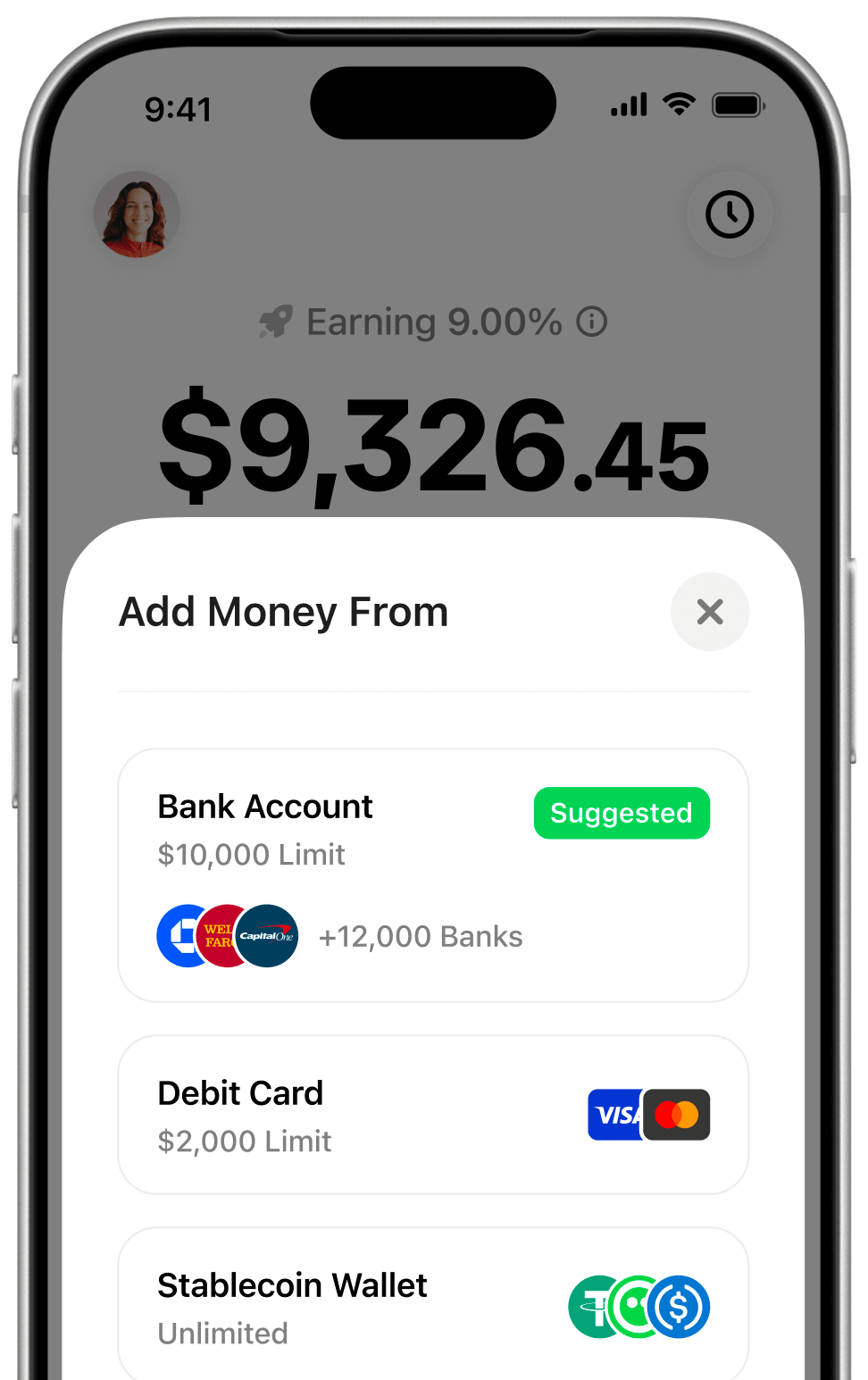

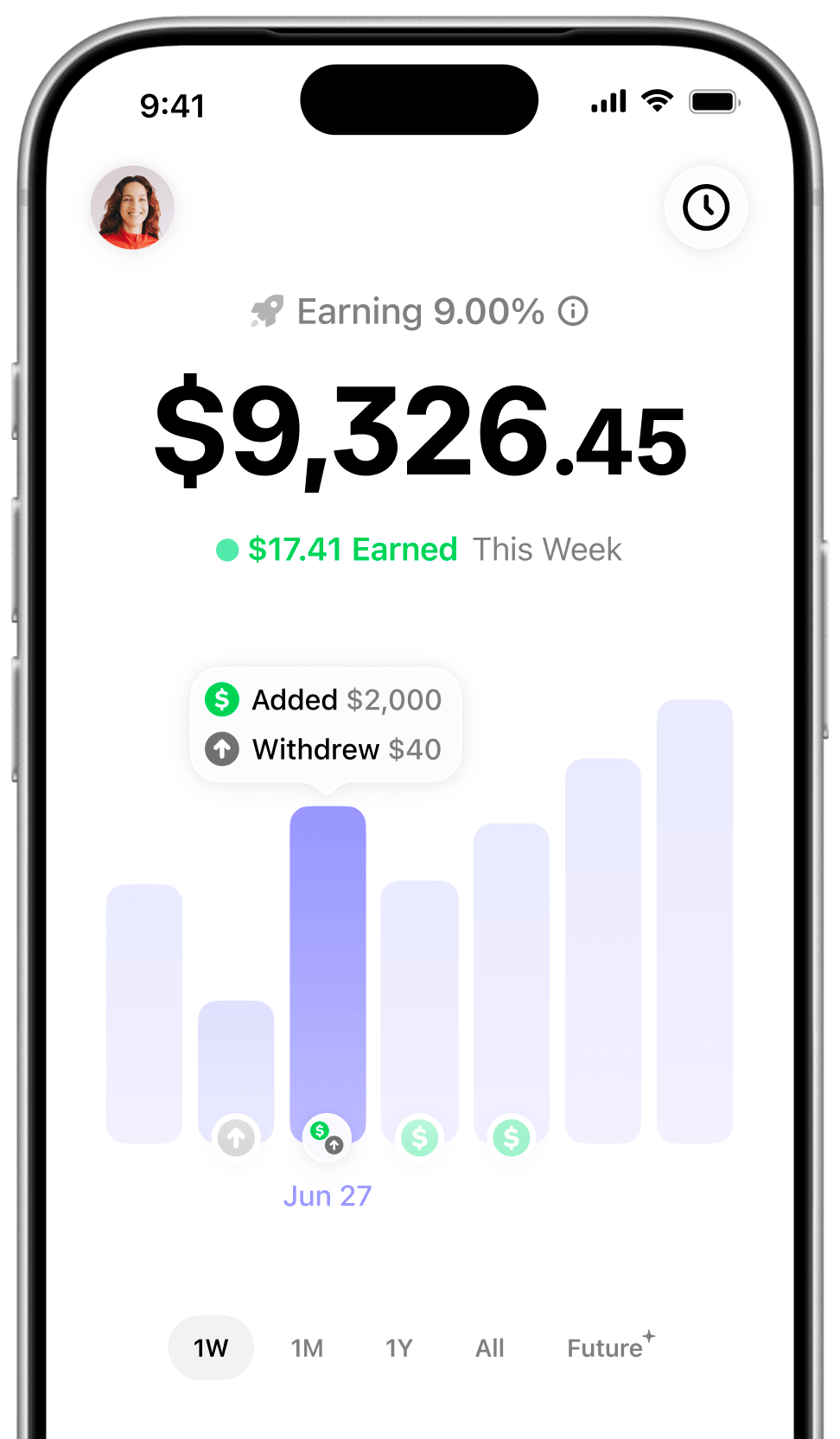

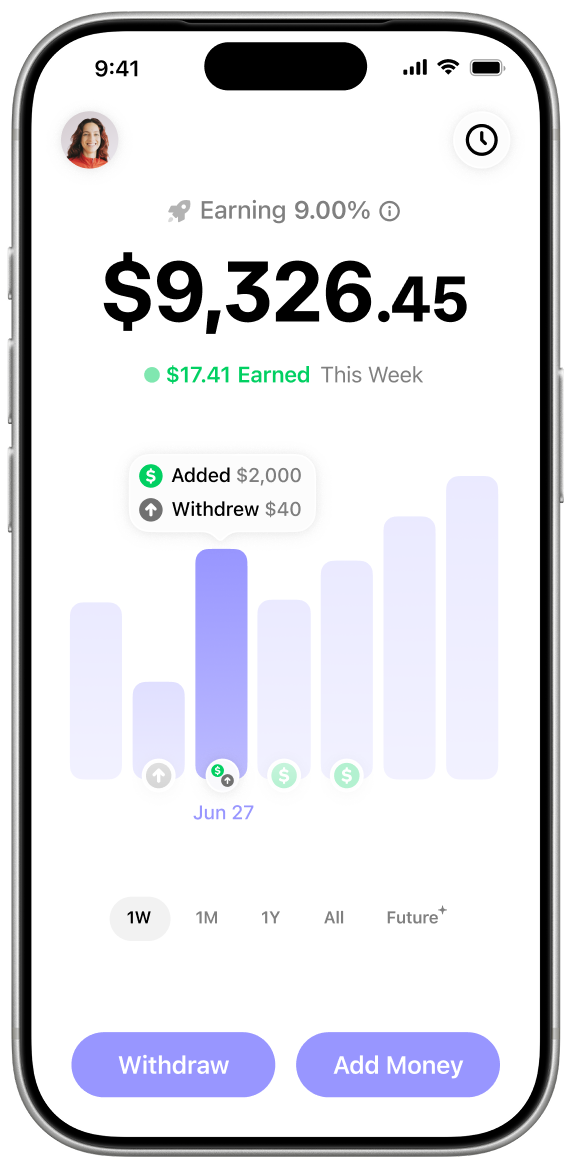

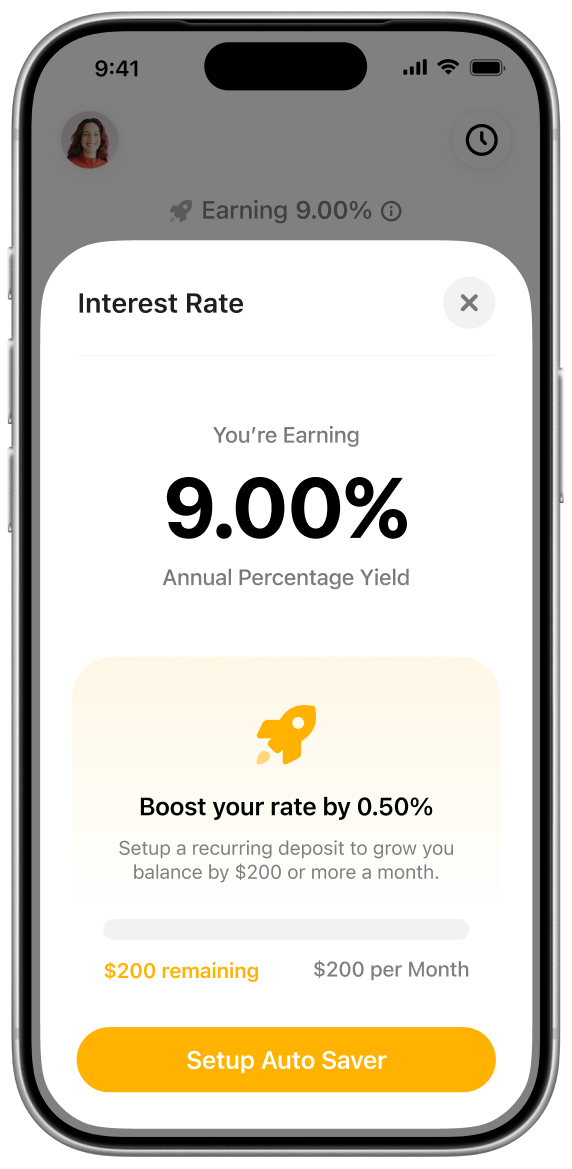

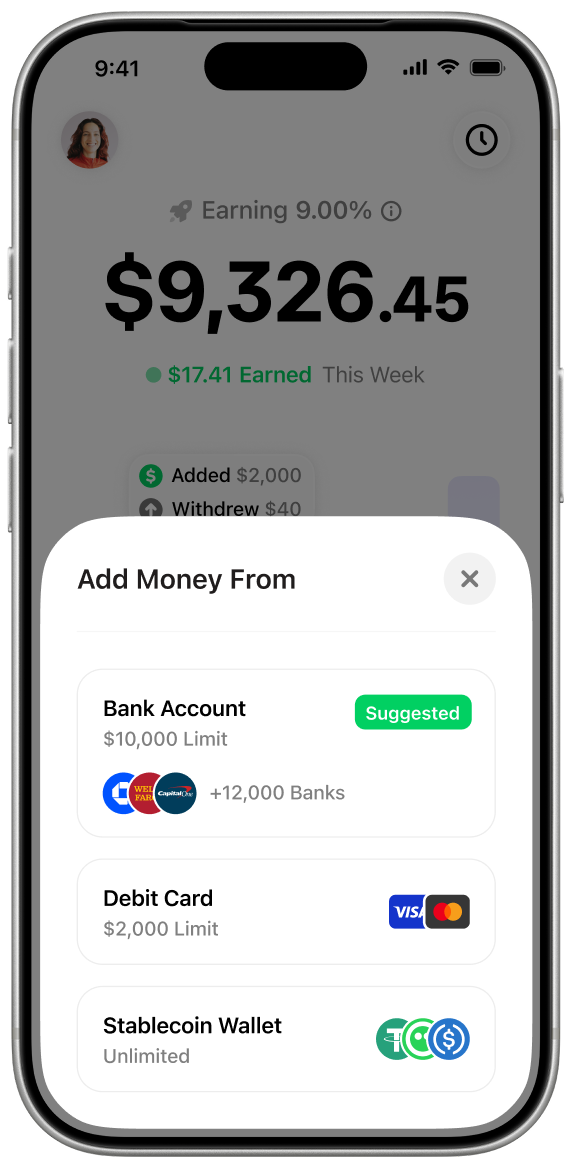

Earn up to 9.00% on your savings with industry-leading interest rates and balance protection up to $1M.

DeFi's largest lending network.

The best build with Aave.

Reach millions of users and access billions in capital with a few lines of code.

We chose Aave for MetaMask Earn because of its DeFi leadership, strong governance, and trusted security. Integrating Aave directly into MetaMask Earn gives users seamless access to stablecoin yield, without ever leaving their wallet.

Igor Teslya, MetaMask Institutional

As we bring Kraken onchain through Ink, Aave stood out as the clear choice. Its proven safety record, adaptive risk management, industry-leading risk adjusted yields that scale, and relentless innovation make it the ideal foundation for a flexible, and trusted B2B solution - built for our retail users.

Andrew Koller, Founder

Aave has been a critical partner in supporting USDC's growth and success since the earliest days of USDC, and has now become a key distribution partner for both USDC and the launch of new Circle stablecoins such as EURC. They deliver some of the most significant innovation, scale and liquidity in DeFi.

Jeremy Allaire, Co-Founder, CEO and Chairman

Aave has been a pioneer in decentralized finance, setting high standards for security, reliability, and risk management. Their achievements in building a leading lending protocol and establishing best practices around how to secure DeFi correctly has made the entire industry attractive to users and institutions.

Sergey Nazarov, Co-Founder

Aave has played a pivotal role in driving USDT's growth within the DeFi ecosystem. By providing stability and liquidity, USDT bridges traditional finance and crypto, forming a strong foundation when integrated with Aave.

Paolo Ardoino, CEO

About Aave.

Earn interest. Borrow when you need. 24/7.

Why choose Aave?

Aave handles tens of billions of dollars across 12+ networks.

Net deposits supplied across 12+ networks.

Volume, past 30 days.

Average stablecoin supply APY Ethereum network, past year.

Average stablecoin borrow APR Ethereum network, past year.

Your money, your choice.

Earn

Earn interest lending out assets.

Swap

Swap assets, even those borrowed or supplied.

Save

Save and earn yield with Aave's native stablecoin GHO.

Health Factor

Easily track your loans.

Serious security.

Peace of mind by design.

Extensive Audits

Peace of mind supported by multiple audits by the world’s leading security firms.

Learn MoreBug Bounty

Security is a top priority. Report vulnerabilities or bugs responsibly and get rewarded.

Learn MoreShortfall Secured

The Aave Protocol is secured with a backstop against protocol insolvency.

Learn More5 Years Strong

Aave is leading the DeFi Renaissance, committed to its mission of bringing global finance onchain.

Learn More%

Collateralisation30 Day Avg

+

GHO Minted1 Yr

Aave everywhere.

Join Aave’s growing constellation of builders.

Governed by you & others.

AAVE token holders guide the Aave Protocol via procedures, voting, and smart contract execution.

Go to the ForumFAQs

Aave is a decentralised non-custodial liquidity protocol where users can participate as suppliers or borrowers. Suppliers provide liquidity to the market while earning interest, and borrowers can access liquidity by providing collateral that exceeds the borrowed amount.

Supplied tokens are stored in publicly accessible smart contracts that enable overcollateralised borrowing according to governance-approved parameters. The Aave Protocol smart contracts have been audited and formally verified by third parties.

No protocol can be considered entirely risk free, but extensive steps have been taken to minimize these risks as much as possible – the Aave Protocol code is publicly available and auditable by anyone, and has been audited by multiple smart contract auditors. Any code changes must be executed through the onchain governance processes. Additionally, there is an ongoing bug bounty campaign and service providers specializing in technical reviews and risk mitigation.

AAVE is used as the centre of gravity of Aave Protocol governance. AAVE is used to vote and decide on the outcome of Aave Improvement Proposals (AIPs). Apart from this, AAVE can be staked within the protocol Safety Module to provide a backstop in the case of a shortfall event, and earn incentives for doing so.